SIPs have, over time, become popular among retail investors and not without reason. They eliminate the need for self-imposed discipline, an area where most investors struggle and they free one from the illusion that market timing is within their grasp.

In reality, timing the market successfully and consistently requires an analytical commitment most ordinary savers neither have nor need. SIPs quietly solve all of this by ensuring you invest on good days, bad days and forgettable days, thereby avoiding the emotional swings that derail wealth creation.

But to conclude that lump-sum investing is not at par would be a mistake. Historically, investors who have stayed invested over a seven-year or longer horizon have been rewarded richly, regardless of when they entered.

The problem is not the strategy it is the temperament required. “Time and again, it has been proved that, if you can tolerate short-term volatility and have a real long-term investment horizon of 7 years and more then going with lump sum investment can be absolutely fine,” says Aditya Agarwal, Co-Founder of Wealthy.in.

Few retail investors have the stomach for double-digit drawdowns within weeks of investing, which is why Agarwal is quick to add that in all other cases, SIPs remain the simplest and most effective route.

Vinit Rathi, CEO of Avisa Wealth Creators, suggests if one has to choose between SIP and lumpsum then it is better to deploy half the money upfront and stagger the rest over six months through SIPs.

It is a pragmatic approach: If markets rise, the lump sum benefits immediately; if they fall, subsequent SIP purchases reduce the average cost. "Indian market is around its long term average valuation and if any US market-related concerns comes then also Indian market should be less effected. Even if it falls little bit, it should recover faster, as Indian economy is expected to grow by 6.5-7% and top corporate earning must grow by 10-12% in such scenario and so should their valuations," says Rathi.

