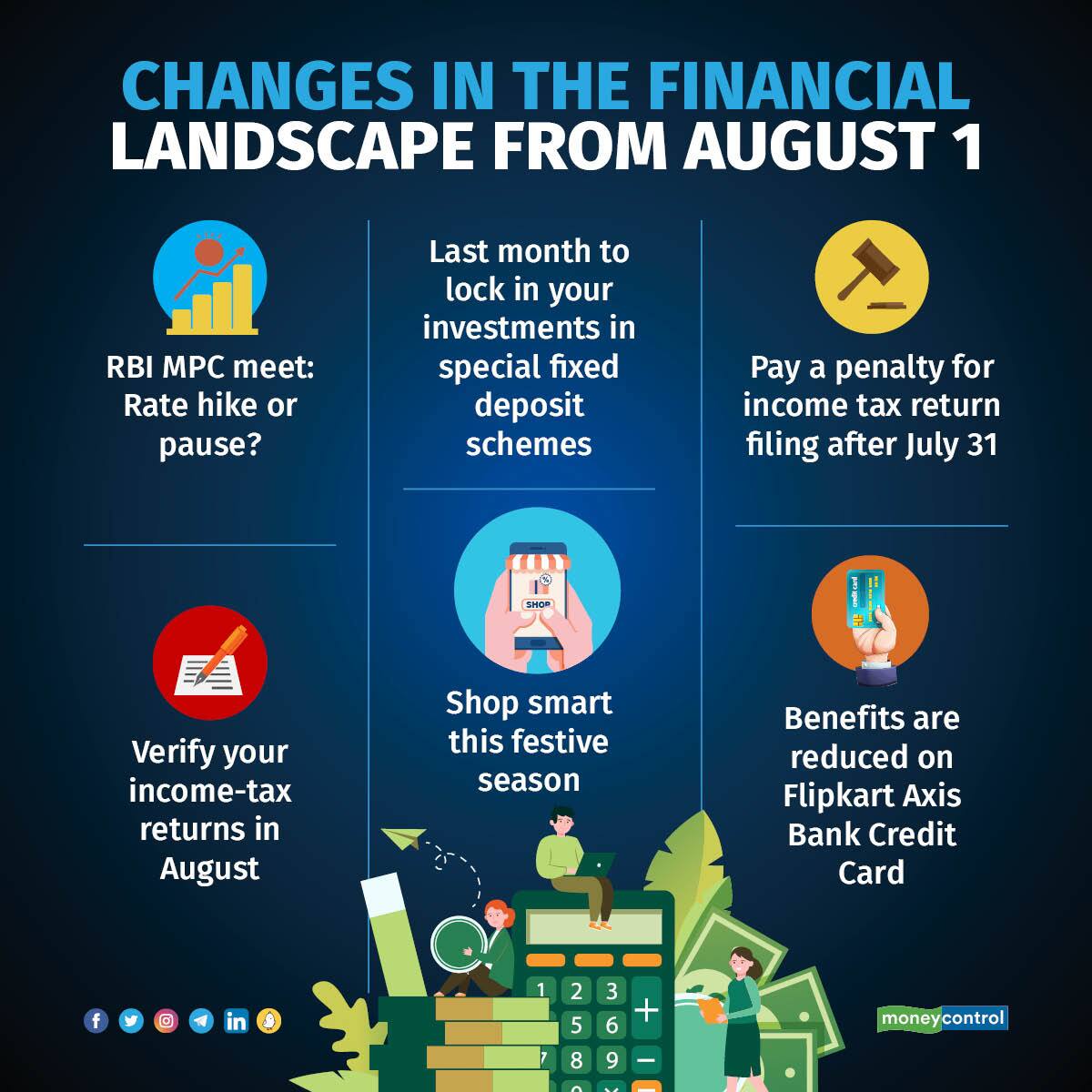

The Reserve Bank of India (RBI) kept the policy repo rate hike unchanged in April and June 2023. However, going forward, you need to keep an eye out on whether the pause in rate hikes will continue or whether the central bank announces a rate hike following the US Federal Reserve raising its benchmark lending rate in July.

The announcement will impact your finances if you have an existing loan or plan to take one. Also, August could be the last month to invest in special fixed deposit (FD) schemes introduced by some banks. During the month, you will also need to verify your income tax (IT) returns. And as the festival season kicks off, make sure to spend smartly.

Let's look a little closer at those changes in August 2023 that could pinch your purse.

