Sumeet Kothari*, a parent from Delhi, is facing a financial pinch as his child, Aarav*, is set to move to the third standard this academic year. The school fee hike of 15 percent has come as a shock to Kothari, who is now struggling to manage his finances.

"My child is currently in a private school, and I want to continue his education there, but the fee hike is a significant burden," Kothari said. "The annual fee is now over Rs 1 lakh, which is a substantial amount for me. I'm not sure how I'll manage it."

Kothari's concerns are not just about paying the fees, but also about the impact it will have on his other financial goals. "I'm worried that this fee hike will affect my ability to save for Aarav's future goals, such as his higher education or extracurricular activities," he added.

As a professional working in a private company where the maximum salary hike is 6-8 percent annually, Kothari is exploring options to manage the increased fees. "I might have to take a loan or adjust my expenses to accommodate the fee hike. It's not an easy decision," he said.

What Kothari is facing is not unique, as many parents across cities like Delhi, Bengaluru and Hyderabad are facing similar financial burdens with the start of the new academic session, as many schools have increased their fees anywhere from 10 percent to a weighty 50 percent.

A survey conducted by LocalCircles in May found that 44 percent of parents reported having to grapple with fee hikes of 50-80 percent or more over the past three years. The survey polled over 18,000 parents of school going children in 301 districts.

"I hope the school administration understands the struggles of parents before implementing such significant fee hikes," Kothari said.

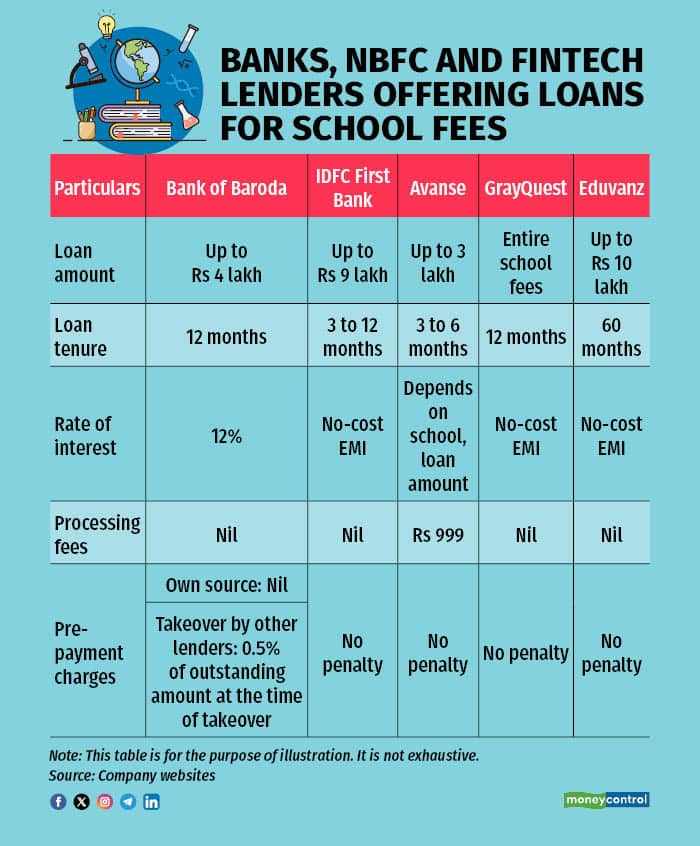

Meanwhile, schools are partnering with fintech lenders, banks and non-banking financial companies (NBFCs) to offer parents short-term loans for paying school fees, with repayment terms ranging from 3 to 12 months. Let's take a closer look to determine if this financing option truly benefits parents.

Traditionally, schools require parents to pay annual fees upfront or quarterly. However, some schools, such as Podar International School, VIBGYOR group of schools, Ryan group of schools, Narayana group of schools, Delhi Public School, and so on, have partnered with fintech lenders such as GrayQuest, EduFin or Eduvanz. They offer an equated monthly instalment (EMI) option. Parents can opt for this plan by submitting an online application or emailing the school management.

“Parents need to complete the KYC (know your customer) process by submitting PAN, Aadhaar, etc., and accept our terms and conditions as part of the sign-up process for the EMI facility,” said Rishab Mehta, founder and CEO, GrayQuest, an education finance firm. This EMI facility is provided in partnership with various banks and NBFCs these have tied up with.

For those who prefer to approach them directly, lenders such as Bank of Baroda and IDFC First Bank also offer loans to pay the school fees. The loan covers various expenses, including tuition fees payable to the school, examination fees, library fees, laboratory fees and hostel charges. Additionally, it covers the cost of books, equipment, instruments, uniforms and personal computers or laptops if required. However, external coaching or extra-curricular tuition fees are not included in the loan coverage.

The banks and fintech lenders require admission documents, school fee structure, income documents and bank statements of parents/guardians to review before sanctioning the loan.

The loan amount is disbursed directly to the school or institution on a term-wise or year-wise basis, covering tuition and other fees. Additionally, the loan also gets disbursed directly to bookstores or shops for the purchase of books, instruments and equipment.

As an example, the rate of interest charged by Bank of Baroda for this type of loan is 12 percent per annum.

IDFC First Bank, GrayQuest and Eduvanz offer no-cost EMI loans for school fees, where they pay the annual fees upfront to the school, and parents repay the amount in monthly instalments. For example, if the loan is taken from GrayQuest for an annual school fee of Rs 2.40 lakh, parents would pay Rs 20,000 per month over a year to the lender and there are no additional charges. However, some lenders may charge processing fees when you apply for a loan. According to Mehta, this option makes sense for parents facing cash flow issues, allowing them to manage their finances more effectively.

What are the pitfalls to avoid?“When opting for the bridge loan scheme to pay school fees, ensure timely payment of all monthly instalments,” advises Harshil Morjaria, a certified financial planner at ValueCurve Financial Services. Failure to do so may result in the school withholding your child's report card at the end of the academic year as per terms.

Moreover, the lender will also be reporting your loan and monthly instalment details to the credit bureaus. In case of a default or a delay in repaying the monthly instalment, this will have a negative effect on your credit score.

Also read | Job loss? Don't panic, there are financial strategies to keep you going What should parents do?“If you can afford the school fee hike and have a stable job with no salary cuts, consider continuing to pay your children's fees as usual instead of opting for a loan,” said Morjaria.

If you're experiencing financial difficulties or job loss, discuss your situation with the school management, providing supporting documents like salary slips or a termination letter, to negotiate possible assistance or alternatives for paying fees.

Even if you opt for an instalment plan to pay fees, you can still apply for a scholarship, and if approved, the school management might waive a portion of the tuition fees.

*Note: Name changed

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.