SIP vs Lumpsum

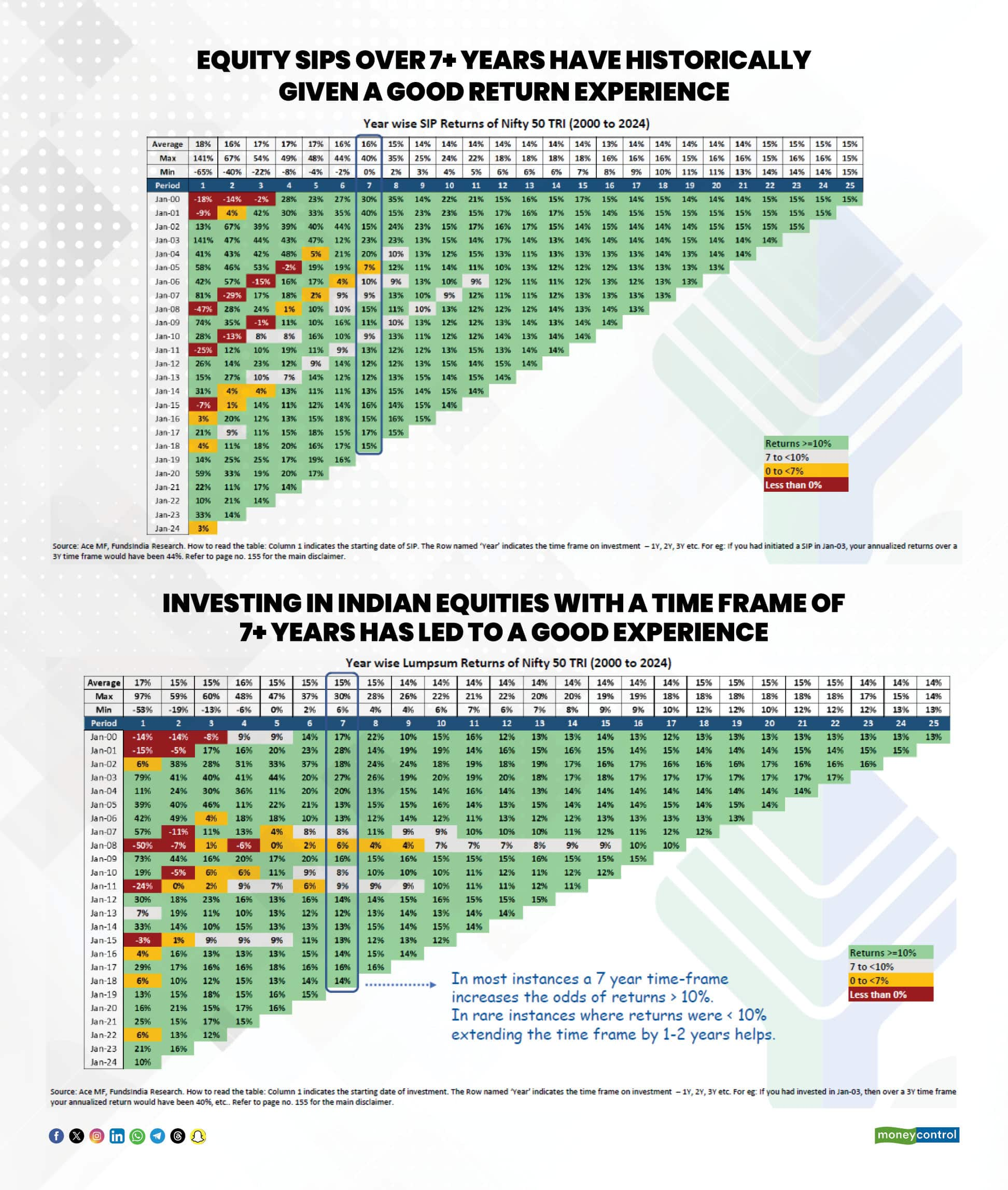

SIP vs LumpsumThe charts above by FundsIndia clearly show that SIPs offer a more stable and consistent return experience than lumpsum investing, especially over a 7-year or longer time frame. SIP returns become reliably positive after the fifth year and turn strongly consistent beyond seven years, with most periods delivering returns above 10%.

In contrast, lumpsum investments show far more red and yellow zones in the early years, highlighting the higher risk of negative or low returns if the investment is made just before a market correction.

While lumpsum investments can outperform over very long periods because the full amount stays invested longer, they expose investors to significant timing risk. Overall, the data suggests that SIPs provide smoother, more predictable outcomes, while lumpsum investing works best only for those with long horizons and strong risk tolerance.

Lump Sum vs STPFor those who possess a lump sum but hesitate to deploy it instantly, the STP or systematic transfer plan offers a neat workaround. The money is first parked in a liquid fund and gradually transferred into the chosen equity fund over a period you control.

In effect, it is a SIP funded by a lump sum, allowing cost averaging without emotional interference. The flexibility STPs offer in terms of frequency, amounts and triggers make them especially useful for investors who dislike timing the market but also dislike idle money.

Valuations, however, cannot be ignored. Before committing a lump sum, investors must assess whether markets are trading significantly above their historical price-to-earnings bands and whether corporate earnings look weak in the coming years.

If either condition holds, SIPs or STPs offer a safer path. Rathi cautions that lump-sum investors must be particularly wary when valuations are elevated or when earnings visibility is soft, as near-term corrections can erode both confidence and capital.

The question becomes even more nuanced when dealing with windfall money whether from a bonus, inheritance or business gain.

"As India is in structural bull run, for windfall funds investor may deploy it right now if he/she has 4-5 years+ view, as after one year consolidation, Indian market is around its long term average valuation and if any US market-related concerns comes then also Indian market should be less effected," says Rathi.

The strategy that works best is the one people can stick with. SIPs triumph because they make consistency effortless and bypass the behavioural traps that plague retail investing.

Lump-sum investing works brilliantly too but only for those who can sit through volatility without flinching. STPs and hybrid approaches deliver balance when the investor wants discipline without rigidity.

The truth is, you don't have to pledge loyalty to one method forever. Your approach can evolve with your income, your goals, the markets and, most importantly, your own comfort with risk. What matters is not choosing the perfect method, but choosing the one that keeps you invested long enough for compounding to work its magic.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.