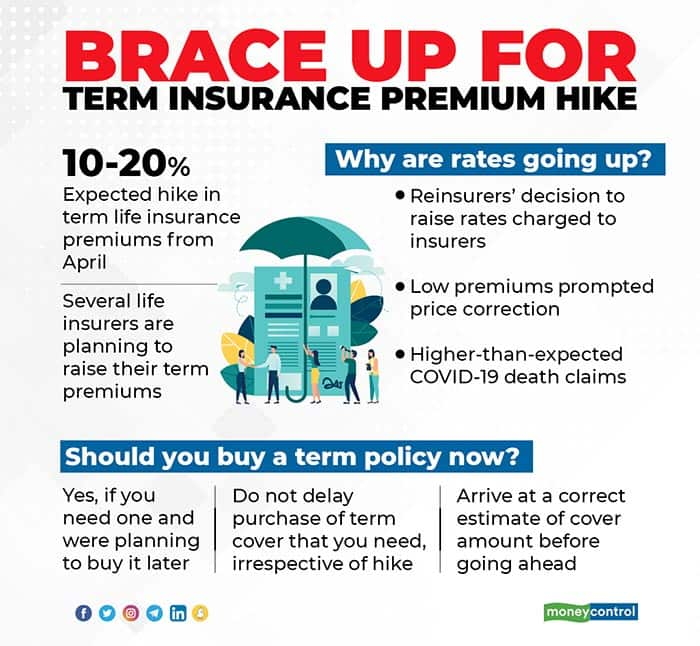

COVID-19 has claimed yet another victim: cheap term insurance policies that Indians had become accustomed to over the last decade. Some life insurers have decided to increase their term insurance premium rates by 10-20 percent from April, while others could follow suit later. Term insurance is the simplest and most cost-effective form of life insurance that promises to pay out the life cover, or the sum assured, to the policyholder’s dependents in case of her death. Unlike endowment or unit-linked policies, such pure protection policies do not offer any maturity benefits if the policyholder survives the policy tenure.

Also read: Avoid term insurance plans that offer to return your premiums

The rise and rise of term insurance premiums

This move comes after a clutch of life insurance firms had increased their premium rates by 25-30 percent in April 2020, on the grounds that the existing pricing was not sustainable.

Just as you pay premiums to your insurer for your life cover, the insurers, in turn, shell out premiums to reinsurers to cover large risks. These reinsurers have decided to increase their rates yet again, this time citing COVID-19 death claims, according to industry officials. “The reason is higher-than-expected COVID-19 death claims. For reinsurers, there is a need to recoup losses and also the fear of anti-selection. When someone looks to buy a term policy now, there is a tendency to be suspicious of the circumstances that triggered the need,” says the CEO of a private life insurance company who did not wish to be named. Some life insurers could still choose to absorb these hikes instead of passing them on to policyholders.

There are other reasons too. “Term insurance premiums had been going down due to aggressive competition. India has one of the one lowest price structures in the world. Now, we are seeing a price correction,” says Naval Goel, CEO, PolicyX, an online insurance aggregator.

This is the third round of hike from the industry’s perspective. “Life insurers who had not hiked their rates in April 2020, effected the increase later during the year. The ones who had increased their premiums in April and not in September-October will be raising their premiums now,” explains a senior official with an online insurance aggregator firm who spoke on the condition of anonymity.

Should you buy a policy now?

Do not buy a term policy with a vague figure in mind in a hurry merely in view of the impending premium hike. Carry out meticulous homework on your requirements. Your term policy should be adequate to replace your income, pay off debts and provide for your family’s future financial goals in your absence.

If you need a simpler method to calculate life cover requirement, you can stick to the thumb rule that says your life cover should be at least ten times your annual income.

However, if you plan to buy a term policy, in any case, to make up for shortfall in protection cover, you should act on your resolve soon before the rates start going up. “Irrespective of the premium rate changes, there is no reason to delay buying a term cover. It is like a safety tool. You buy it hoping that you will never have to use it. You are likely to need larger protection cover in future as your goals and responsibilities increase,” says RM Vishakha, MD and CEO, IndiaFirst Life Insurance.

Once you buy a term policy, level premiums will mean that these will remain constant throughout the 20-30 year policy tenure. A 35-year-old non-smoker male can buy a Rs 1-crore cover with a 20-year tenure for an annual premium of Rs 9,000. “It is important to lock into premiums now. If you plan to buy a term cover, it makes sense to advance the decision,” says Goel.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.