A committee set up by the Reserve Bank of India has proposed measures to improve customer services at banks including hassle-free settlement of the accounts of deceased deposit holders and simpler know-your-customer norms.

Dealing with the loss of a family member is extremely challenging for families. An unfriendly administrative process to gain access to the accounts of the deceased family member only adds to their agony.

“It is a welcome move by the RBI to set norms for service standards for hassle-free settlement of claims of accounts of deceased account holders,” said Sneha Makhija, head of wealth planning, products & solutions at Sanctum Wealth.

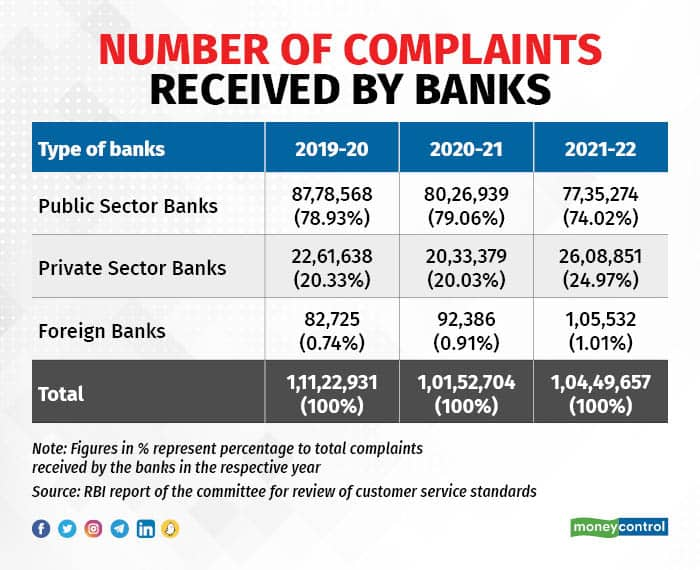

The committee found that the number of complaints against banks under the internal grievance redress mechanism over the past three years to be about 10 million to 11 million a year. The most complaints – as much as 79 percent – were against public sector banks in 2020-21.

The committee conducted a survey of 5,016 customers of RBI regulated entities (REs) in July 2022 to identify the major areas of concern with regard to bank services. The key concerns pertained to account operation services (22 percent), net and mobile banking (16.3 percent), and facilities related to ATM and cash deposit machines (16.2 percent).

The committee’s report released on June 5 lists recommendations to improve customer service standards. The RBI set up the seven-member committee, headed by former deputy governor BP Kanungo, in May 2022 to examine and review customer services in REs with the aim of protecting the interests of customers.

Also read: RBI panel suggests penalty for home loan providers on loss of borrowers' documents

Deceased account holders

The committee came across several cases of hardship faced by nominees and legal heirs while closing the accounts of their deceased relatives. Although many accounts do not have nominations, difficulties were faced even when nominations were made.

While specific instructions related to the procedure to be followed to settle claims in respect of deceased depositors have been laid down, these are not always followed. Moreover, even in cases where nominations are available, banks insist on submission of unnecessary documents such as undertakings to indemnify the bank in case of future legal disputes, and succession certificates, which are prohibited.

“The RBI has a proactive approach to settle the claims of deceased account holders,” said Rajat Dutta, founder of Inheritance Needs Services.

He added that the RBI has been instituting regulations and updating them through notifications since June 2005. Bank boards are required to approve a model operating procedure and upload the process on their websites to guide and assist customers.

“None of the above helps on the ground level because the operating counter staff, including customer service cells, do not adhere to them and there is no accountability at any stage,” said Dutta.

As no performance parameters are collected, checked or even questioned with regard to death claims, the RBI is unaware of the ground-level situation and the brunt is borne by customers, he said.

The committee said banks should update their model operating procedures in line with the regulations for hassle-free settlement of claims with regard to the accounts of deceased account holders in various scenarios. The procedure may provide for documents required to be submitted by claimants. If a nomination exists, the proceeds may be released immediately upon submission of the required documents.

The committee recommended that obtaining nominations in deposit accounts be made mandatory to facilitate hassle-free settlement of claims. The REs should be asked to obtain nominations in all such cases within a reasonable period, say three years.

Makhija said making nominations mandatory will obviate the need for legal heirs to obtain succession certificates, a process that could take three to six months as against immediate access to funds in the case of a nomination.

To eliminate the need for nominees to visit bank branches, the process of settling claims may also be made available online.

“These days, with most families having family members based overseas, the online facility will add to greater convenience,” said Makhija.

Online and physical claims may be settled within a reasonable period, say 30 days, from the date of submission of all documents.

“Set timelines of settlements within a period of 30 days will ensure the assets are not frozen for an uncertain period of time for the family and financial continuity is made available,” said Makhija.

Beyond 30 days, REs may be required to pay interest, which may be 2 percent higher than the rate at which the deceased person’s deposit was held.

Also read: RBI’s BP Kanungo committee proposes banking services for senior citizens, differently abled persons

KYC process

The committee came across instances of banks stopping account operations because the holder did not submit know-your-customer documents in time. Freezing of accounts for non-submission of KYC documents is said to be a practice in many REs even though the rules don’t provide for it.

The panel said REs should periodically update KYC but it must be ensured that account operations are not halted. In many cases, KYC is insisted upon repeatedly even after customers have submitted all the documents.

“Every bank uses its own enterprise software solution and it faces challenges with the same person having to update his/her KYC more than once in case he is also the karta (seniormost male member) of an HUF (Hindu undivided family) and a partner in an LLP,” Dutta explained.

Logically, the PAN and Aadhaar card, once updated, should hold good for all financial assets in the account holder’s name, he added.

The committee recommended that REs should maintain a centralised database of KYC documents of all customers, linked to a unique customer identifier, obviating the need for submitting KYC documents repeatedly.

Related reading: RBI committee proposes guidelines on gold loan recovery in case of borrower’s death

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.