personal-finance

What are EPF's taxable and non-taxable accounts?

Apr 28, 03:04

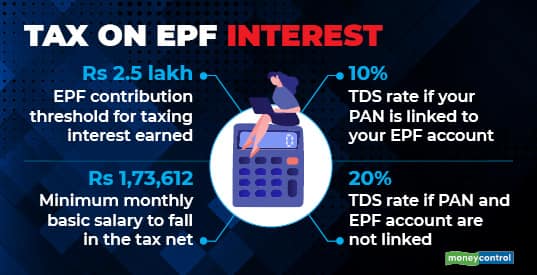

Budget 2021 introduced a tax on interest on employees' provident fund (EPF) contribution of over Rs 2.5 lakh a year. Later, the I-T department decreed that EPF statements would display taxable and non-taxable accounts separately. This year, the rules will be implemented when interest for 2021-22 is credited. EPFO will deduct tax (TDS) @ 10 percent while crediting the interest. However, you will have to pay tax as per the slab rate applicable to you. If your PAN and EPF account are not linked, the TDS rate will be 20 percent. So, the month in which your contribution breaches the threshold, the excess amount and applicable interest will be ‘moved' to the taxable account.