This Children’s Day, resolve to build the education corpus for your kid’s higher education. Now, children’s education costs result in one of the biggest cash outflows for any family. In India, the education cost is increasing at a fast pace, which is a worrying point for most of the parents. New-age private universities such as Ashoka, Jindal and Manipal charge as much as Rs 5 lakh to Rs 11 lakh per annum for undergraduate courses. To avoid the lack of funds from becoming a hindrance to your child’s higher education, it’s important you plan ahead and take the right steps for building the corpus.

Account for education inflation

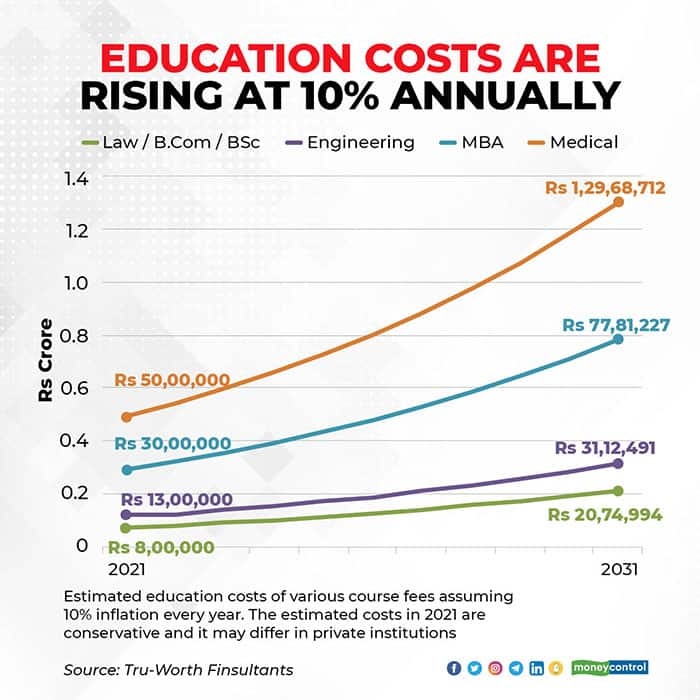

Education inflation has led to a rise in costs. “The interesting trend to note is that education inflation has been 10-12 percent over the years, which is double that of household inflation,” says Tivesh Shah, Founder of Tru-Worth Finsultants. A great example of this could be the MBA programme from IIM Bangalore. The cost of an MBA last decade was close to Rs 13 lakh, but is now well over Rs 23 lakh for a two-year program.

In the future, the cost of education will continue to rise. For instance, a four-year engineering course costs around Rs 12 lakh at present. In ten years (2031), the cost is likely to be around Rs 31 lakh. By 2038, it would cost Rs 61 lakh to get an engineering degree. The cost of MBBS course is around Rs 50 lakh for the five-year program. By 2038, it would cost Rs 2.53 crore to get MBBS degree (refer to graphic).

Also, there are foreign universities setting up campuses in India, which have higher fees. “It would be intelligent to target an education corpus that is a little higher than the inflation-adjusted cost while investing,” says Eela Dubey, Co-founder of EduFund.

