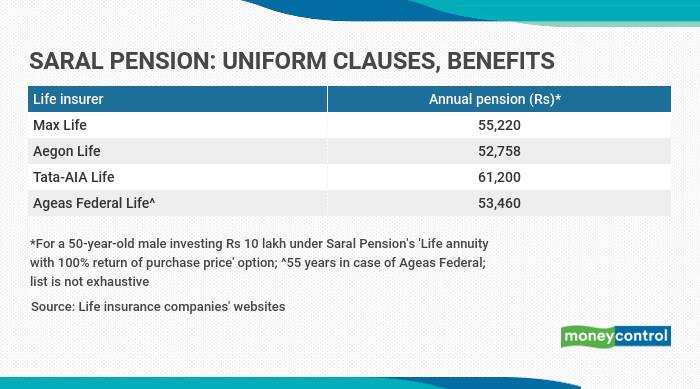

After the regulator IRDAI came out with regulations for a standardised non-linked, non-participating immediate annuity plan – Saral Pension – in January, some firms have rolled out their products. These include Max Life Insurance, Tata-AIA Life, IndiaFirst Life Insurance, Ageas Federal Life Insurance and Aegon Life.

Like other standardised products, the features, benefits, terms and conditions are identical across insurers. Currently, the returns being offered by these companies range from 4.6-6.2 percent, depending on the age at entry and amount invested.

Take for example, the case of a 55-year-old male who invests Rs 10 lakh (termed the purchase price) in Ageas Federal’s Saral Pension single life annuity with return of purchase price option. He will get an annual pension of Rs 53,460 during his lifetime, while the initial amount invested will be handed out to his spouse or legal heirs after his death.

How does Saral Pension work?

Put simply, when you buy an immediate annuity plan, you hand over a lump-sum – termed purchase price – to the life insurer. Usually, it is the retirees who invest their accumulated corpus in these single premium annuity plans. The company promises a lifelong pension, depending on the annuity option you choose, at regular intervals to ensure a constant stream of income during your retirement years.

Saral Pension is a single premium, non-linked, non-participating plan that all life insurance companies will have to offer. It comes with two annuity options – ‘Life annuity with return of 100 percent of purchase price’ and ‘Joint life last survivor annuity with return of 100 percent of purchase price on death of the last survivor’. Under option one, regular pension – monthly, quarterly, half-yearly or annually, as per policyholder’s choice – will be paid throughout your life. After the annuitant’s death, the purchase price will be ‘returned’ to the nominees or legal heirs. In case of the joint life variant, the surviving spouse will continue to receive the annuity after the primary annuitant’s death. The purchase price will be paid out to the nominees or legal heirs after the surviving spouse’s death.

The minimum pension you are entitled to receive under this product would be Rs 1,000 per month, Rs 3,000 per quarter, Rs 6,000 every six months and Rs 12,000 per year. There is no maximum cap on what you can receive. The minimum age at entry is 40 years, while the maximum is 80 years. Like in the case of all other standardised insurance policies that IRDAI has announced through the last year and a half, the pricing aspect has been left to the insurers. However, these will have to conform to purchase price bands – less than Rs 2 lakh, Rs 2-5 lakh, Rs 5-10 lakh, Rs 10-25 lakh and Rs 25 lakh and above.

Also read: IRDAI’s standard home insurance policy: Should you buy it?

What works

A uniform set of features and clauses makes the product simple to understand and compare across insurers. “Standardised plans in general constitute a good concept. They set a minimum threshold for all life insurance companies, which itself is a positive. The fact that all life insurers have to offer this product provides more options to annuitants. They can compare the returns and will naturally gravitate towards the best offering,” says Abhishek Bondia, Co-founder, Securenow.in.

The number of annuity options are limited to just two instead over seven that some life insurers currently offer. This will reduce the scope for confusion in annuitants’ minds. “Both the options offer return of purchase price, which is a plus. Many are financially aware and end up buying only life annuity (where the initial investment is never returned to the spouse or legal heirs). This is a challenge as they lose out on their entire corpus,” says Suresh Sadagopan, Founder, Ladder7 Financial Advisories.

This apart, the policy also has provision for meeting emergency medical needs. If you, your spouse or children are diagnosed with critical ailments such as cancer, cardiac arrest and kidney failure, you can surrender – or terminate – the policy six months after you buy it. You will receive almost the entire amount – 95 percent of the purchase price – to fund the treatment expenses.

“This is a key feature in this policy as most other pension plans do not offer the benefit of returning almost the entire amount in case of such emergencies. This has been a limitation in regular pension plans, but Saral Pension is free from it,” explains Sadagopan. However, the surrender condition is restrictive and is allowed only in case of critical illnesses. The framework also allows you to take a loan to meet such requirements. The interest on the loan will be the 10-year G-Sec rate per annum as on April 1 of the relevant financial year, plus up to 200 basis points.

Annuities are taxed

Taxation remains pension plans’ chief limitation – the entire annuity income that you earn during the year is taxable as per the slab rate applicable to you. “With returns of 5-5.6 percent (when age at entry is 55 years), they are comparable to other traditional pension plans offered currently. However, the post-tax returns of even those in the 20 percent bracket will be much lower, at less than 4.5 percent,” points out Sadagopan.

Moneycontrol’s take

Simplicity and uniformity are the chief advantages, as annuity is not a product understood by many. Fewer annuity options might stifle innovation, but for those who don’t understand annuity products, it’s good as multiple pay-out options can get confusing. Post-tax returns, however, continue to be a drag on the entire annuity space.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!