March 31 is nearly here. If you have chosen the old income-tax regime, that allows you to claim deductions and exemptions, then you have very little time in hand. For those, who are looking to beat the clock, there are certain tax-saving investments they can make online. The National Pension System (NPS) is one of them.

Also read: Why the new tax regime has few takers

NPS for additional deductionIf you have completely exhausted the limit under section 80c, NPS can help you maximise your tax benefits. It provides an additional deduction of ₹50,000 under section 80CCD (1B).

An NPS account can be opened online. Here’s a step-wise guide to opening an eNPS account.

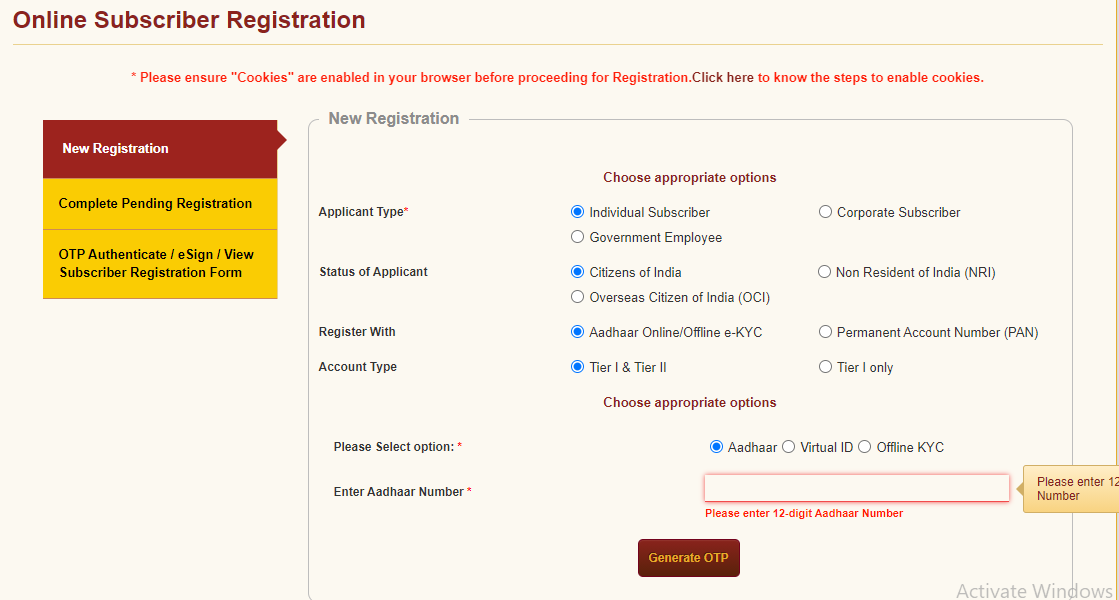

Register yourselfVisit the NSDL portal and register yourself to open an eNPS account (https://enps.nsdl.com/eNPS/NationalPensionSystem.html > Registration > National Pension System). Indian citizens between the ages of 18 and 70 years can open Tier-I – the primary, pension account – as well as the Tier-II or investment account.

Choose the Aadhaar as your identity document to complete the process entirely online. Ensure that your mobile phone is linked to your Aadhaar, so that an OTP can be generated and proceed further to confirm your personal information. If you haven’t linked your mobile to your Aadhaar, first do so by visiting your nearest enrollment centre.

Confirm all your details and enter the missing information before you proceed to generate an acknowledgement number. It will also be sent to you via SMS or email. At this stage, you can either go ahead and complete the registration or opt to do it later by quoting the acknowledgement number. You can then proceed to furnish all the information asked for, including your occupation and bank account details.

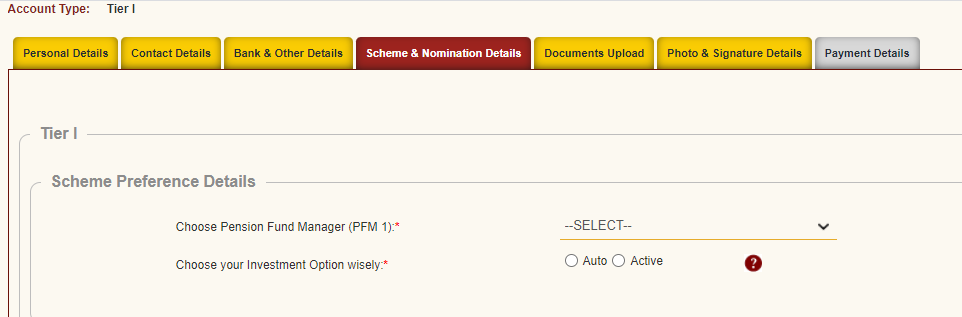

This is an extremely crucial part and is not merely clerical step in the procedure – choosing one one pension fund manager out of seven to manage your retirement funds. You can invest in NPS funds - scheme E (equity), scheme G (government securities), scheme C (corporate debt) and scheme A (alternative asset). Ensure that you scrutinise the long-term performance of all seven pension fund managers before select one.

Also, take a call on whether you want to opt for auto or active choice. If you are under 50, you can allocate a maximum of 75 percent of your contribution under both options.

Also read: How to choose between auto and active choices

You will have to appoint nominees, decide the share of proceeds they will be entitled to in case of your death. Upload scanned copies of your PAN, cancelled cheque and signature to proceed to making the payment.

Make the payment to generate ePRANYou will have to make a minimum contribution to the Tier-I account to start with. If you choose to receive your ePRAN card and welcome kit through the digital mode, that is email, you will have to pay a charge of Rs 18 – physical modes will be slightly costlier. You can choose to authenticate all your details through esign/OTP which will be sent to your mobile and Email. Download and save your subscriber registration form, which also contains your ePRAN. You will need this number to make future NPS contributions and other transactions. You can also download and save your ePRAN card from the portal.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.