Ruchi Agrawal

Moneycontrol Research

Under pressure from the government, Oil & Natural Gas Corporation (ONGC), Oil India and Indian Oil Corporation (IOC) have been asked to consider buying back a portion of their shares.

After the failure of some strategic sales, like that of Air India, due to varied reasons, the buyback route is being seen as a tool to meet the year’s divestment target by the government. While the government is pushing to get the buyback through, oil companies have been reluctant owing to scheduled capex plans. However, they might have to give in to the government’s directives. In the short term, it could be positive for the minority shareholders as well.

Details of the buyback

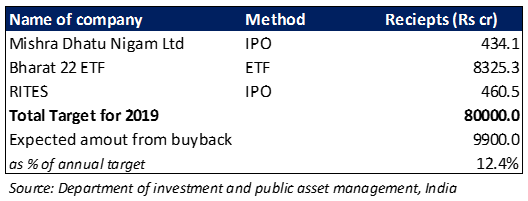

The total buyback programme is slated to be around Rs 9,900 crore. Of this, around Rs 4,000 crore is expected from Indian Oil Corporation, ONGC is expected to take up Rs 4800 and the remaining Rs 1,100 crore is to be brought in by Oil India.

The government’s side

With rising oil prices, depreciating rupee and planned investment expenditure, the government’s fiscal position has been strained. The proposed buyback is an attempt to fund the deficit by the government. It amounts to almost 13 percent of the divestment target for the current fiscal and provides a way to achieve the year’s target.

While the government has the option to sell the stake in the companies, buy back seems a safer option which could fetch higher than market price for the stake, given the waning investor interest in the oil companies owing to rising uncertainty.

What it means for the companies

The three companies have the required liquidity to fund the buyback. IOC's total cash and liquid investments amount to around Rs 41,544 crore (on 31 March 2018) and the current buyback amounts to 9.6 percent of this.

Oil India has substantial free cash and the buyback amounts for 8 percent of its total cash and liquid investments.

On the other hand, while ONGC also has the required free cash to fund the buyback, looking at its total free cash and liquid investment, the buyback seems a bit hefty and amounts to around 42 percent of its total cash and liquid investments.

While the companies have enough liquidity to fund the buyback, the added buyback expense might tighten the position for the companies planned capital expenditures, especially for ONGC.

The three companies have sizeable capex plans for the year with IOC planning to spend Rs 23,000 crore in the current year, ONGC planning Rs 38,000 crore capex and Oil India’s capex plan for the current year being close to Rs 4,300 crore.

Outlook

We believe while IOC and Oil India have enough liquidity to fund both the buyback and the capex, it might put ONGC in a tough spot, which could have an impact on the company’s dividend payments.

On one hand, a cut in the dividend might not go well with the government’s revenue department, on the other hand, we believe altered balance sheet position might come in the way of future growth. Moreover, ONGC and Oil India have already been under pressure owing to the contingent burden of subsidy sharing in times of higher crude oil prices and buyback could further weaken the position.

Moreover, rising crude oil prices have brought the margins of both oil upstream companies and oil marketing firms (OMC) under the scanner. While on one hand public outrage has led to shrinking margins for OMCs, it has exposed upstream oil PSUs to probable subsidy sharing and policy burden from the government. In such operationally strained time, the buyback would mean an added expense for these companies.

However, the proposed buyback would surely help the government to ease its stressed fiscal position the move will help to inch slightly towards meeting the year’s divestment target.Follow @Ruchiagrawal

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.