One set of funds focused on MNC firms and made solid returns in the past. These specific type of MF (mutual fund) schemes were called MNC funds. At present, there are four such MNC funds: Aditya Birla SL MNC, ICICI Prudential MNC, SBI Magnum Global and UTI MNC. These funds invest at least 80 percent of their assets in the stocks of multinational companies. They were delivering top returns. But in recent years, MNC funds have lost their appeal, given their lower returns and the presence of competitive Indian companies that presented good investment opportunities. Many have also gone global, too.

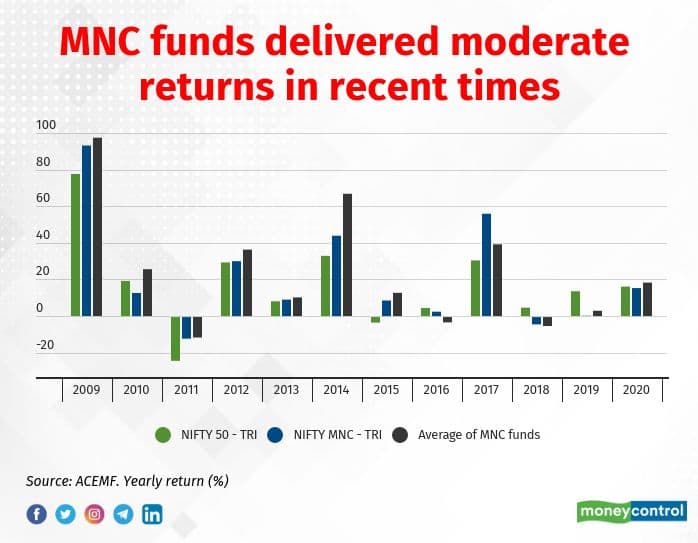

In the last ten years, Nifty MNC TRI outperformed Nifty 50 TRI only three out of 10 times (see graph).

MNC funds are now struggling to remain relevant. The likes of ICICI Prudential MNC fund have also changed the way they look at their companies. Do MNC funds remain relevant for Indian investors?

What went wrong?

MNC stocks were the darlings of investors. Strong corporate governance standards, strong parentage and superior cashflows led to robust share performance and attractive dividends for investors.

Times have changed. These days, Indian companies have become competitive, in terms of product quality and earnings. The composition of the benchmark MNC index also has a role to play in funds not doing as well. Deepak Jasani, Head Research, HDFC securities says, “The Nifty MNC index has given large weightage to FMCG, Auto, Metals and Capital Goods stocks. During 2012-2021, the latter three indices underperformed vis-a-vis the Sensex, while FMCG’s was in line. This resulted in the Nifty MNC index underperforming the Nifty over this period.”

The top holdings in the portfolios of funds include Maruti Suzuki India, Hindustan Unilever, Procter & Gamble Hygiene & Health Care, Nestle India, Honeywell Automation India, Grindwell Norton and Cummins India. These registered a moderate return in recent years. For instance, Maruti Suzuki India, Procter and Gamble Hygiene and Health Care and Cummins India delivered an absolute return of -22 percent, 32 percent and 21 percent over the last three years.

In the last 15-months period, MNC funds gave 62 percent returns on an average. The NIFTY 50 index rose 78 percent, Nifty Midcap 100 and Nifty Small-cap 100 indices rallied 104 percent and 136 percent, respectively.

Higher valuation multiples

MNC stocks have also enjoyed high valuations due to their strong parentage. The trailing PE multiple of the MNC fund category as of May 31, 2021 was 60 times, while the Nifty 500 index trades at 31 times. This has its own downside. When markets correct, experts say that MNC stocks can correct faster than the rest, despite their strong balance sheets.

“The disadvantages of MNC stocks include no plans for large capex, as the focus is on dividend payouts, little local innovation or research and development, and in many cases, little freedom to local management to venture into newer areas. All new businesses of the parent may not come to the listed subsidiary, but get diverted to the unlisted wholly owned subsidiary so that minority shareholders cannot benefit etc.,” Jasani explains.

How MNC funds adapted to changing times

Aditya Birla SL MNC and UTI MNC typically invest in the conventional MNC stocks. On the other hand, ICICI Prudential MNC and SBI Magnum Global have tweaked their definition of what constitutes an MNC stock.

Anish Tawakley, senior fund manager, ICICI Prudential Mutual Fund his fund also invests in companies incorporated in India with global operations. The list includes foreign companies having business operations across the globe but not listed on Indian stock exchanges.

“This give us flexibility to switch between countries where we find companies doing well, operationally,” says Tawakley. Currently, ICICI Prudential MNC Fund has around 10 percent allocation to overseas stocks. This helped the scheme generate a return of 68 percent over the last one year, while Aditya Birla SL MNC and UTI MNC delivered around 33 percent. International investments also helped SBI Magnum Global that holds around 5 percent exposure to overseas stocks; it managed a one-year return of 50 percent.

Should you invest?

MNC funds are low-risk, low-return schemes. To that extent, they are less volatile than many other funds. But the low risk doesn’t justify investing exclusively in MNC stocks, when there are enough and more home-grown competitive companies. Juzer Gabajiwala, Director, Ventura Securities says, “Many diversified equity schemes, especially large-cap funds, already invest in MNC stocks. So, if your portfolio has funds which already have exposure in MNC stocks, then investing in an MNC Fund will not cater your purpose of diversification.”

An MNC stock is not necessarily a passport to success. It’s best if your fund manager gets to decide whether she wants to invest in home-grown or MNC stocks. Instead, stick to well-managed diversified funds.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.