Smaller private banks have reduced interest rates on tax-saving fixed deposits (FDs) by 25-50 basis points. For instance, DCB Bank and Yes Bank have reduced interest rates on tax-saving FDs to 6.50 percent from 6.75 percent earlier. Similarly, IndusInd Bank brought down rates to 6 percent from 6.5 percent.

Despite falling interest rates, you should invest a certain percentage of your portfolio in tax-saving FDs offering higher returns. The tax planning decisions should be taken wisely considering your financial goals. Those in the lower tax brackets find bank FDs more attractive. Investments of up to Rs 1.5 lakh can be claimed for tax deduction under section 80C of the income tax act. Tax-saving FDs have a lock-in period of five years and premature withdrawals are not allowed.

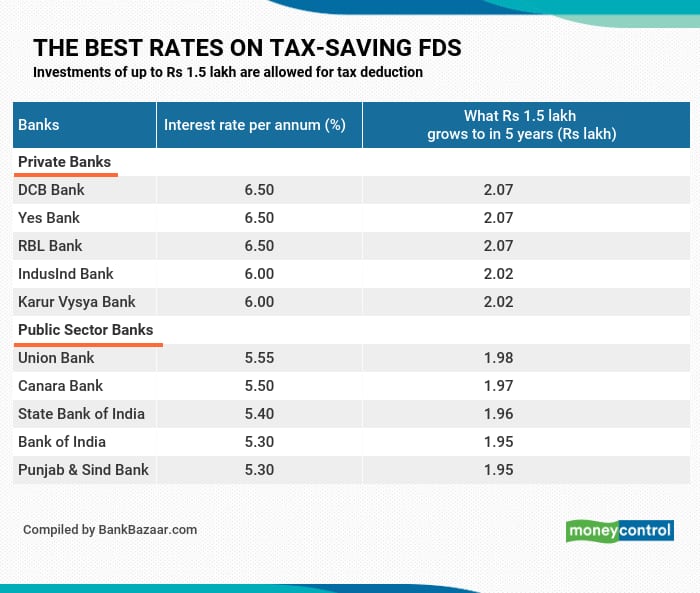

Even though FD rates have fallen, some banks offer you attractive interest rates.

Also read: Union Bank, Central Bank of India offer the lowest interest rates on personal loans

Smaller private banks offer higher interest rates

Smaller private banks offer interest rates of up to 6.50 percent on tax-saving FDs, according to data compiled by BankBazaar. These interest rates on tax-saving FDs are higher compared to leading public sector banks.

DCB Bank, RBL Bank and Yes Bank offer 6.50 percent interest on tax-saving deposits, followed by IndusInd Bank that gives 6 percent.

Suryoday Small Finance Bank offers 7.25 percent interest on tax-saving FDs. It is followed by Ujjivan Small Finance Bank and AU Small Finance Bank offering 6.75 percent and 6.25 percent interest respectively on these FDs. The interest rates offered by small finance banks are higher compared to leading private banks. The foreign banks such as Deutsche Bank and Citi Bank offer 6.25 percent and 3.50 percent interest respectively on tax-saving FDs.

Private Banks such as Axis Bank, ICICI Bank and HDFC Bank offer 5.75 percent, 5.35 percent and 5.30 percent interest respectively on tax-saving FDs.

The highest rate offered by a public-sector bank on a 5-year tax-saving FD is Union Bank of India that offers 5.55 percent interest, followed by Canara Bank and State Bank of India (SBI) offering 5.50 percent and 5.40 percent interest on tax savings FDs respectively. Bank of Baroda is offering 5.25 percent interest on tax-saving FDs.

Also read: RBL Bank, Yes Bank offer the best interest rates on 1-year fixed deposits

A sum of Rs 1.5 lakh invested in Yes Bank and Union Bank of India tax-saving FDs grows to Rs 2.07 lakh and 1.98 lakh, respectively, after five years.

A note about the table

Data compiled as of June 16 2021 from respective banks' website. BankBazaar has accounted for FDs belonging to only those foreign, private, small and public sector banks that are listed on the stock exchanges. Banks, for which data is not available on their respective websites, were dropped. These rates are only of tax-saving five-year FDs for non-senior citizens.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.