Khyati Dharamsi

Life Insurance Corporation of India (LIC) has put fresh policy issuances on hold amidst rising coronavirus cases.

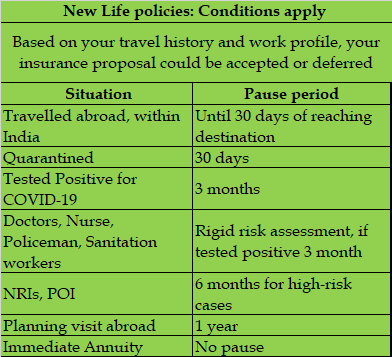

In a guideline on new underwriting norms – a copy of which is with Moneycontrol – it is mentioned that policy issuance to non-resident Indians (NRIs), persons of Indian origins (PIO) and resident Indians with travel history or future plan to travel abroad is postponed by three months to one year.

While the firm would continue to issue immediate annuity plans, other life insurance plans for high-risk individuals, especially those above 55 years, deferred annuity and single premium policies would be put on hold for a period of six months.

“We have not put a halt on anything. We have already sold 1 lakh policies so far this month. A COVID-19 questionnaire is being used to assess risk as per re-insurers request,” refuted Mukesh Gupta, executive director of LIC.

Similarly, LIC will scrutinise (or carry out ‘aggressive assessment’ as per the LIC document) fresh policy applications from those who have been in quarantine or isolation centres, and even medical staff, sanitation workers and policemen, based on their medical reports. A 30-day waiting period would be applicable for those quarantined, while a three-month pause is mandated for individuals who have tested positive.

“Profiling would be done by medical examiners through video calls and reinsurers. If they are at risk, the premium would be high. There are some limits for non-medicals, beyond which special medical reports are required. There is no halt,” Gupta added.

Source: LIC Underwriting Guidelines during COVID-19

Travelling overseas? Think again

According to the letter, there are restrictions introduced on fresh policy issuances to resident Indians, including Merchant Mariners who have travelled from another country or even within India. Such policy proposals would be red flagged and assessment would be deferred for 30 days after reaching the destination (from abroad or within India).

Not only has LIC marked your past travels, it also mandates that you must not travel anywhere abroad later this year after buying a life insurance policy. LIC has said that it would accept the life insurance proposal only if “he/she has no plans to visit any foreign country within the next 1 year.”

So, if you plan to visit another country within the next year, LIC would decline your insurance proposal. In a life insurance policy, claims would be made only if the policyholder dies. At the time of making the claim, if it is found that the policyholder has travelled anywhere abroad, the claim would be rejected. But if you intend to travel abroad, you would have to come back and wait for three months before you apply afresh. LIC would then conduct health and other assessments, afresh.

It has issued a fresh questionnaire for health declarations during the COVID-19 outbreak.

What about other insurers?

Moneycontrol assessed whether all insurers were adopting a similar wait-and-watch strategy during this phase, when people are scurrying to get insurance coverage.

“There has been a change in the way we underwrite proposals amidst the COVID crisis, specifically for NRIs. We collect additional information through a physical questionnaire and video calls to our prospects / customers, as per the customer’s convenience to assess the risk,” says Casparus Kromhout, MD & CEO, Shriram Life Insurance.

Kayzad Hiramanek, Chief-Operations and Customer Experience, Bajaj Allianz Life, says, “The re-insurers publish a dynamic list of negative geographies, where insurance issuance to NRIs living in these countries may be placed on moratorium. If she is located in the negative geography then she cannot buy a life insurance policy now, but it will open up at a future date. If there is a risk attached, even lower sum assured wouldn’t be covered in these regions.”

Medical check-ups in lockdown times

Physical medical tests at diagnostic centres are ruled out during the coronavirus outbreak and hence insurers are resorting to telephonic and video medical tests or home tests. “While normally all cases were examined physically, during the pandemic period, tele and video medicals are being conducted for those opting for a sum assured of up to a certain limit, until the physical infrastructure opens up,” says Hiramanek.

“We have enhanced our non-medical limits and are using video medical report facilities. Wherever possible, medical examination is being conducted through home visit with due safety procedures and social distancing norms,” says Kromhout.

At the moment, insurers want to ensure that the life risk that they take on is limited.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!