In India, consumers go with banks or remittance service providers to send or receive money internationally. Also, while traveling abroad for holidays, some of us spend in foreign currencies or even withdraw money using our ATM, credit or debit cards, but unknowingly pay hefty fees. We end up paying hidden fees/charges for remittances.

According to a study commissioned by Wise, a London stock exchange listed company, and Capital Economics in August 2021, Indian consumers paid over Rs 26.3 crore as foreign exchange fees in the year 2020. Of this Rs 9.7 crore was ‘hidden fees,’ as exchange rate mark-ups on currency conversions, payments and card purchases. The study reveals that between 2016 and 2020, the annual amount Indians lost in hidden fees has increased from Rs 5.9 crore to Rs 9.7 crore (refer to graphic).

“Any time the rupee changes into a dollar or euro or any other international currency or vice versa, consumers find themselves tangled in a web of hidden exchange rate mark-ups and high fees,” says Rashmi Satpute, Country Manager, Wise India. She goes on to add that the research exposes a severe lack of transparency in foreign exchange transactions—for far too long consumers have unknowingly paid “unnecessary costs for foreign transactions” when providers charge fees in exchange-rate mark-ups that users aren’t really aware of.

What is forex currency mark-up fees?

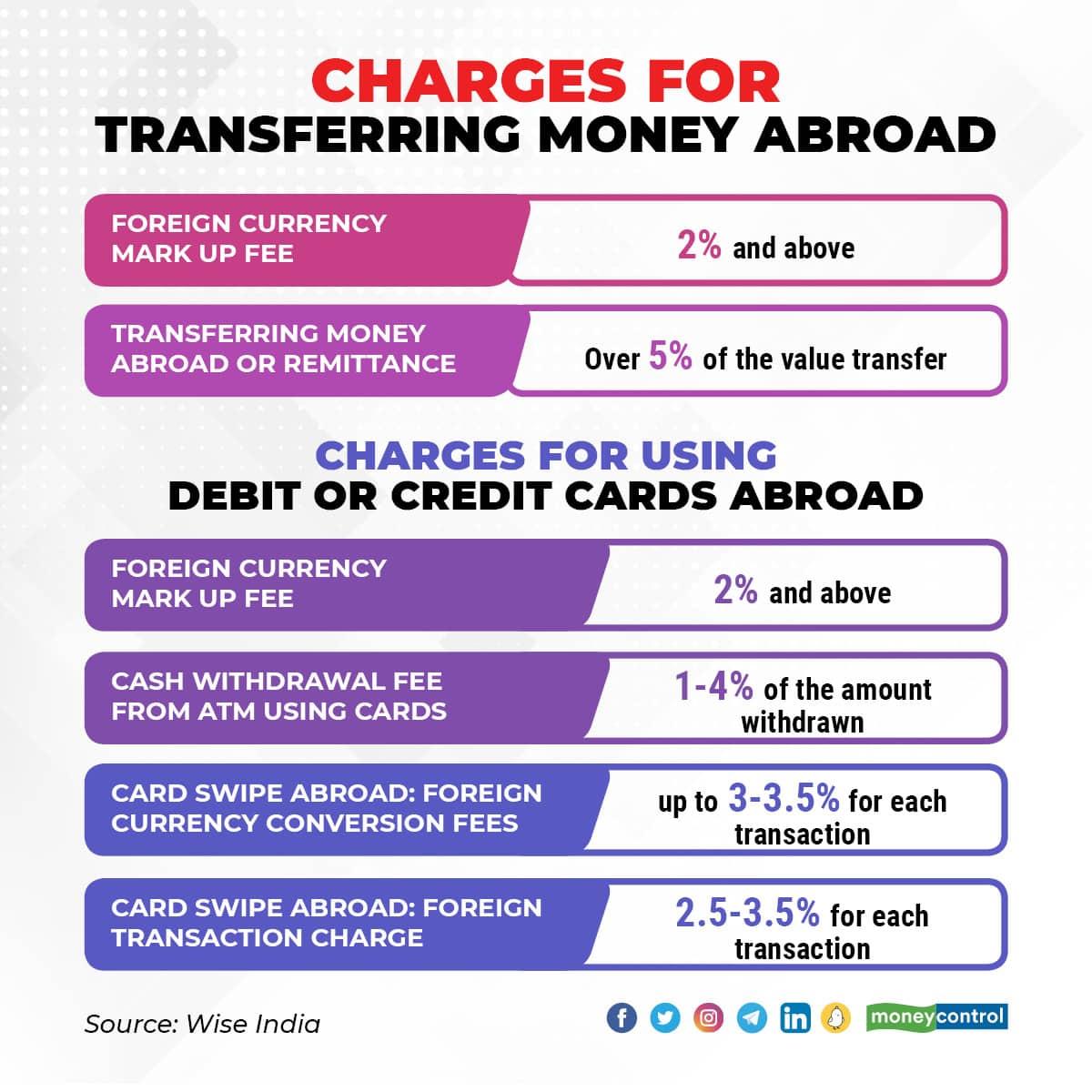

If you swipe your card overseas, the issuer converts the amount you have spent to Indian rupees. It charges a forex currency mark-up as fee for the transaction. The charges are 2 percent of the transaction value or higher, varies with the bank issuing the card.

Therefore, it’s necessary to keep a tab on your foreign currency mark-up fees, foreign transaction costs and cash withdrawal charges when you use your card abroad. Every time you withdraw money from ATMs abroad using your debit/credit card, you pay a withdrawal fee (1 percent to 4 percent of the amount withdrawn) to the bank.

Banks and money transfer service providers also charge these mark-up fees while remitting money from and to India. For instance, you end up paying fees while sending money to your family member or friend abroad. Similarly, Indian citizens living overseas pay these fees when they send money to family members or friends who live in India.

Ambiguous remittance pricing structures

Most people do not understand the actual costs of sending money abroad because of a continued lack of transparency around fee structures. Often, these fees can be well over 5 percent of the value of one’s transfer.

There are two costs associated with foreign currency transactions: the upfront transaction fee and the exchange rate. “The upfront fee can vary, but would often not represent the total cost of the transaction as traditional banks and providers add an undisclosed mark-up on the exchange rate,” says Satpute.

