All eyes will be on Reserve Bank of India (RBI) governor Sanjay Malhotra on June 6 as he will announce the monetary policy, after the conclusion of the three-day Monetary Policy Committee (MPC) meeting.

The central bank has reduced the repo rate by 25 basis points (bps) twice this year, in February and April, to boost growth, thus bringing the current repo rate to 6 percent.

Rate cut expectations

Economists are optimistic about an additional 25-bps rate cut in June, as retail inflation remains below the RBI’s medium-term target of 4 percent for a third consecutive month.

A Moneycontrol poll indicated that economists and bank treasury heads predict a 25-bps repo rate cut by the RBI's Monetary Policy Committee in its June 6 review.

In contrast, the State Bank of India's Economic Research Department forecasts a more significant "jumbo rate cut" of 50 bps in its research report, 'Prelude to MPC Meeting'. This divergence in expectations highlights differing views on the extent of monetary policy easing required to support economic growth.

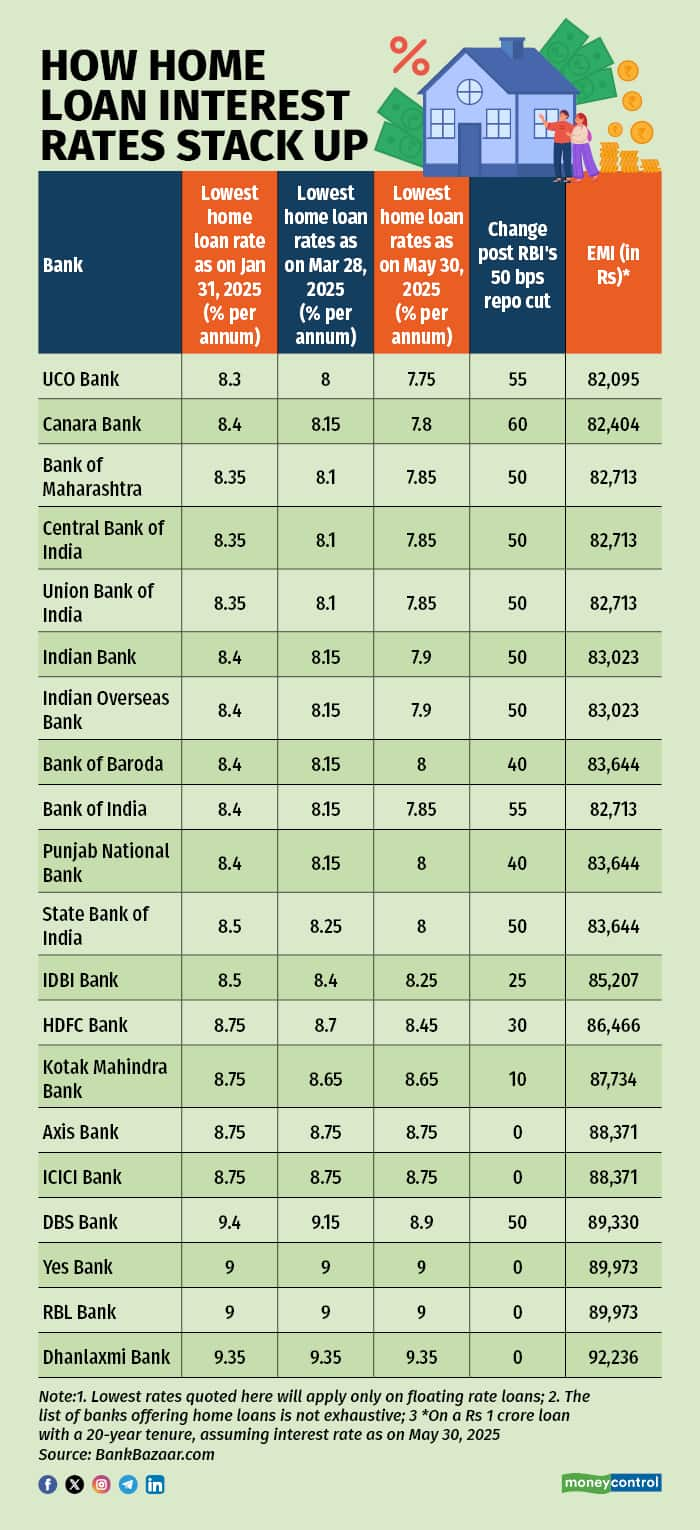

Given that lenders such as UCO Bank, Union Bank of India, Canara Bank, Indian Bank and Bank of India, among others, offer interest rates ranging from 7.75 percent and 7.9 percent, a repo rate cut on June 6 could mean home loan rates dipping below 7.75 percent per annum.

Also read | Secure. Stable. Smart: Why NPS deserves a spot in your retirement plan

Private banks slow in transmitting rate cut benefits

After the consecutive 25-bps repo rate cuts in the February and April monetary policy announcements, some banks have not transmitted the entire benefit to new borrowers, choosing to adjust the spread over the repo rate instead.

For instance, as per BankBazaar data, private sector banks, such as Axis Bank and ICICI Bank, have not transmitted the rate cut, but benefited and adjusted the spread to maintain interest rate of 8.75 percent on fresh home loans between January 2025 and May 30, 2025. Banks like Kotak Mahindra Bank and HDFC Bank have reduced interest rates by 10-30 bps on fresh home loans.

All new retail floating-rate loans sanctioned after October 1, 2019, are linked to an external benchmark, which is the repo rate in case of most banks. The effective interest rate charged on home loan borrowers comprises three key components: the repo rate, which is determined by the central bank; the spread, which is the bank's margin decided by the lender; and the credit risk premium, determined by the borrower's credit score.

Banks offering lowest home loan interest rates

Data from Bankbazaar.com reveals that for a home loan of Rs 1 crore for a tenure of 20 years, banks are offering interest rates ranging between 7.75 percent and 9.35 percent (data as on May 30, 2025, from bank websites). These rates are indicative and may vary based on individual factors like credit score, income, and other criteria.

UCO Bank

Starting at 7.75 percent, the home loan interest rate offered by UCO Bank is the lowest among all banks. It has passed on the 50-bps repo rate cut benefit to its new as well as existing borrowers. The Equated monthly installment (EMI) on a Rs 1-crore loan with a 20-year tenure works out to Rs 82,095.

Canara Bank

Canara Bank offers home loan interest rate starting at 7.80 percent. It has passed on the 50-bps rate cut benefit to its new as well as existing home loan borrowers. The EMI on a Rs 1-crore loan with a 20-year tenure works out to Rs 82,404.

Also read | School fees are on the rise. Can a bridge loan be a help or a hazard?

Bank of Maharashtra, Bank of India, Central Bank of India, Union Bank of India

These four banks have transmitted the 50-bps repo rate cut in February and April to all their home loan borrowers. The interest rate starts at 7.85 percent. The EMI on a Rs 1-crore loan with a 20-year tenure will work out to Rs 82,713.

Indian Bank and Indian Overseas Bank

These two banks levy interest rates starting from 7.90 percent. Both have passed on the 50-bps repo rate cut benefit to all their home loan borrowers. The EMI on a Rs 1-crore loan with a 20-year tenure works out to Rs 83,023.

Bank of Baroda, Punjab National Bank and State Bank of India

These three banks levy interest rates starting from 8 percent. They have transferred 40-50 bps repo rate cut benefit to all their home loan borrowers. The EMI on a Rs 1-crore loan with a 20-year tenure works out to Rs 83,644.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.