The Pension Fund Regulatory and Development Authority (PFRDA) is planning to bring out a system of on-tap licenses for pension fund managers.

Supratim Bandyopadhyay, Chairman PFRDA, said during a virtual interaction that the pension regulatory body wants a system similar to what the Reserve Bank of India has allowed for new banking entrants.

"We will bring out a circular to this effect in the next few weeks. There will be a window where interested entities can apply," he added.

Another significant change proposed is that the National Pension System will allow subscribers up to the age of 70 years to be a part of this scheme. Till now, the age limit was 65 years.

In addition, Bandyopadhyay said that the maturity for subscribers who join after the age of 60 years will be able to continue their scheme till the age of 75 years. For other regular NPS accounts, the maturity age limit is 70 years.

As reported by Moneycontrol earlier, under the National Pension System (NPS), the PFRDA is also planning a new system for a systematic withdrawal plan (SWP) or pay-out within funds. This would offer additional options to subscribers as these individuals can decide whether to opt for annuity plans or for SWPs.

Bandyopadhyay said that the regulatory body is working to bring out a structured process for SWPs.

In addition, he said that the pension regulator will also be looking at a separate scheme that can offer a guaranteed minimum rate of return. This will be over and above the NPS.

This will be part of the PFRDA Amendment Bill, which is awaiting parliamentary approval.

FDI hike nod under discussion

While the foreign direct investment (FDI) hike under pension is linked to the insurance sector, Bandyopadhyay explained that the subject is under discussion.

At present, the FDI limit in the pension sector is 49 percent. On the other hand, the insurance FDI limit has been hiked to 74 percent in March after the Insurance Amendment Act 2021 was passed.

NPS subscribers zoom

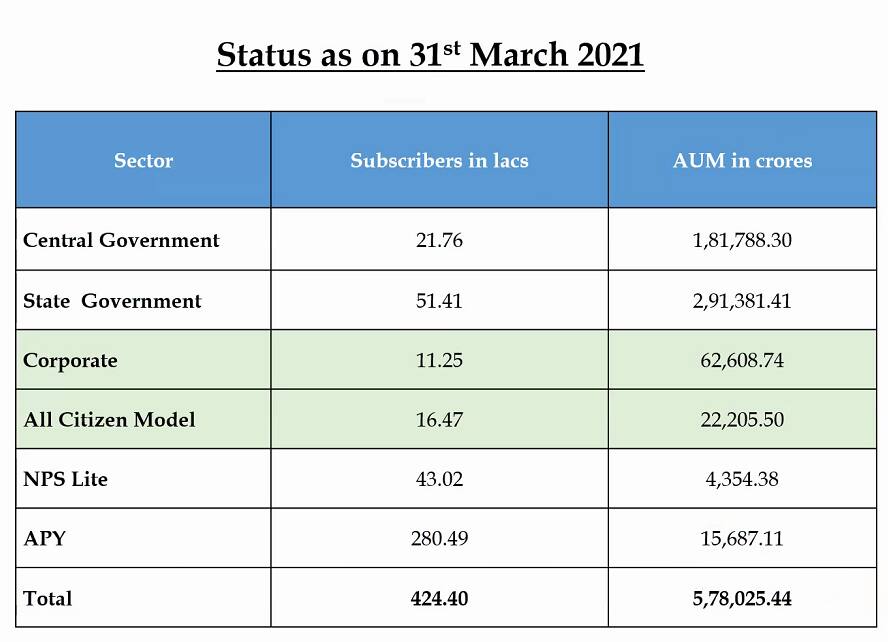

Despite the pandemic in 2020, the total assets under management (AUM) for pension products rose by 38 percent to Rs 5.78 lakh crore.

Currently, LIC Pension Fund, SBI Pension Funds and UTI Retirement Solutions are the pension fund managers for the public sector.

For the private sector, apart from these three, there are four others: HDFC Pension Management, ICICI Prudential Pension Fund Management, Kotak Mahindra Pension Fund and Aditya Birla Sun Life Pension Management.

Bandyopadhyay added that Axis Asset Management will join the other private sector pension managers as the new entrant.

In FY22, PFRDA is eyeing an addition of one million new subscribers under NPS, as against 600,000 added in FY21.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.