Smaller private banks have reduced interest rates on one-year fixed deposits (FDs) by 25 bps to 50 bps. For instance, RBL Bank has reduced interest rates on one-year FD to 6.10 percent from 6.5 percent earlier. Similarly, Indusnd Bank reduced the interest rate to 6 percent from 6.5 percent on a one-year FD.

Despite falling interest rates, you should invest a certain percentage of your portfolio in FDs offering higher returns on one-year FDs.

Risk-averse investors should prefer investing in FDs due to safety and assurance of returns. However, you should do a thorough risk assessment and due diligence of the bank before investing in FDs.

Smaller private banks are offering higher rates

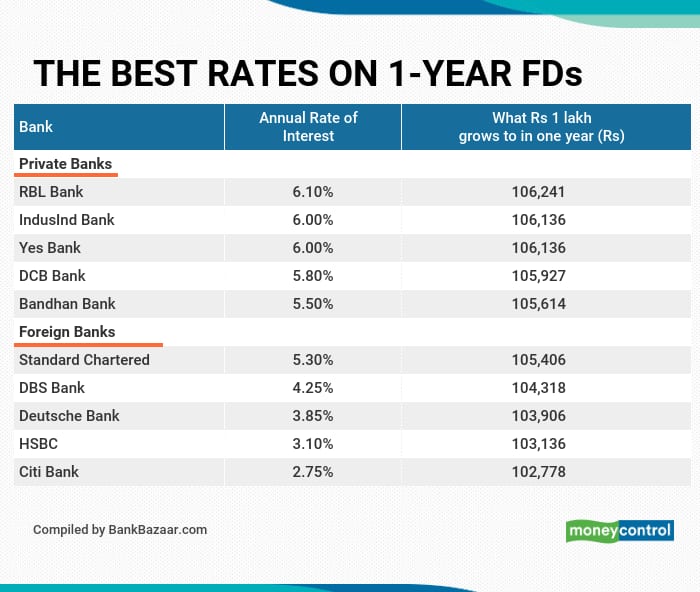

Smaller private banks are offering 6.1 percent interest rates on one-year FDs, according to data compiled by BankBazaar. For instance, RBL Bank is offering 6.10 percent and IndusInd Bank is offering 6 percent interest rates on one-year FD. These interest rates are higher compared to those offered by foreign banks and public sector banks.

The interest rates offered by foreign banks Standard Chartered Bank and DBS Bank are 5.30 percent and 4.25 percent on one year FDs.

The interest rates offered by small finance banks are higher compared to leading private banks. Suryoday Small Finance Bank offers 6.75 percent on-year FDs. Ujjivan Small Finance Bank offers 6.50 percent interest on one-year FDs.

Also read | Punjab National Bank and IDBI Bank offer the best rates on savings accounts

Leading private banks such as ICICI Bank and HDFC Bank offers 4.90 percent interest on one-year FDs. Axis Bank offers 5.15 percent interest. Kotak Mahindra Bank offers 4.50 percent interest on one-year FD which is the lowest rate among all private banks.

Public sector banks such as Union Bank and Bank of India offer 5.25 percent interest on one-year FDs. Established banks such as State Bank of India (SBI) and Bank of Baroda (BOB) offer 5 percent and 4.90 percent interest respectively, on their one-year FDs.

Investments in fixed deposits of up to Rs 5 lakh are guaranteed by the Deposit Insurance and Credit Guarantee Corporation (DICGC), a subsidiary of the RBI.

The minimum investment amount varies across banks. At private bank, the amount ranges from Rs 100 to Rs 10,000 and at the foreign bank the amount ranges from Rs 1,000 to Rs 20,000.

Also read: Gold loans: Bank of India and State Bank of India among those offering the lowest rates

A note about the table

The data on FDs is as of June 9, 2021, as given in the respective banks’ websites. Interest rates of all listed (BSE) private banks and foreign banks considered for data compilation. Banks for which verifiable data is not available are not considered. The minimum investment amount may vary depending on the type of the term deposit account. For all FDs, quarterly compounding is assumed.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.