US Fed hikes rate; will RBI follow?

On July 26, the US Federal Reserve raised its benchmark lending rate to the highest level since 2001 to tackle above-target inflation and signalled the possibility of further increases ahead. The quarter-percentage-point rise lifts the US Fed's key lending rate to a range between 5.25 percent and 5.5 percent. Economists in India are of the opinion that the US Fed’s rate hike could influence the RBI’s third monetary policy announcement in the financial year 2023-24 on August 10.

It was a small relief to home loan borrowers that the RBI had not raised interest rates in its April and June monetary policy announcements.

It remains to be seen whether the RBI will hike or pause rates in August. If the RBI hikes interest rates, banks will once again increase interest on home loans and other loans linked to the repo rate as an external benchmark, as per the terms of the loan agreements.

Also read | Which is the best bank FD in a rising interest-rate scenario?

Last chance to invest in special high-rate FDs?

With the hike in repo rates since May 2022, several banks started increasing their FD rates and also introduced special FD schemes for specific investment tenures, targeting regular and senior citizens.

August may see several newly launched FD schemes from select banks discontinued. For instance, IDBI Bank’s Amrit Mahotsav FD new scheme of 375 days is valid up to August 15. In this scheme, senior citizens earns 7.60 percent interest per annum, and general, NRE, and NRO category investors earns 7.1 percent interest per annum. Besides this, existing Amrit Mahotsav FD for 444 days offer interest rates of 7.65 percent to senior citizens and 7.15 percent to general, NRE, and NRO customers till August 15.

Similarly, the last date to invest in SBI’s Amrit Kalash FD scheme is August 15. It offers 7.1 percent interest to regular customers and 7.6 percent interest to senior citizens for investing in 400-day term deposits.

Indian Bank also has special term deposit schemes named IND Super 400 days and IND Supreme 300 days. The last date to invest in these schemes is August 31. The bank offers 7.25 percent interest to regular customers, 7.75 percent to senior citizens, and 8 percent to super senior citizens for investing in the IND Super 400-day scheme, and 7.05 percent interest to regular customers, 7.55 percent to senior citizens, and 7.8 percent to super senior citizens for investing in the IND Supreme 300-day scheme.

Thus, August may be the last month to lock in your investments in special FD schemes offering high interest rates.

Don't forget to verify your return in August

After filing your IT return, you need to verify it before the income tax department takes it up for processing. You can verify the return online through an income-tax e-filing portal using your Aadhaar, pre-validated bank account, demat account, and so on. Alternatively, you can verify the return offline by downloading the ITR-V or acknowledgement form from the e-filing website and sending it by post to the income tax department's central processing centre in Bengaluru.

You need to verify your return within 30 days from the date of filing.

Also read | DIY ITR preparation can lead to errors. Here’s where to seek help in tax filing

Pay penalties for belated income tax return

Did you not file your IT return (ITR) by July 31? Then be prepared to pay a penalty for filing belated returns. A belated return is a return that is filed after the due date mentioned in the income tax rules. The deadline for filing ITRs is July 31, but one can still file returns until December 31 for the financial year 2022-23. A penalty of Rs 5,000 will be charged for delay in filing returns if the total income to be reported exceeds Rs 5 lakh. If the total income of the person is less than Rs 5 lakh, then the penalty payable is up to Rs 1,000.

Also read | How Income from YouTube, Instagram, Twitter handles is taxed

Spend smartly this festive season

In August, thanks to Independence Day and Raksha Bandhan, e-commerce websites, retail chains, and independent neighbourhood stores will roll out shopping offers. Make a budget and track your shopping expenses during the festival season. Prepare a list of gift items that you need to buy and, thus, avoid impulsive spending. Use cards from partner banks for additional discounts and cashbacks. Redeem reward points for additional savings. Avoid shopping for things you may not use immediately, and zero-cost EMI schemes, as they are debt traps.

New rules by credit card companies

Effective August 12, Axis Bank has revised the features of the Flipkart Axis Bank Credit Card. The bank has reduced cashback benefits on this card. For instance, if you are spending on flight and hotel payments on Flipkart and other purchases on Myntra, you will be eligible for 1.5 percent unlimited cashback, down from 5 percent earlier. Axis Bank has also increased the spending limit for the annual fee waiver of Rs 500. So, now you need to spend Rs 3.5 lakh annually to earn a fee waiver, compared to the minimum spending limit of Rs 2 lakh a year.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!