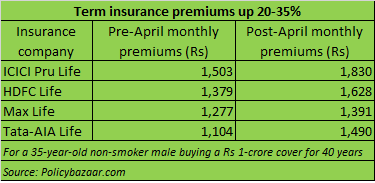

HDFC Life, ICICI Prudential Life, Max Life and Tata-AIA have hiked their pure protection term insurance premium rates in April.

“Term premiums for these companies’ policies have gone up by over 20 per cent,” says Santosh Agarwal, Chief Business Officer- Life Insurance, Policybazaar.com, an online insurance aggregator.

On expected lines

The increase was on expected lines, as reinsurers - to whom insurers pay premiums to cover large risks - had raised their rates earlier this year.

This hike in reinsurance rates is a result of higher-than-expected mortality rates (deaths per thousand assured lives) across insurers in India.

“Taking into consideration the emerging mortality experience across players, reinsurers have recently revised their protection rates. Consequently, the premium for term plans has increased. This increase by re-insurers is varied, depending on their mortality experience with the various insurers,” says Suresh Badami, Executive Director, HDFC Life. The quantum of hikes varies across age-groups as well as sums assured, policy tenures and premium paying terms chosen. India has one of the lowest rates when it comes to protection products, compared to the rest of the markets across the world. “There has been an increase in the rates, but our prices are based on our previous mortality experience across customer segments. We have priced it competitively, while keeping in mind the profitability and risk,” explains Badami.

According to Tata-AIA Life, it has replaced its flagship product with a new term product at reduced prices, but these are more expensive than their erstwhile flagship term plan rates.

Moreover, insurers are not done with the premium enhancement yet, say industry-watchers. “Another round of hikes will happen over the next 3-6 months as reinsurers have increased their rates by up to 40 per cent. For now, life insurers have not passed on the entire hike to their customers, but eventually they will,” he adds.

Moreover, the underwriting criteria – that is, the prospective policyholder’s risk profile assessment prior to policy issuance – could also turn more stringent, which could add to the premium burden.

Cover, a must despite higher premiums

Having an adequate term insurance policy, which is the most cost-effective form of life cover, is a must at all times. These are pure risk policies, and so you will not be entitled to any payout if you survive the policy tenure. The policyholder’s dependents, however, will get the sum assured in case of her death. So, you can secure your family’s financial future at an inexpensive premium rate. For example, a 35-year-old, non-smoker make can obtain a large cover of Rs 1 crore with a policy tenure of 20 years for as little as Rs 12,000-Rs 16,000 a year, depending on the company and plan variant chosen.

This, however, does not mean that you should rush to buy or enhance your life cover guided simply by the COVID-19 pandemic-induced panic and likely premium hikes. Your requirements should be your sole focus. If you are not adequately insured and are looking to buy a policy, now is as good occasion as any other to buy a term cover, irrespective of premium increases. If not, first compute your family’s financial requirements in your absence. The cover should be enough to replace your income, pay off liabilities and also fund your dependent spouse’s retirement. If you are looking for a simpler method to calculate life cover requirement, you can stick to the thumb rule that says your life cover should be at least ten times your annual income.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.