When foreign investors pump money into Indian markets, it usually means that better days are ahead. And undoubtedly, they place the heaviest bets on the biggest and mightiest companies. So much so that about 15 companies in the Nifty 50 have over 1,000 foreign portfolio investors (FPIs) invested in them.

Data collated by Prime Database shows that Reliance Industries has more than 1,800 foreign portfolio investors, holding close to Rs 3.5 lakh crore. FPI holdings constitute about one-fifth of RIL. This translates into an average FPI holding of around Rs 180 crore.

Other Nifty 50 companies that have garnered a large FPI fan following include the HDFC twins, ICICI Bank, Axis Bank and State Bank of India. No surprises here since financial services make up 37 percent of the Nifty’s weightage and are at the forefront of India’s growth story.

The surprises

Despite having a smaller market capitalisation, 48th among the top 50 companies, Apollo Hospitals has a surprisingly large number of FPI shareholders, at 988. They hold approximately 47 percent of the company with an average FPI holding of about Rs 29 crore. Cipla has a similar story, with over 800 FPI shareholders, while its market cap is towards the bottom rung of the Nifty 50.

UPL, which also ranks lower when it comes to market capitalisation, has over 870 FPI shareholders, with the average holding per FPI at Rs 26 crore. Hindalco, 40th in market cap, has 890 FPI shareholders, with the average bet size at Rs 30.5 crore.

Investors should note here that entities with less than 1 percent exposure in a company are not required to make a disclosure regarding their investments. So, while the number of FPIs invested in a company is exact, it is not possible to identify the FPIs with less than 1 percent stake. The data is based on shareholding at the end of the March quarter.

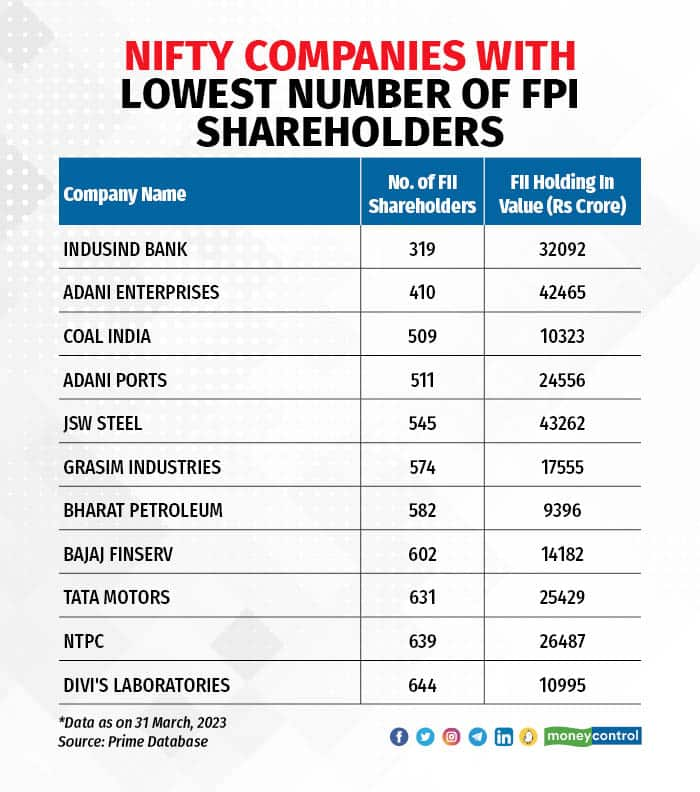

On the flip side, Adani Enterprises, which is relatively larger in size, has a little over 400 FPI shareholders, less than a fourth of the number of FPIs in some of the leading companies in the Nifty. The average FPI holding for the flagship Adani entity is Rs 103 crore. Adani Ports has 511 FPI shareholders, with the average holding per FPI at Rs 48 crore.

Meanwhile, start-run Coal India, NTPC and ONGC, all from the energy sector, have fewer FPI shareholders, with the average holding per FPI hovering near the Rs 20 crore level.

Additional disclosures required

On June 29, the Securities Exchange Board of India said that FPIs that have 50 percent group concentration or have exposure to the Indian equity market beyond Rs 25,000 crore will now have to make additional disclosures.

With this, Sebi is looking to prevent the violation of minimum public sector shareholding rules and opportunistic takeovers of Indian companies using the FPI route, as well as to plug gaps in the Prevention of Money Laundering Act (PMLA) and Foreign Institutional Investor Regulations.

This means several FPIs in Nifty 50 companies could now be required to give granular details about their holdings.

Disclosure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.