Currently, some banks offer 8-9 percent interest per annum on fixed deposits (FDs).

This increase from 4 percent can be attributed to the Reserve Bank of India’s (RBI) repo rate hikes in financial year 2023 (FY23). With 250 basis point repo rate hikes to 6.5 percent in the last one year, there is an upward push on interest rates on FDs as well. One basis point is one-hundredth of a percent.

While it may tempt you to immediately redeem your FDs when they touch these higher rates, there are certain parameters to keep in mind while short-listing banks.

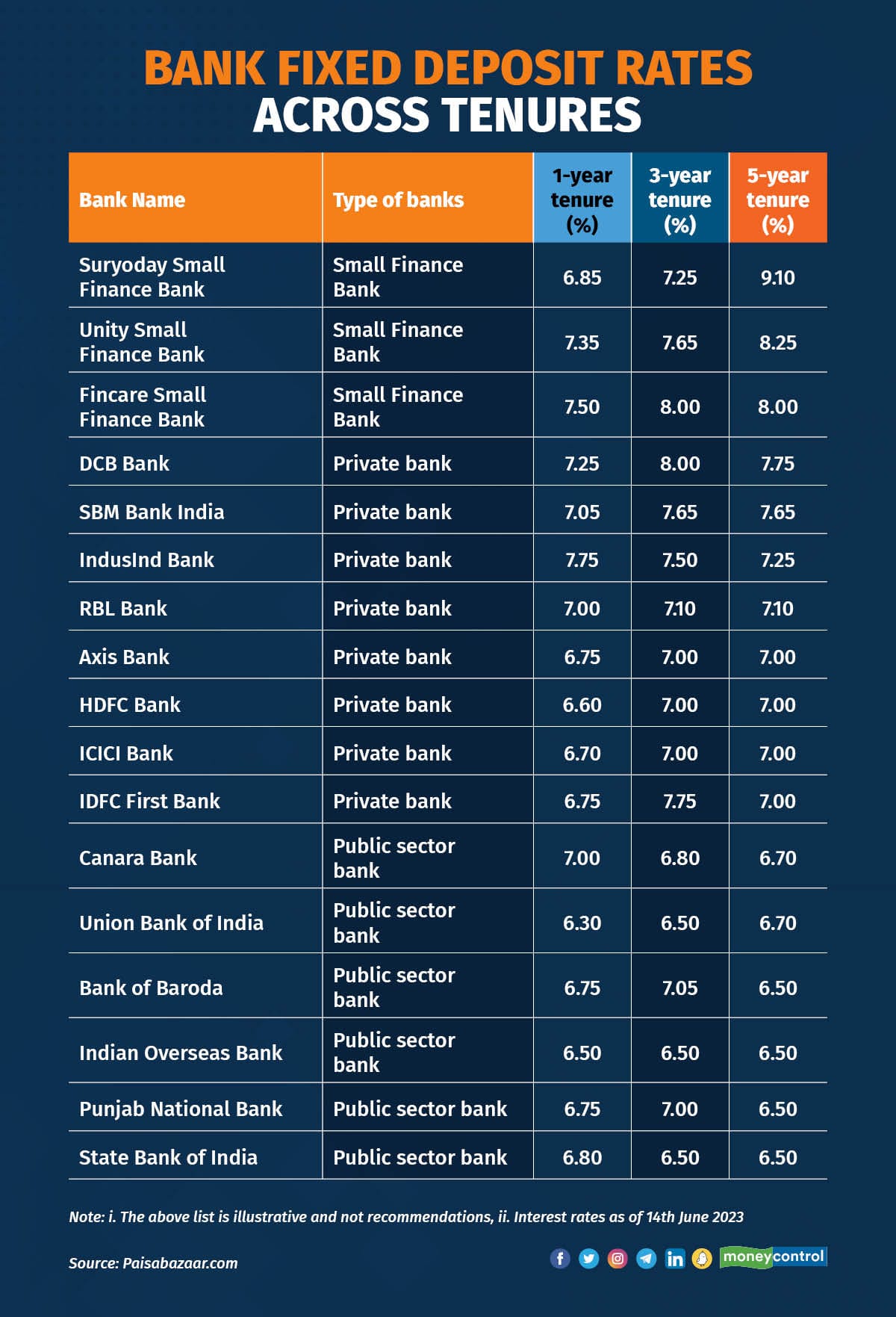

Small finance banks (SFBs) offer higher interest rates. Should I prefer them?SFBs offer the highest interest rates on FDs, followed by private and the public-sector banks in that order.

For instance, Suryoday Small Finance Bank and Unity Small Finance Bank offer over 9.1 and 9 percent interest per annum, respectively, on FDs.

