Most salaried individuals have access to two broad retirement-specific instruments to build their nest-egg. One is Employees’ Provident Fund (EPF) and the other is National Pension System (NPS).

Between March 2021 and February 2022, the Employees’ Provident Fund Organisation (EPFO) added 1.11 crore subscribers, while the NPS enrolled 93.6 lakh over the entire FY 2021-22. Even though most companies offer EPF, there are also income-tax benefits that NPS offers. Which one works better?

Also read: A step-by-step guide to opening an NPS account online

Equities compound wealth, tax benefits nudge investments

Both investments are aimed at saving up for your retirement. Hence, they discourage early withdrawals. That’s not bad given that both investments are meant to compound over decades to create a kitty which you can utilise post your retirement when regular income stops.

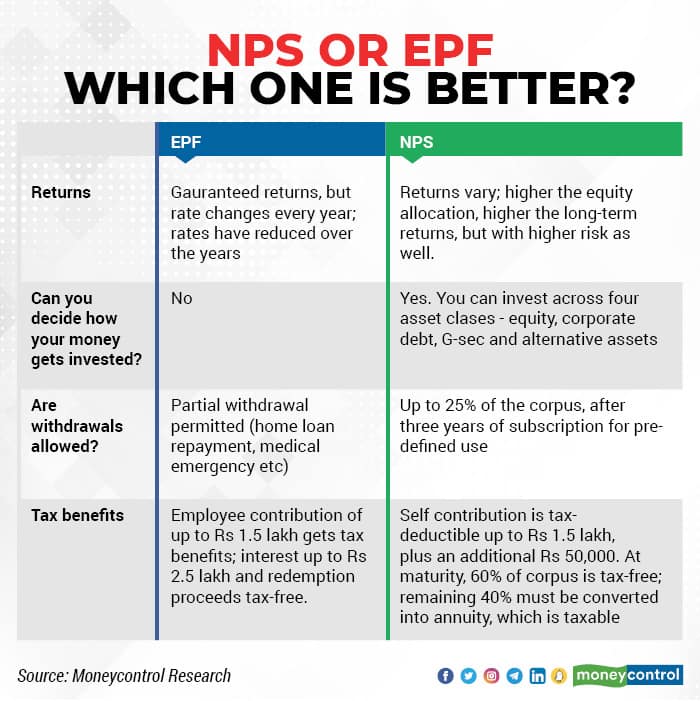

The big difference in here: EPF is a defined benefit plan where the emphasis is on the returns that EPF makes every year. The government of the India guarantees its returns. When you reach your retirement, you get a lumpsum amount.

NPS is a defined contribution plan, where your money gets deployed in equity and debt markets. The idea is that your systematic contributions every month compound at market rates, enough to pay you a regular- and hopefully handsome- pension after you retire. EPF is an employee benefit scheme (only salaried individuals get EPF benefits), whereas any individual in any profession or work structure can use NPS to save up for their retirement.

NPS offers you a bit more flexibility. It allows you to choose how much money you want to put in equities; the maximum is 75 percent of your monthly contribution. In EPF, there is no control on where your money gets invested -- the fund can invest between 5 percent and 15 percent of the corpus in equity.

According to Khyati Mashru Vasani, Founder - Plantrich Consultancy LLP, “Wherever it’s relevant and possible we encourage clients to invest some in both. The objective is different; EPF being guaranteed income works better for the necessary retirement expenses and NPS works better in planning for the negotiable expenses.”

There are tax incentives for both EPF and NPS. For both, you can get a deduction from taxable income, of up to Rs 1.5 lakh under Section 80C of the Income Tax Act, for the amount being invested. For NPS you can get an additional Rs 50,000 worth deduction under section 80CCD (1B).

Vasani says that while clients opt for NPS mostly for the additional tax benefit, as there is no restriction on contributions, it may be useful to invest higher amounts depending on the retirement plan. At maturity, you can withdraw 60 percent of the NPS fund tax-free. In case of EPF, the maturity proceeds are tax-free, but interest earned on annual contributions in excess of Rs 2.5 lakh will be taxable.

Also read: Tax benefits that come with investing in NPS

What ails NPS and EPF?

EPF suffers from some obvious drawbacks. It doesn’t give you a choice to choose your equity investments, even if you may be comfortable for a slightly higher equity allocation.

EPF interest rates have also fallen over the years. In the most recent review, EPF interest rate has been reduced to 8.1 percent a year. In 2001 it was 11 percent a year. For those who are to join their first jobs this year, and in future, this is worrisome. Also, not everyone can contribute to EPF; it’s only available if you are an employee with an eligible organisation. For professionals and small business owners, between the two, NPS would be the only option.

On the other hand, NPS returns are market-linked. This can be risky in the short term. But over the long term, this helps, as a high equity allocation (up to 75 percent) beats inflation over the long term.

There is just one big problem with NPS. On your retirement, you cannot withdraw the entire corpus. You can withdraw 60 percent of your accumulated corpus. The remaining 40 percent compulsorily gets invested in an annuity. Worse: income from annuity is also taxable at your income tax rates.

Rohit Shah, Principal Officer, GYR Financial Planners Private Limited, says, “NPS is a product with low charges and one can choose up to 75 percent allocation to equity which can potentially deliver higher long-term returns. However, the taxed annuity can become a deterrent post retirement, especially given that other more flexible options like long-term investments in mutual funds are available.”

What should you do?

While having a higher allocation to equity via NPS is advantageous for building a retirement kitty, the benefit gets diluted thanks to a mandatory annuity and tax on that portion. If retirement is a decade or two away, it may be too soon for you to know how much annuity you need or even know if you would like a pre-determined annuity. Taking the entire corpus at maturity and then structuring an annuity as per your requirements could be a more relevant estimation of your retirement finances.

Mrin Agarwal, Founder Director, Finsafe India Private Limited, says, “For employees, EPF becomes mandatory. For professionals and others, the awareness around NPS is not high. Deferred annuity plans from insurance companies are preferred, perhaps because of the visible monthly income that they offer.”

At 8.1 percent tax-free income, EPF may seem more attractive than many other debt investment options and the guarantee gives it an edge over equity volatility. NPS has its advantages too, but it competes with unit-linked insurance plans and mutual funds that do just about the same thing.

But just for the discipline that both these investments offer -- with a few income-tax benefits thrown in, most experts say that NPS works just as well too, to save for your retirement. But, if you are disciplined, invest regularly every month, diligently save for your retirement, and do not face the urge to withdraw your money prematurely, a solid, well-managed equity fund works better.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!