The January-March earnings season has reached its fag end, with numbers either in line or above estimates, excluding state-run banks. The misses include corporate banks, IT and pharma companies while consumer staples, non-banking financial companies (NBFCs), and materials performed better. Excluding Axis Bank, ICICI Bank and Lupin, PAT growth for Nifty constituents stood at 10 percent year-on-year (YoY).

Going forward, FY19 consensus earnings growth expectations stood at over 20 percent as compared to sub-10 percent growth witnessed in FY18. “Q4 FY18 results of constituents have been a mixed bag. On an aggregate basis, the result season has been largely in-line with expectations on the revenue front. On the net profit front, provisioning by state-run banks impacted overall profitability,” Jayant Manglik, President, Religare Broking, said. While he remains optimistic about earnings growth gaining further traction, he does not rule the possibility of some earnings downgrade in FY19.

On the margins front, while automobiles saw some pressure on account of higher raw material prices, fast moving consumer goods (FMCG) companies saw an improvement.

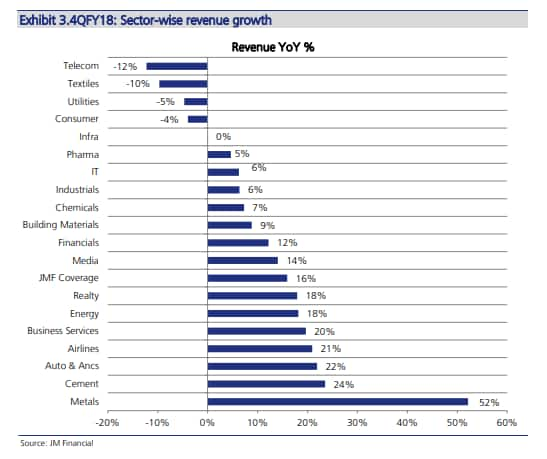

“The beats-to-misses (BTM) ratio for Q4 was 0.76 times, indicating that there were more misses than beats. After the largely positive surprises in 2Q, which had a BTM of 1.42 times, Q3 and Q4 have witnessed a sequential decline. Among sectors, cement and private banks had the worst BTM in Q4, while the same for metals, NBFCs and IT were the highest. In Q4 FY18, YoY PAT growth has been nearly flat at 0.6 percent against expectation of 10.3 percent for companies under our coverage,” JM Financial said in a recent report.

Here is a list of 10 stocks from different brokerages that could return up to 16-47% over the next one year:

Sun Pharma: Buy | Target: Rs 600 | LTP: Rs 494.75 | Return: 24%

CLSA upgraded Sun Pharma to buy from sell post Q4 results and raised its 12-month target price to Rs 600 from Rs 445 earlier as it feels that earnings have bottomed out. The global investment bank expects its earnings per share (EPS) to nearly double as monetisation of specialty pipeline begins.

Tech Mahindra: Buy | Target: Rs 880 | LTP: Rs 686.40 | Return: 24%

Goldman Sachs maintains a buy rating on Tech Mahindra post Q4 results but raised its 12-month target price to Rs 880 from Rs 824 earlier.

The Q4 results were above expectations on continued margin beat. The entire topline growth was led by enterprise business in Q4. Going forward, 5G remains a key structural growth opportunity for Tech Mahindra, said the report.

Indian Hotels: Buy | Target: Rs 165 | LTP: Rs 143.40 | Return: 17%

HSBC maintains a buy rating on Indian Hotels post Q4 results but raised its target price to Rs 165 from Rs 143.40 earlier. The global investment bank expects 2019 growth to be better than 2018. The occupancy rate is already near record-high levels in major cities, said the report.

NCC: Outperform | Target: Rs 177 | LTP: Rs 121.20 | Return: 47%

Macquarie maintains an outperform rating on NCC post Q4 results but raised its 12-month target price to Rs 177 from Rs 160 earlier.

NCC has a strong balance sheet to support working capital needs. The global investment bank also raised FY19/20 earnings estimate by 31/21 percent. The stock is well placed to fund higher working capital requirements. The risk of near-term claims/write-offs has come down.

ONGC: Buy | Target: Rs 240 | LTP: Rs 173.95 | Return: 35%

CLSA maintains a buy rating on ONGC but raised its 12-month target price to Rs 240 from Rs 225 earlier post Q4 results. EBITDA and net profit were a miss due to higher Opex and larger exploration write-offs.

Higher crude price led to a 6 percent hike in EPS. CLSA assumes upstream companies to bear all subsidies above Rs 4000 crore. Recent reports of a formula with no subsidy till USD 70/bbl is positive for the company.

ONGC is attractively priced at current levels as the risk-reward ratio is favourable. The stock is pricing Brent of USD 53/bbl.

Glenmark Pharma: Buy | Target: Rs 650 | LTP: Rs 524.25 | Return: 21%

CLSA upgraded Glenmark Pharma to buy post Q4 results and raised its 12-month target price to Rs 650 from Rs 480 earlier. Earnings growth returns and some signs of balance sheet deleveraging are visible now. The stock trades at an attractive 15x one-year forward PE. CLSA estimates a 20 percent earnings CAGR for FY18-20.

Coal India: Buy | Target: Rs 363 | LTP: Rs 288.75 | Return: 23%

Jefferies maintains a buy rating on Coal India post Q4 results but raised its 12-month target price to Rs 363 from Rs 350 earlier. It said that the operating profit, ex-gratuity provision) was up 124 percent year on year and 22 percent ahead of estimates.

Coal India has strong 40 fuel supply agreement (FSA) and the average selling price of those FSA’s should sustain. Low power plant coal stocks should support steady offtake growth, said the note.

Jefferies expects the EPS to grow at 20 percent CAGR over FY18-20. Commenting on valuations, at 5.1x FY19e EBITDA, valuations appear cheap.

Mahindra & Mahindra: Buy | Target: Rs 1,075 | LTP: Rs 895.60 | Return 16%

CLSA maintains a buy rating on M&M post Q4 results but raised its 12-month target price to Rs 1,075 from Rs 960 earlier.

Domestic vehicle manufacturer Mahindra and Mahindra reported a 50 percent year-on-year rise in its net profit for the March quarter to Rs 1,155 crore on Tuesday.

M&M delivered a strong Q4 led by better-than-expected margins. The rural outlook improved on expectations of a normal monsoon and expectations of a big MSP hike.

New MPV launch in FY19 is likely to boost SUV segment volume. CLSA expects strong 18 percent EPS CAGR over next two years, and valuations still remain attractive.

Bajaj Auto: Buy | Target: Rs 3395 | LTP: Rs 2763.10 | Return: 22%

Nomura upgrades Bajaj Auto to buy from neutral earlier post Q4 results and raised its 12-month target price to Rs 3,395 from Rs 3,252 earlier.

The global investment bank sees 25 percent upside from current level. The export outlook has improved, and the market like Nigeria have recovered. The stock trades at 14x FY20 EPS which is attractive.

Larsen & Toubro: Buy | Target: Rs 1,730 | LTP: Rs 1,365 | Return: 26%

CLSA maintains a buy rating on L&T post Q4 results but raised its target price to Rs 1,730 from Rs 1680 earlier. The global investment bank raised its EPS by 4-7 percent over FY19-20.

The EPS upgrade was based on two value accretive divestitures. Divestitures have happened at significant premiums to CLSA SoTP and will yield L&T USD 2.7 billion, said the note. It will drive L&T’s ROE to expand (80bps against earlier estimates) on the reallocation of capital.

L&T has a credible strategy to improve both growth and its return on equity. The stock is a good proxy for domestic capex.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.