In the mood for festive shopping and forgot your bank cards back home? Don’t head back. There is a way to withdraw cash at automated teller machines (ATM), without using your debit card.

Typically, one inserts a debit card in the ATM kiosk card slot, enters the 4-digit personal identification number (PIN), mentions the amount to be withdrawn and receives cash at the ATM.

However, there could be situations such as forgetting the wallet, or a medical condition, owing to which you cannot move much. If you send a third person to collect cash from the ATM, you need not hand over your card or divulge the secure PIN.

Also read: MC Explains: How to withdraw cash from any ATM using your mobile phone

You can simply send someone to transact at the ATM using a special one-time PIN, using a feature called cardless cash withdrawal.

To do this, you would need a mobile phone with the bank’s mobile app that permits you to use Unified Payments Interface (UPI).

Due to the convenience, several bank account holders used the facility to hand over cash of Rs 100 to Rs 25,000 to someone during the pandemic to avoid infections. This is because someone who isn’t a bank account holder, too, can withdraw cash through this cardless facility triggered by you.

Fraud prevention

Such transactions also ensure that there is no need to worry about your card data being stolen or ATM PIN being captured using externally-fitted cameras, which has been the modus operandi of fraudsters in the past.

If your card isn’t physically used and neither is your PIN, frauds are less likely. Cardless cash withdrawals avoid frauds by securing the transaction using three mediums – registered phone, mobile app password and temporary PIN.

To avoid any serious mishap, the transaction limits of Rs 10,000-25,000 per day have been set by banks for cardless cash withdrawal facility.

Also read: RBI panel proposes measures to improve customer services at banks

How to withdraw cash without cards?

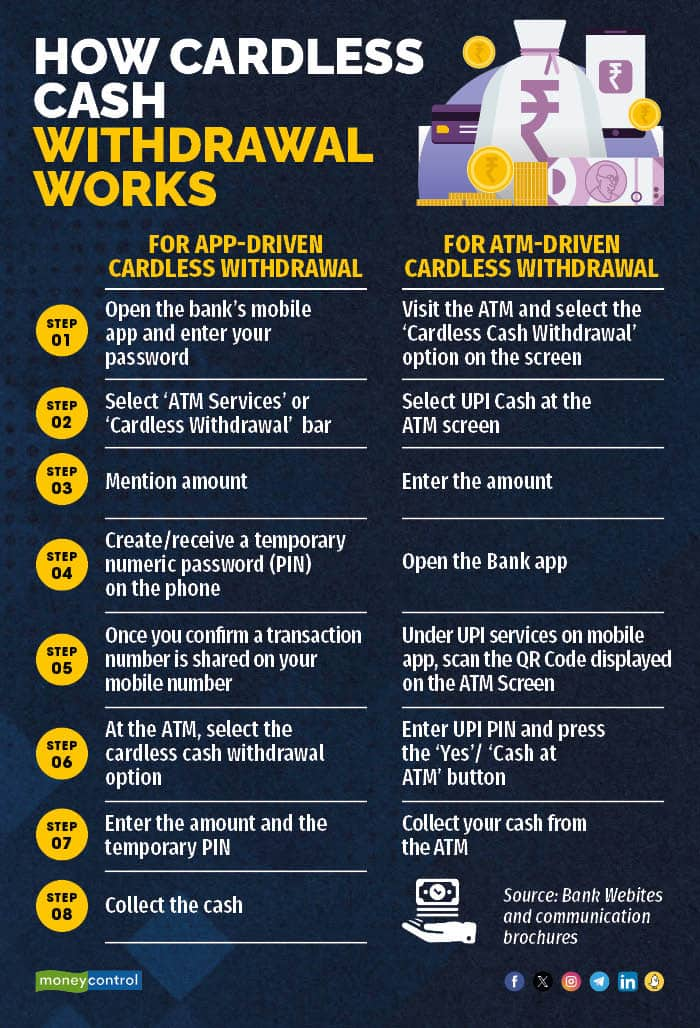

Cardless cash withdrawal prompts are valid for 24 hours. So, if you set the amount and PIN at 10 am today, the withdrawal can be made maximum by next day at 10 am. There are two ways to withdraw cardless cash.

Method 1: Enter information using the mobile (netbanking in case of some banks) or

Method 2: Fill details at the ATM itself and verify using the QR Code scanning facility at the ATM.

Triggering through mobile

Under the first method, you need to log in to the mobile app or net banking and enter your password. Select the option ATM under services and select ‘Cardless Cash withdrawal’ transaction. Once you are at the cardless cash withdrawal page, enter the amount you wish to withdraw.

You would be asked to set a PIN for the transaction at this stage or a temporary PIN will be shared on your registered mobile number along with the transaction number.

Banks often have a cooling-off period of 10-30 minutes, once the information has been entered using the app or through netbanking.

Head to the ATM after the cooling-off period and select the ‘Cardless Withdrawal’ or ‘Cardless Cash’ option. Upon selection, you would be asked for the four details – mobile number, 9-digit reference number and the temporary PIN, along with the amount you wish to withdraw.

To ensure the transaction sails through and you have your cash, you need to enter all the details as mentioned on the bank’s mobile app.

In fact, instead of an ATM, you can head to the kirana or other local stores that have been brought into the bank’s fold for cash disbursal, especially in rural areas.

Triggering through ATM

If you are already at the ATM and wish to make a cardless cash withdrawal, on the opening screen select ‘Cardless Withdrawal’. Next, enter the amount and open your mobile banking app on your phone.

A QR Code will appear on the ATM screen. Scan this QR Code by using the BHIM/ UPI option in your mobile banking app. Collect the disbursed cash from the ATM.

Which bank’s ATM to use?

Understand that if, for instance, you are using an ICICI Bank app to trigger the cardless cash withdrawal, you would have to use the same bank’s ATM. It is so with most banks. However, in case of Bank of Baroda, Union Bank of India and City Union Bank and a few payment wallets, interoperable cardless cash withdrawal (ICCW) transactions are permitted.

So, if you head to any other bank ATM, an additional option of ICCW needs to be selected. Only a couple of banks’ cardless cash transactions would be acceptable. The withdrawal limits for ICCW are Rs 10,000 per day.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.