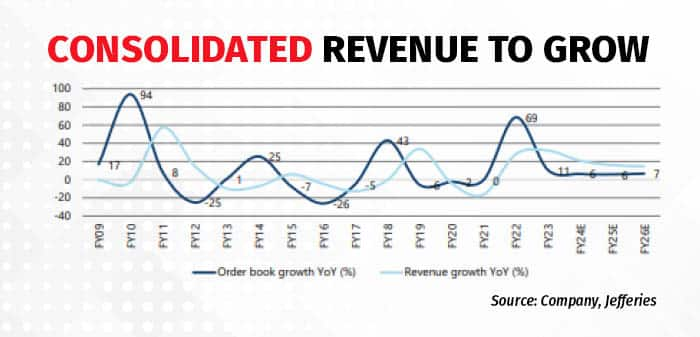

A broad consensus among US-based investors is that India’s capex cycle is on an upswing, a recent report by Jefferies says. Power capex in India, Jefferies adds should rise at 9x CAGR in FY24E-26E vs FY10-20. The foreign brokerage firm recently met a few foreign investors and discussed the following stocks.

L&T (Buy)

The strong absolute and relative performance of the last 6-12 months, the report says, has not made investors wary of L&T’s valuations. While muted margin guidance is a near-term dampener, they say that the 1-year story of execution pickup and eventual margin recovery is on track.

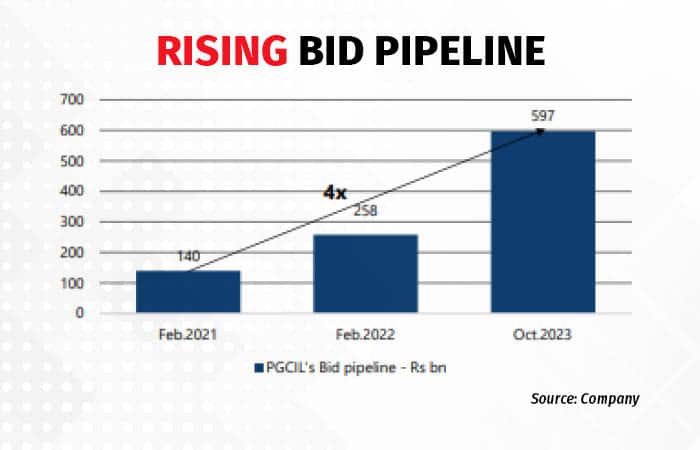

Power Grid (Buy)

Jefferies says that Power Grid is standing out as a defensive play with a 5 percent dividend yield and growth uptick with market share gains in recent transmission bids. Analysts at the brokerage believe that project wins and capex guidance upgrades will drive upside ahead.

Siemens (Buy)

.

.

While investors raised concerns about the uncertainty around Siemens’ parent stake sale and implications for the stock. Analysts at Jefferies said that the company’s de-merger would be “a step for value creation, as automation tends to re-rate, being a higher-quality business”.

Thermax (Buy)

Jefferies analysts say that Thermax's earnings surprise is attracting investors. In each of the last four quarters, the company recorded a 40 percent YoY profit growth. Other factors driving investor interest include ESG-driven revenue portfolio, market leadership in key segments, good corporate governance and green hydrogen-linked MOU with Australia’s Fortescue Future Industries, the report said.

KEI (Buy)

.

.

KEI, the report says is a name liked by investors as it’s a play on India’s power transmission, housing, industrial capex and exports theme. Analysts say that the recently announced brownfield capex in power transmission cables is giving confidence that the capacity constraint will not limit high double-digit growth.

NTPC (Buy)

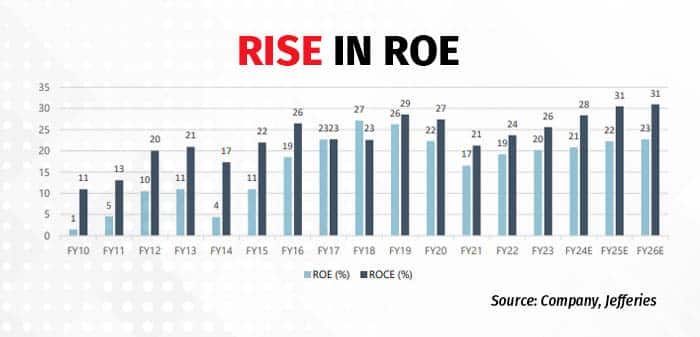

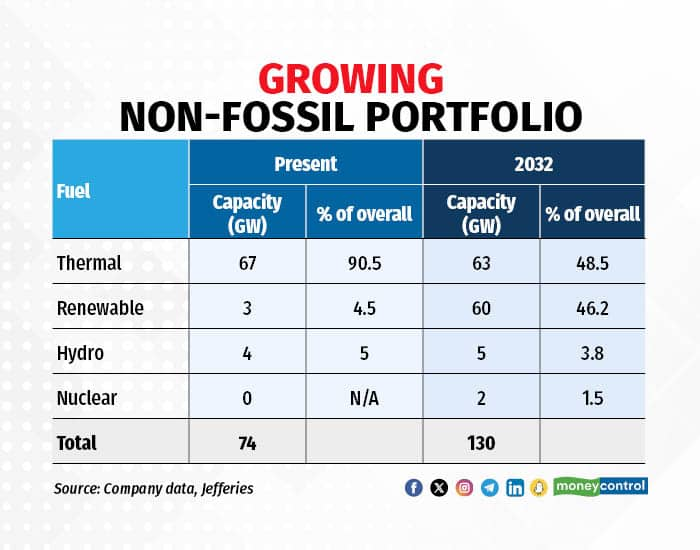

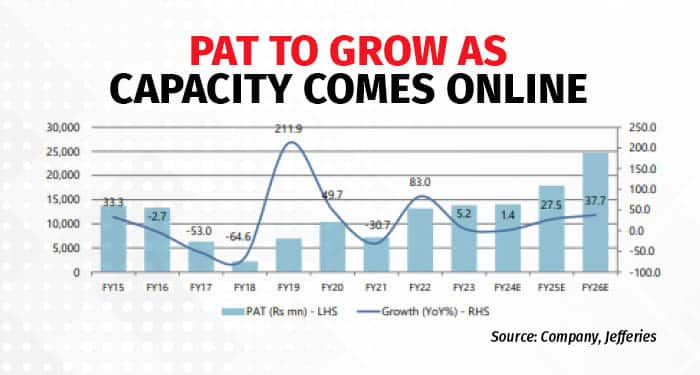

Analysts say that NTPC is still trading at a 36% discount to the previous up-cycle average multiple and the gap is narrowing as they ramp up Renewable Energy (RE) capacity addition.

JSW Energy (Buy)

.

.

On JSW, Jefferies analysts expect three triggers to play out in the next 12-24 months - improving visibility on renewable energy moving to 81 percent of capacity by FY30E from 52 percent; commissioning of 700 MW merchant capacity in peak power deficit times and progress on one of India’s first green hydrogen plants and energy storage battery unit. The report adds that the merchant capacity offers earnings upside while fixed-tariff projects protect the downside.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.