Financial institutions can levy hefty prices on currency conversions, without explicitly informing consumers what they are being charged for. “To avoid this outgo, it’s essential for a consumer to look for the official mid-market exchange rate, and match it with the quoted rate given by the transfer service before going ahead with the transaction,” says Satpute. The difference between rates results in a hidden fee, which unnecessarily costs you a lot more when sending money abroad.

Traveling abroad? Take forex in India

As countries open their boundaries gradually for Indian citizens, business travellers and tourists may look to fly abroad during Christmas and New Year. With an increase in foreign travel, there is going to be a demand for forex. The study by Wise has revealed that before the pandemic, Indian travellers spent Rs 4.2 crore as foreign exchange fees in 2019 alone, of which Rs 2.4 crore was hidden in exchange rate mark-ups.

Sudarshan Motwani, CEO and co-founder of BookMyForex.com says, “Before flying abroad, buy foreign currency in India instead of exchanging currency abroad from banks or airports, since the conversion charges are high and mark-up charges added.”

Arindam Sengupta, Co-founder and CIO at EduFund adds, “While purchasing forex, look at the mark-up. Many people end up paying 3-4 percent as mark-up charges, which is an enormous cost.” To get the best forex price and save time in research, you can explore online forex marketplaces, as they aggregate rates from multiple currency exchange vendors and banks.

Further, when you travel abroad, avoid using debit or credit cards, as they are costly. For every swipe done abroad, banks charge you a foreign currency conversion fee (up to 3-3.5 percent for each transaction) and levy a foreign transaction (of around 2.5 percent to 3.5 percent, again for each transaction).

Need for greater transparency?

Experts feel that there is a need for greater transparency across the industry on hidden fees in foreign exchange transactions. “Banks and foreign exchange brokers can achieve it by putting an end to the use of misleading terms such as ‘free' and ‘zero percent commission',” says Satpute.

Some brokers and financial institutions often say they have low, or even no fees, but sneak in extra charges in the fine print or hidden fees in the form of a mark-up exchange rate. Additionally, it is important to provide a clear breakdown of the costs associated with every transaction. “Also, they should show the difference between the foreign exchange rates offered by the provider, benchmarked against the mid-market rate,” adds Satpute.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.