Traditionally, debit cards are used to withdraw cash from bank ATMs. Now, thanks to innovation, you don’t need your card to withdraw cash from an ATM. Recently, Bank of Baroda and State Bank of India (SBI) started providing the option of interoperable cardless cash withdrawal at their ATMs.

On April 8, 2022, the Reserve Bank of India (RBI) announced it was allowing interoperable cardless cash withdrawals across all bank ATMs in the country. These transactions are processed using the Unified Payments Interface (UPI) facility.

Says Akhil Handa, Chief Digital Officer at Bank of Baroda, “The interoperable cardless cash withdrawal facility being offered by the bank gives customers the freedom to withdraw money without the use of a physical card — it is a simple, convenient, and secure way to withdraw cash."

Read on to learn how to withdraw cash using UPI from any bank’s ATM and to understand the key benefits of this facility.

What is an interoperable cardless cash withdrawal facility?

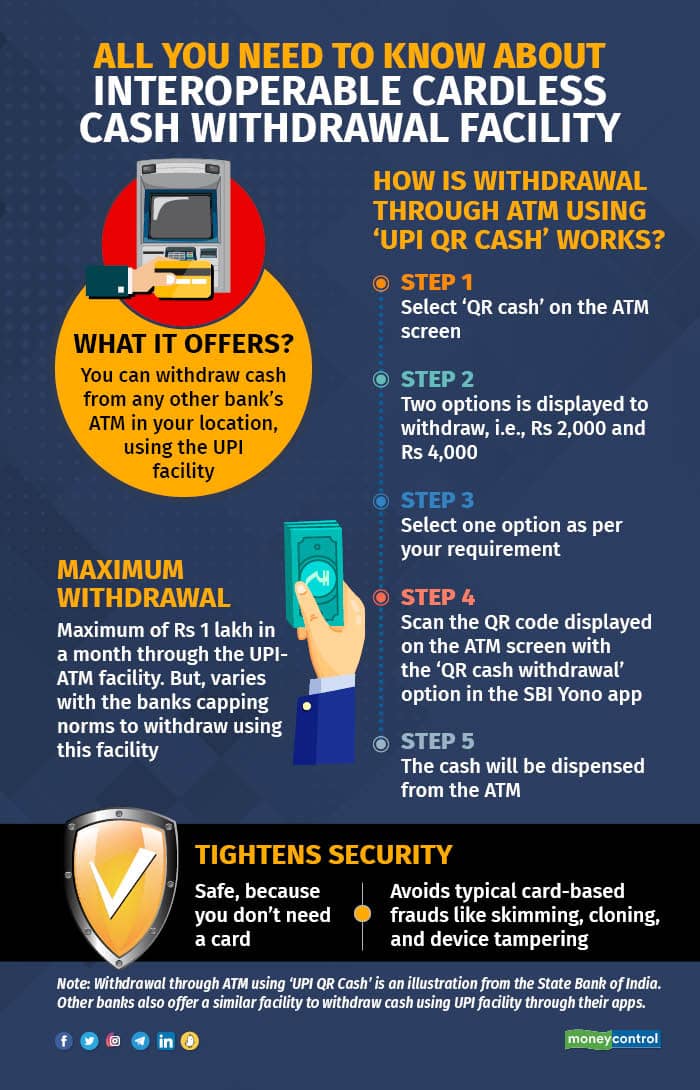

Using the interoperable cardless cash withdrawal facility, you can withdraw cash from any bank’s ATM, using the UPI facility. For instance, if you have an account with Union Bank of India, but only an ATM of the State Bank of India (SBI) nearby, you can withdraw cash from your Union Bank of India account at the SBI ATM using the UPI facility.

How does one withdraw cash from an ATM using UPI?

Customers of SBI and other banks can withdraw cash seamlessly from interoperable cardless cash withdrawal-enabled ATMs of any bank by using the 'UPI QR Cash' functionality. The transaction will be facilitated through a single-use dynamic QR code displayed on the ATM screen. Users can conveniently withdraw cash by employing the scan and pay feature available on their UPI application.

For instance, assume you have an account with SBI and want to withdraw cash using UPI from an ATM of the bank. You will require the SBI Yono or Yono Lite app installed on your mobile handset with mobile banking facility.

Now, select ‘QR cash’ on the ATM screen. You will have two options displayed to withdraw cash, i.e. Rs 2,000 and Rs 4,000. Select one option as per your requirement and scan the QR code displayed on the ATM screen using the ‘QR cash withdrawal’ option in the Yono app. The cash will then be dispensed by the ATM.

Bank of Baroda and other banks offer a similar facility to withdraw cash using UPI facility through their mobile banking apps.

What is the maximum amount you can withdraw using the UPI ATM facility?

Every month, you can withdraw a maximum of Rs 1 lakh through the UPI ATM facility. This is because, as per RBI guidelines, one can carry out transactions of only up to Rs 1 Lakh through UPI every month.

However, withdrawal using this facility also has a cap imposed by banks. For instance, using the UPI facility, Bank of Baroda customers can avail of two transactions in a day per account, with a withdrawal limit of Rs 5,000 per transaction. If you use the same bank account for other UPI transactions, the overall withdrawal limit will decrease accordingly.

Securing card-based transactions

This facility simplifies the cash withdrawal process, and also ensures enhanced security for customers. By eliminating the need to enter a PIN or physically handle a debit card, the interoperable cardless cash withdrawal facility minimises the risks associated with shoulder surfing or card cloning.

“Besides avoiding the risk of misplacing or losing one’s card, the solution will aid in containing frauds such as skimming, cloning, and device tampering,” says Mandar Agashe, MD & Vice Chairman, Sarvatra Technologies, a banking solution provider to banks and fintechs.

Also read | Government flip flop on TCS confounds credit card holders

How does the new facility benefit customers?

Besides enhancing security, cardless withdrawals through UPI offer users greater freedom to avail of withdrawals anywhere, anytime at their own ease, without a physical card. “This has taken convenience a notch higher and is likely to be favoured by audiences, especially those belonging to the millennial and Gen Z cohorts,” says Agashe. He adds that younger audiences are already accustomed to making all digital payments via mobile phones, using UPI instead of a debit card. Now, they will also be able to avail of cash withdrawals using their mobile phones, through UPI. The sheer convenience will prove to be extremely attractive to the youth, who prefer not carrying their debit cards.

Also read | TCS of 20% on credit cards put on hold, forex cards get Rs 7-lakh exemption

What should I do if a withdrawal fails at an ATM after using this facility?

If a withdrawal fails at an ATM due to a technical glitch and the amount gets deducted from your account, inform your bank immediately. The amount will be credited back into your bank account within seven working days.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.