Effective September 1, 2024, IDFC First Bank is reducing the minimum amount due from 5 to 2 percent of the principal payable on its credit cards. Axis Bank had done the same in November 2023.

But paying just the minimum amount and rolling over your debt can be disastrous as you end paying interest of 3-4 percent a month on the outstanding amount. That’s more than 40 per cent a year.

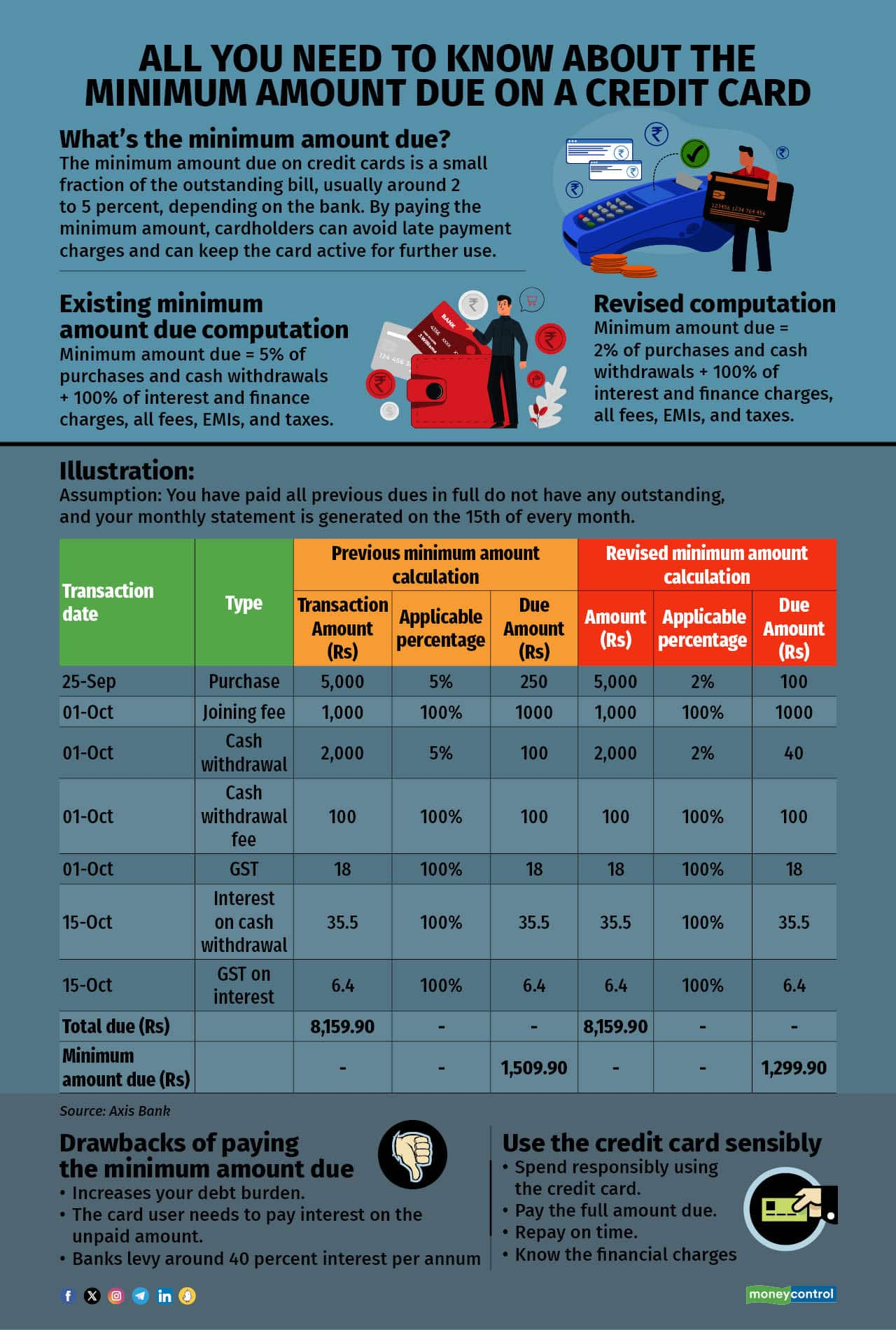

How it hurtsThe changes made by banks such as IDFC and Axis <see graphic> will impact your finances if you aren’t a disciplined spender.

For example, if your credit card bill is Rs 1 lakh, then the minimum amount due would have been Rs 5,000 (5 percent) earlier. Now, it would be Rs 2,000 (2 percent). “The credit card user can now avoid late payment charges and reduce the impact on his or her credit score by just paying Rs 2,000 instead of Rs 5,000,” says Parijat Garg, a digital lending consultant. However, it’s important to note that the user needs to pay interest on an outstanding balance of Rs 98,000 instead of Rs 95,000 earlier.

What is the minimum amount due?Minimum amount due is the absolute minimum you need to repay against your monthly credit card outstanding to keep your account in good standing and avoid late payment fees / overdue charges. It is usually a percentage of the total amount due for a specific statement or billing cycle.

“An important point to note is if you have an unpaid amount left over from your previous bill, you don’t get any interest-free period for your transactions thereafter. You will be charged interest from the date of the transaction itself,” says Dev Ashish, founder of StableInvestor.com, a personal finance advisory.

Also read | Why are banks charging 1% fee on utility payments using credit cards?Why are banks reducing the minimum amount?For the bank, it enables the customer to pay more regularly rather than default. “Additionally, the customer who rolls over the balance ends up paying interest on the outstanding amount — this effectively means higher potential revenue for the bank,” says Garg. So, reducing the minimum amount due ultimately benefits the bank.

Paying only the minimum amount due can lead to the customer falling into the well-known credit card debt trap. “Customers should ignore this reduced minimum amount due and continue to pay their total bill as before,” says Sumanta Mandal, founder of TechnoFino, a platform that reviews debit and credit cards.

According to calculations by Axis Bank, when you spend Rs 5,000 on your credit card and pay back only the minimum amount due every month (subject to a minimum of Rs 100), it will take you roughly seven years to pay back the total amount. So, paying just the minimum amount due, or anything less than the full outstanding, can be very expensive.

Mandal advises that whenever your cash flows allow, pay back the entire outstanding or an amount substantially more than the minimum amount due.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.