Krishna Karwa

Moneycontrol Research

Highlights:

- We prefer Aditya Birla Fashion & Retail, Trent and V2 Retail

- India’s consumption theme is intact

- Festive and wedding sales to drive growth- Good chance to derive operating leverage

--------------------------------------------------

Of late, Indian markets have been jittery due to the US-China trade tensions, the possibility of fiscal slippage, the upcoming Union Budget and uncertainties pertaining to the general elections in mid-2019. Even as concerns about capex slowdown continue to persist, the consumption theme, in contrast, is one worth banking on.

In this context, it is worthwhile to gauge how the quarter gone by is likely to pan out for India’s leading retail companies. We prefer Aditya Birla Fashion & Retail (ABFR), Trent and V2 Retail for the long-term.

Here’s what one can expect:-

Festive delay to drive sales

In 2018, all the key festivals were celebrated in the October-December period. In 2017, the festival dates were in late September and early days of October.

So, owing to a low base in Q3FY18, retailers are estimated to report strong year-on-year (YoY) revenue growth in Q3FY19. From a sequential perspective too, Q3FY19 numbers should be better than those reported in Q2.

Store additions to gain momentum

To cash in on the demand uptick in the seasonally strong quarter (because of weddings and festivities), retailers are likely to add brick-and-mortar stores at a faster pace. In most cases, store additions will be undertaken through the franchise route to keep the business asset-light. While some players already have their online portals in place, others are working towards scaling it up.

Higher advertisement spends and overheads

To achieve brand/store/product/scheme recall, marketing expenses are slated to increase in Q3. On account of network augmentation and store refurbishment initiatives, fixed overheads will also go up.

A good margin accretion opportunity

On the back of high footfalls at stores, retailers stand a good chance to deliver healthy same-store sales growth. This, coupled with the right product mix (i.e. type of products – grocery, apparel, beauty, home furniture, electronics etc) could aid margin expansion.

On the flip side, extended end of season sale (EOSS) periods may force companies to take price cuts in order to withstand the competition and/or gain market share. Though this will help boost sale volumes, realisations (i.e. selling prices per unit) could possibly take a hit.

Which stocks should you go long on?

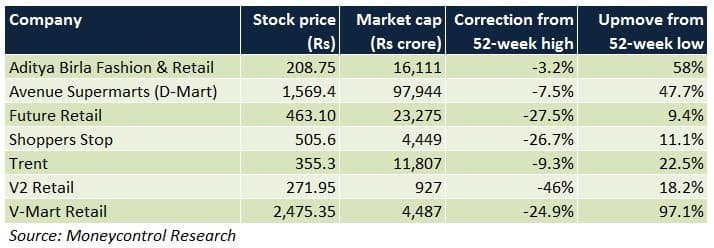

Most retail stocks, despite a steep downfall from their 52-weak peaks, offer little valuation leeway at this point.

In recent times, there have been talks of FDI (foreign direct investment) rules in e-commerce being reviewed to curtail market dominance by Amazon. Therefore, we are cautious about Shoppers Stop and Future Retail till there is further clarity on this subject. While the former has entered into a tie-up with Amazon, the latter is currently in talks with the e-commerce major. As a result, these 2 could be the worst-hit if FDI regulations are unfavourable or restrictions are imposed on discounting/sale of private label brands.

After a disappointing Q2FY19, D-Mart corrected sharply. The price rebound since then leaves little comfort.

Aditya Birla Fashion & Retail (ABFR) and Trent are two stocks that generally tend to trade in a range-bound manner. Both companies aim to improve their earnings profile through cost rationalisation measures. While the heady valuations keep their upside potential capped in the near-term, we don’t see a significant downside either.

V-Mart and V2 Retail, retailers that primarily operate in the semi-urban and rural areas of India, should witness noticeable top-line traction. This would be largely attributable to positive spending-cum-consumption patterns prior to elections. Both stocks, by virtue of their aggressive network expansion plans and fundamental strengths, are capable of re-rating. For now, we are more bullish on V2 Retail since it is reasonably valued compared to V-Mart.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!