“It is important to remember that higher returns usually come with higher risks,” says Shavir Bansal, Founder and CEO of Kifaayat, a FinTech start up. SFBs are newer and smaller than traditional banks (private and public sector banks), and they have a smaller capital base. This means they are more susceptible to defaults and non-performing assets (NPAs).

“Higher interest rates can potentially yield better returns on your investment. However, be cautious if the interest rates offered by a bank are significantly higher than others, as it may indicate higher risk,” says Adhil Shetty, CEO of BankBazaar.com.

Each bank offers different interest rates and has a different perception among investors. “Diversifying across banks remains the golden rule, stemming from the ideology that you should not put all your eggs in one basket,” says Akshar Shah, Founder and CEO of Fixed, an investment-technology platform.

It doesn’t matter whether you invest in an SFB, private bank or a public sector bank as long as you do your due diligence. “It is important to consider trust, convenience, diversification, competitive offers, customer service, and personal preferences,” says Shetty. One should maintain a balance between interest rates, convenience, and overall financial goals, he says.

Also check whether the bank is covered under a deposit insurance scheme, such as the Deposit Insurance and Credit Guarantee Corporation (DICGC), which insures claims up to Rs 5 lakh. DICGC offers an additional layer of protection to FD investors.

Consider the range of tenure options for FDs. “Different banks offer varying tenure periods, allowing you to choose the one that aligns with your investment goals,” says Shetty. Some banks may offer flexible tenure options, including both short-term and long-term options.

Unforeseen circumstances may require you to withdraw funds before maturity, and it is important to be aware of the penalty charges.

“You may also want to assess the bank's financial health by reviewing its financial statements, annual reports, and other financial indicators,” says Shetty.

While investing in a bank FD, you need to first consider the financial stability of the bank closer to your home location. “There are a number of factors that can be used to judge stability, including capital adequacy ratio, asset quality, profitability, liquidity, management, etc.,” says Bansal. If this gets too complicated, you can simply check the bank's credit rating, preferably from CRISIL, and a rating above ‘AA’ should be fine.

If the bank closer to your home is fairly stable, and if it is recommended by financial advisors to diversify savings across multiple banks, go for it. This is because there were instances in the past when the RBI had restricted cash withdrawals from the Punjab and Maharashtra Co-operative Bank (PMC) and Yes Bank. “You wouldn’t want to be in a position where your liquidity is stuck because of external factors,” says Bansal.

Also read | Fixed deposits: Three pointers to resolve the dilemma of peak interest ratesShould I open an FD with an existing bank with a long relationship or prefer some other bank with no prior relationship?“If you have a long-standing relationship with a bank, it can provide a sense of trust and familiarity,” says Shetty. You may already be familiar with their services, customer service quality, and overall banking experience.

If you have all your savings and investments in a single bank and that bank faces financial difficulties, it could potentially put your entire investments at risk. “So, spreading your investments can reduce this concentration risk,” says Shetty.

Consider the interest rates and investment options offered by your existing bank and other banks. Compare the rates, fees, and terms. “Sometimes, new banks may offer attractive introductory rates or promotional offers that could be beneficial,” says Shetty.

For instance, some banks provide better services like discounts on locker services, and priority banking if you have a relationship value above a certain threshold. “If making an extra deposit helps you meet those threshold limits and you would like to avail such services, you can certainly consider investing in the bank where you have your savings account,” says Bansal.

If you find that the new bank is more convenient and offers more services such as online banking facility, better interest rates, low charges, etc., it may be worth switching.

“Also, keep in mind your personal preferences, risk tolerance, and investment goals while investing in bank FDs,” adds Shetty.

Also read | Green fixed deposit norms kick in from June 1. Here’s what you need to knowIn a rising interest-rate scenario, should I invest in FDs for a long-term or short-term tenure?RBI’s monetary policy committee did not hike repo rates in the last two bi-monthly reviews. “It seems like RBI won’t increase repo rates for a while now, and, subsequently, decide to start decreasing rates, leading to a decrease in FD rates as well,” says Bansal. It is extremely tough to be 100 percent sure, given the extremely volatile macro scenario.

We can expect rates to decline over the next few months, if inflation remains under control. “Thus, this is a good time to invest in FDs and lock in high interest rates,” says Shah. Investment tenure is a very subjective discussion and depends on the investor’s time frame. “In case an investor has sufficient liquidity, he should definitely make an FD investment as an attractive opportunity in the prevailing high-rate environment,” he says.

“Under such a scenario, I would prefer following an FD laddering strategy,” says Bansal. In such a strategy, you invest in bank FDs with different maturities. This creates a "ladder" of maturity dates, so you have some money maturing every few months or years. This gives you regular liquidity, and you can access your money whenever you need it. It also gives you the opportunity to reinvest your money at potentially higher interest rates in the future.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.