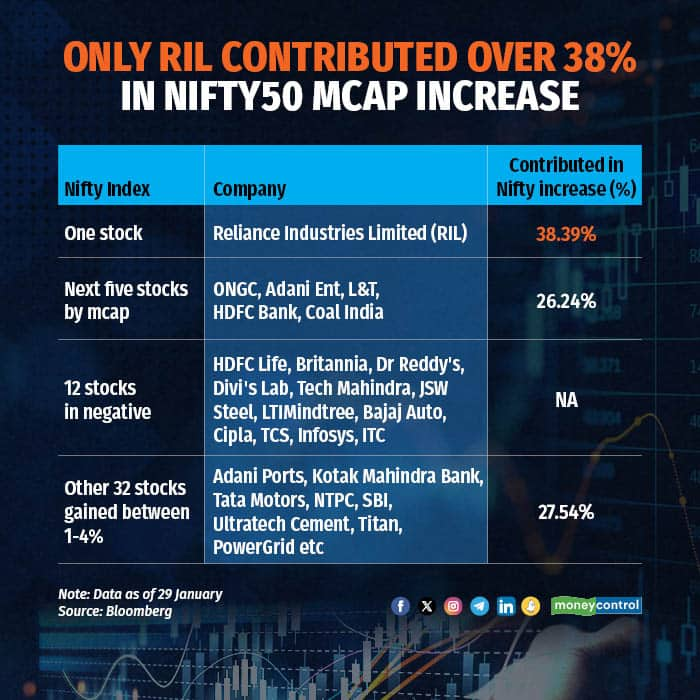

The Mukesh Ambani-led Reliance Industries Ltd (RIL) single-handedly contributed to a 38 percent surge in the Nifty 50 market capitalisation on January 29. Apart from strong fundamentals, analysts also attributed the rally to foreign funds taking refuge in Reliance Industries to hedge their short positions on the index.

RIL market cap increased around Rs 1.29 lakh crore on January 29. The stock scaled a fresh record high of Rs 2,905, taking the market capitalisation to Rs 19.5 lakh crore.

The next five stocks - ONGC, Adani Enterprises, Larsen & Toubro, HDFC Bank and Coal India - together contributed over 26 percent to the up-move.

Both the benchmarks Sensex and Nifty jumped over 1.7 percent each on January 29. Nifty's mcap rose to Rs 173.3 lakh crore from Rs 169.95 lakh crore on January 25, making an increase of Rs 3.35 lakh crore.

Also Read: Budget and Markets: Will the FM spook the F&O party by hiking securities transaction tax?

What led to the RIL rally?

According to Shrikant Chouhan of Kotak Securities, Reliance's unexpected surge, a rare occurrence, is notable. "Such moves usually follow when there are numerous short positions in the overall market, and FIIs look for strong stocks to hedge their positions," he said.

This trend has been observed in the past with stocks like Infosys, Bajaj Finance, and HDFC Bank, he said.

If we look at the derivatives data, Ruchit Jain, Lead Research, 5paisa.com noted that FIIs had last week rolled over their short bets in the index futures with short positions at 78 percent and net short contracts over 1.08 lakh contracts.

"These positions are seen as short heavy and such short heavy positions around the support usually leads to a short covering move," he said.

Further, on January 29, other refiners like HPCL and BPCL also performed well, driven by the strength in Brent crude, as it means better refining margins.

"After Q3 results, brokerages had revised RIL target price to Rs 2,900 levels, making Reliance an attractive option for FIIs looking to hedge short positions, especially as it was 10 percent below its fair value," Chouhan added.

Independent analyst Prakash Diwan also said that the recent surge in Singapore GRMs (gross refining margins) indicates a positive outlook for RIL's O2C business.

"This marks a valuation reset for RIL, which is currently under-owned by FIIs. As FIIs sell HDFC Bank, IT and FMCG stocks due to bleak outlook, they will redirect funds elsewhere. And, RIL will be a big beneficiary," he said.

Also Read: India sees biggest FII outflows in January among Asian markets

RIL stock has seen a nearly 12 percent increase in January, fuelled by positive remarks on capped expenditures and robust retail performance in its Q3 earnings. The company's Q3 capital expenditure (capex) dropped by 22 percent sequentially to Rs 30,100 crore, attributed to reduced spending by Jio after the 5G rollout and limited retail space expansion.

Despite a slight increase in net debt, analysts anticipate a positive trend driven by reduced capex and an improved EBITDA run rate, signaling positive free cash flow for the next two years.

Disclosure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.