If you have missed out on recent initial public offerings (IPOs), you could buy shares after the lock-in period of anchor investors is over. That’s the time some anchor investors sell their shares. In many cases, that causes fall in stock prices. That’s usually the time when some smart investors come in and buy these shares. Is there an opportunity for you?

When stocks corrected

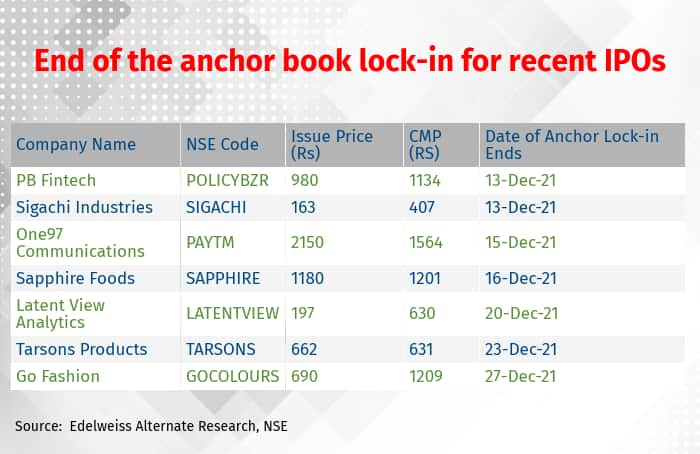

According to a note released by Edelweiss Alternative Research, 76 percent of the stocks have felt the heat when the anchor investor lock-in expired in CY2021 and were about to be sold. The average price correction recorded was at 2.6 percent on the day of sale.

The note further states that the selling pressure persists. “As many as 61 percent (25 out of 41) of the issues declined by 2.2 percent on the day after the anchor opening date. And after five days of the anchor opening date, 61 percent of the issues traded 3.9 percent down,” writes Abhilash Pagaria, Head-Alternative & Quantitative Research, Edelweiss Securities in the report.

The lock-in period of the shares held by anchor investors ends 30 days after allotment.

Why do stocks fall?

Elevated valuations have been a concern for most investors. Irrespective of their fundamentals, IPOs have been priced at humungous levels. Shyam Sekhar, Chief Ideator, ithought Advisory says, “Too many anchor investors are trying to exit over-valued stocks and there isn’t adequate buying power on the retail investor side. That has led to selling pressure.”

Says Vikas Gupta, founder and Chief Investment Strategist, Omniscience Capital, “Many anchor investors do not have a long-term view on the stock. They are here for a quick trade and look for the first opportunity to exit.”

What should you do?

“For day traders, it can be an opportunity to short-sell these stocks with appropriate stop loss. But do not be selective. Sell each stock that comes out of lock-in. If the trend continues and the markets remain volatile, you may end up making decent money on that strategy,” says a money manager who wish not to be identified.

Day-trading entails high risk and calls for prudent monitoring of positions, which may not be possible for many individual investors.

For long-term investors who missed the stock at the IPO level, the weakness in the stock prices of such newly listed stocks may appear like an invitation. However, investors have to be careful.

“Though the prices have come down in some recent IPO stocks, the valuations are (still) rich in most cases. It will be too early to enter these stocks,” says Sekhar.

You need a clear understanding of the right price to pay in light of fundamentals of the company. As the stocks start trading on the bourse and company management starts interacting with the investors, more information becomes available. You should take note of this fresh flow of information and make informed decisions, instead of going by the details shared at the time of the IPO and actions of large investors, including anchor investors.

“Some retail investors think that an IPO is the beginning of the journey of the stock and stick to the strategy of buying a stock in the IPO with a view to hold it for the long term. However, given the elevated valuations and, in some cases, poor fundamentals, this may not deliver the desired returns,” says Gupta.

Invest in IPOs if you are convinced of the company’s long-term potential and its ability to earn profits. And keep a timeframe in mind, with an understanding of how much loss you’re willing to bear if the company doesn’t meet your expectations.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.