Set a goal amount for higher education

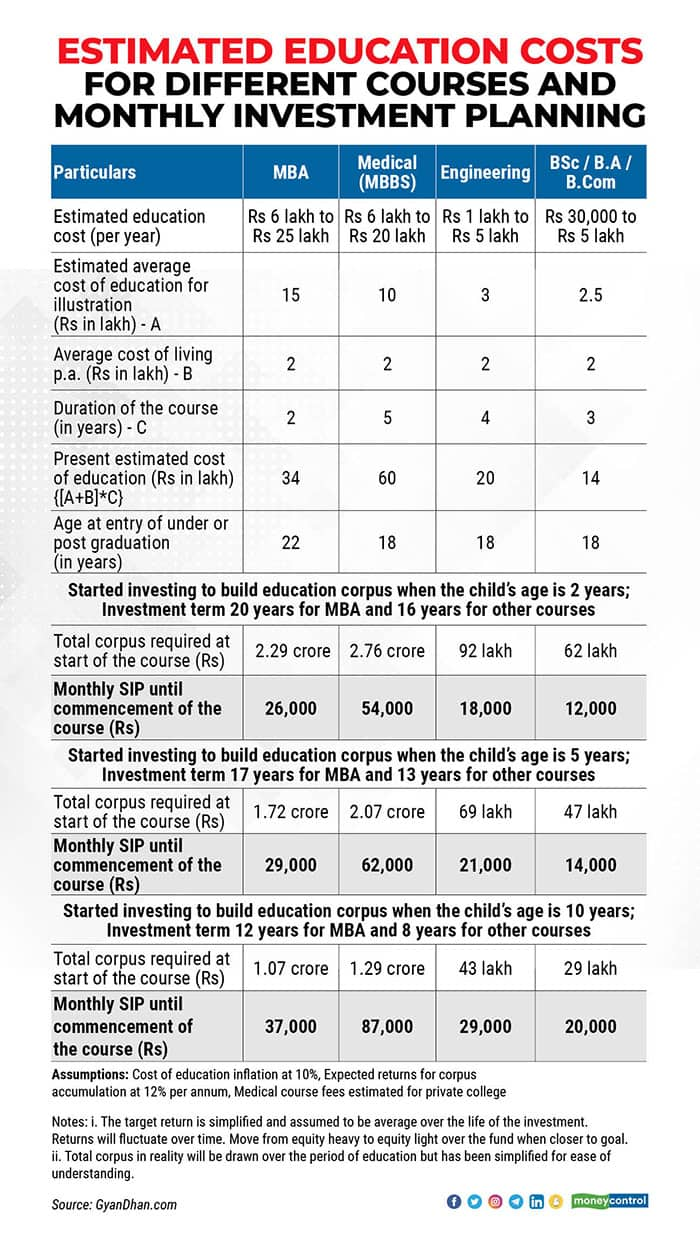

Parents are often unsure how much to save for diverse courses such as medical, engineering, arts, science and commerce. The fees vary from Rs 2.5 lakh to Rs 15 lakh per annum for these courses (refer to graphic). The right way to go about it is to account for the best opportunities you want to give to your child, be they the best institutions and their career interests. “In addition, assume over 20 percent of the tuition fees will go for other expenses – accommodation in another city, library, extra-curricular activities while studying, purchasing equipment, etc.,” says Mayank Bhateja, Co-founder of Credenc.

“Once you have the goal amount, a regular SIP and the power of compounding can get you there with ease when you have time on your side,” says Dubey. After deciding on the SIP amount, review it periodically and increase it whenever you have additional funds to do so, by using the step-up facility. Ideally, increase the SIP amount every year as your income grows.

Accumulating the education corpus will compete with other financial goals.

Also read: Short on money for overseas education? Here’s how you can raise funds

Investment plan

Invest in mutual funds after considering the risk appetite. “Re-balance the portfolio when you are closer to attaining goal and increase exposure to debt schemes,” says Ankit Mehra, CEO & Co-Founder of GyanDhan.

Financial planners advise staying away from children-focused investment products as many of these come with problems such as high costs, stringent conditions about payoffs, lack of intermittent liquidity, among others. For example, we come across many child plans that promise to pay in instalments when the child reaches the age of 18, 20 or 22. “The issue is education fees may happen earlier if required, as investments have lock in. You may be forced to take costly short-term personal loans to pay the fees,” says Mehra.

Mutual fund schemes dedicated to funding children’s education come with a lock-in, typically till the child turns 18 and they invest heavily in stocks. If your lock-in period does not let you shift your money to safer debt investment options well ahead of your financial goal, you will see the corpus value erode if there is a massive correction in the market. Also, index funds are substantially cheaper than child specific mutual schemes.

Vishal Dhawan, Founder and Chief Financial Planner, Plan Ahead Wealth Advisors also advises a term insurance. He says, “If something happens to the earning parent, the education goal is not compromised. Term insurance covers the risk of untimely death of the earning parent along with an open-ended investment product.”

Manage cash flows

Financial planners emphasize flexibility in your investment plan. “When we are saving to create an education corpus, we do not know how the future will be. The cash flow needs may be far different from what we foresee them now,” says Dhawan.

Many individuals buy a property or land and earmark it for funding their kid’s education. Such individuals should sell that asset much ahead (at least three years) of the education goal’s timeline. That said, using physical assets such as land or a property to fund a future financial goal are best avoided because of liquidity problems.

Start investing early. That way you will have to set aside more manageable sums and would also be on course for other goals such as retirement.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.