It’s September already, and this month, salaried individuals with additional sources of income, like interest from deposits, rental income, capital gains, etc., are liable to pay the second instalment of their advance tax.

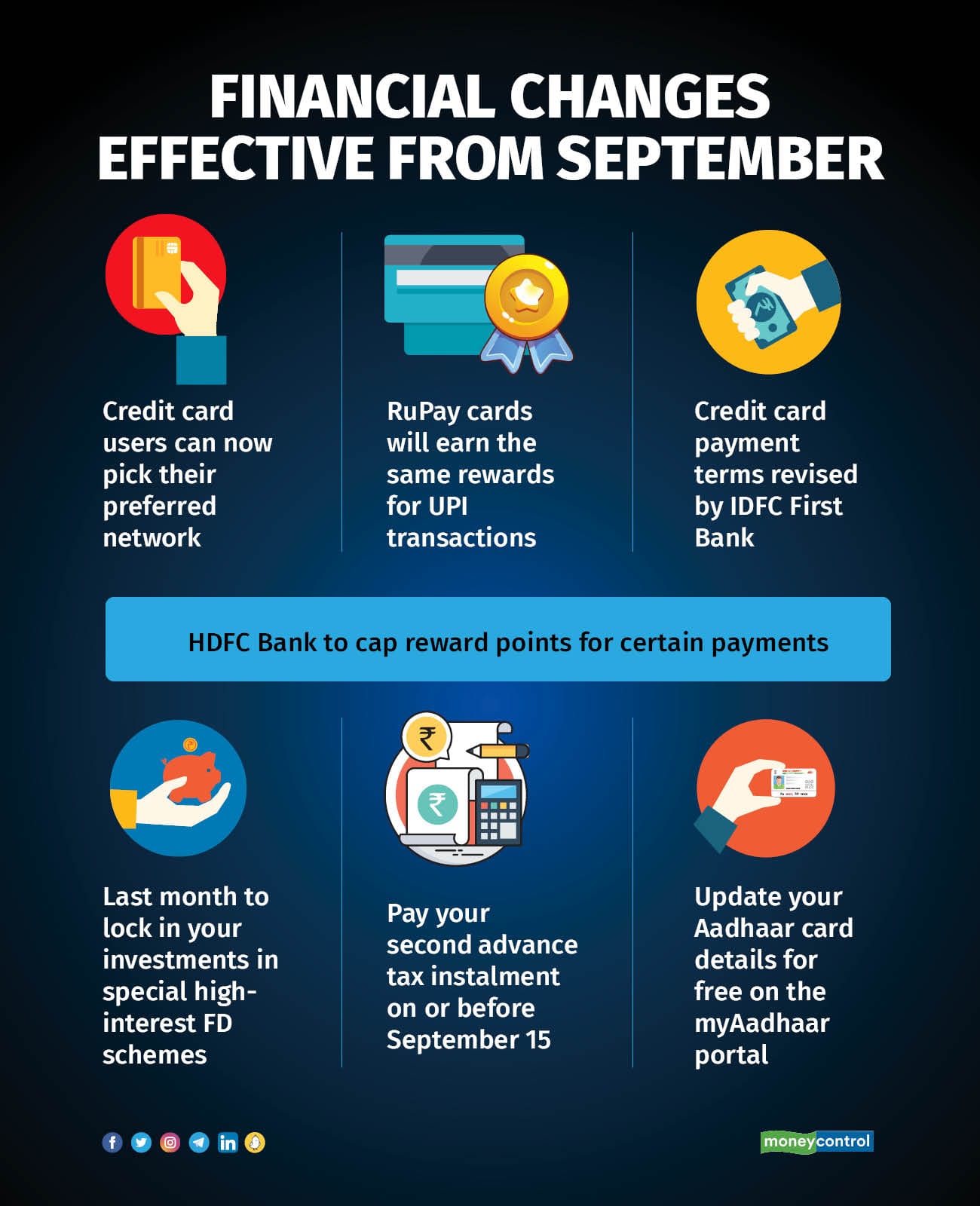

Also, September onwards card users will have the option of choosing their preferred card network while renewing and applying for a card, and RuPay card users will be able to earn the same reward points for UPI transactions as they do for POS / online transactions. September is also the last month to lock in attractive interest rates for specific fixed deposit (FD) tenures that’s offered by some banks.

Below, we’ve laid out the action that’s going to impact your finances this month.

Card users can choose their networkStarting September 6, banks will be required to offer customers the flexibility to choose their preferred card network when applying for or renewing a card. This means that if a bank issues a Mastercard, for instance, the customer can opt for a Visa card instead, or vice versa, as long as the bank offers both options. Existing customers will also have the opportunity to make this choice when their current card is up for renewal.

The RBI had issued a circular on March 6 prohibiting banks and non-bank card issuers from entering into exclusive agreements with card networks. The central bank wants banks and non-banks to give their customers the freedom to pick from multiple card networks.

Rewards for UPI transactions using RuPay cardsIn a move to push RuPay credit cards, the NPCI has announced that RuPay card users will now earn the same reward points for UPI transactions as they do for POS / online transactions. This change, effective September 1, aims to provide an enhanced benefit for RuPay credit card holders.

The NPCI’s August 5 circular has shed light on a rewards imbalance affecting RuPay credit card users. Unlike traditional card transactions, UPI payments made with RuPay cards do not earn comparable reward points. As reward points are a driver of credit card usage, this gap needed to be closed to push the usage of RuPay cards.

IDFC First Bank revises credit card payment termsIDFC First Bank is revising its credit card payment terms starting with the September 2024 statement cycle. The changes include modifications to the payment due dates and the minimum amount due.

The bank has shortened the payment due date to 15 days from the statement generation date (reduced from 18 days). Please note these changes to ensure timely payments and avoid any potential late fees or penalties.

Additionally, the bank is reducing the minimum amount due from 5 to 2 percent of the principal payable on its credit cards. Even though the minimum amount due has been reduced, it will affect your finances if you aren’t a disciplined spender.

For instance, previously, for a credit card bill of Rs 1 lakh, the minimum payment due was Rs 5,000 (5 percent). Now, it's been reduced to Rs 2,000 (2 percent). This allows you to avoid late payment charges at a lower cost and minimise the impact on your credit score. However, bear in mind that you'll still incur interest on the outstanding balance, which would be Rs 98,000 (instead of Rs 95,000 earlier).

Also read | How NPCI's new UPI Circle feature benefits users and what precautions to takeHDFC Bank limits reward pointsEffective September 1, the bank will limit rewards earned on utility and telecom transactions to 2,000 points per month.

Additionally, payments for education made through third-party apps (CRED, Cheq, MobiKwik, etc.) are excluded from earning points. However, education-related payments made directly through the college / school website, or their POS machines, will continue to earn rewards.

This policy applies to all HDFC credit cards, including co-branded ones like Swiggy and TataNeu.

Several banks have introduced special fixed deposit (FD) schemes with attractive interest rates for specific investment tenures, catering to both regular and senior citizens. These FD plans are an attractive option for individuals seeking higher returns on their investments.

Come September, several banks are expected to discontinue their special FD schemes. For instance, IDBI Bank's Utsav FD scheme is available only till September 30. This limited-time opportunity applies to the following tenures — 300, 375, 444, and 700 days. In this scheme, senior citizens can earn 7.55 to 7.85 percent interest per annum, and general, NRE, and NRO category investors can earn 7.05 to 7.35 percent interest per annum depending on the tenure.

Similarly, SBI’s Amrit Kalash FD scheme with a tenure of 400 days is offered to general and senior citizens at rate of interest of 7.10 and 7.60 percent, respectively. This scheme is also available until September 30.

Also explore | High-return FDs offered by trusted banks and NBFCs on the Moneycontrol appSeptember 15: deadline for the 2nd advance tax instalmentAs a salaried individual, you may think advance tax doesn't apply to you. However, if you have additional income sources like interest from deposits, rental income, capital gains, or more, you may be liable for advance tax. Assess your situation to determine if you need to pay.

According to Section 208 of the Income Tax Act, individuals with an estimated tax liability of Rs 10,000 or more for the financial year, after considering TDS and TCS, must pay advance tax in four instalments, where 45 percent is to be paid on or before September 15.

Failure to pay or delayed payments will incur penal interest under Section 234C, at 1 percent per month or part of the month on the outstanding taxes.

Free Aadhaar card update ends soonThe Unique Identification Authority of India (UIDAI) had extended the deadline for free Aadhaar card updates till September 14, 2024. However, this free service is only available on the myAadhaar portal. Updates made at physical Aadhaar centres attract a fee of Rs 50.

To update your Aadhaar card, submit your proof of identity and proof of address documents. Please note that starting September 15, 2024, Aadhaar card updates will be chargeable at Rs 50 even on the myAadhaar portal.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.