Private life insurance companies have registered a marginal improvement in their individual death claims payment track record in 2018-19 compared to what it was a year earlier, as per the Insurance Regulatory and Development Authority of India's (IRDAI) annual report released recently. The Life Insurance Corporation of India’s (LIC) claims paid ratio – in terms of number of policies – has witnessed a slight dip during the period.

Since the core objective of buying a life insurance policy is to ensure dependents’ financial security in case of the policyholder’s death, the claims paid ratio plays a critical role while choosing an insurer. The ratio reveals the number of claims a life insurer has paid out, of the total claims received during the financial year. From a prospective policyholder’s perspective, the higher the ratio, the more dependable the company.

The current record

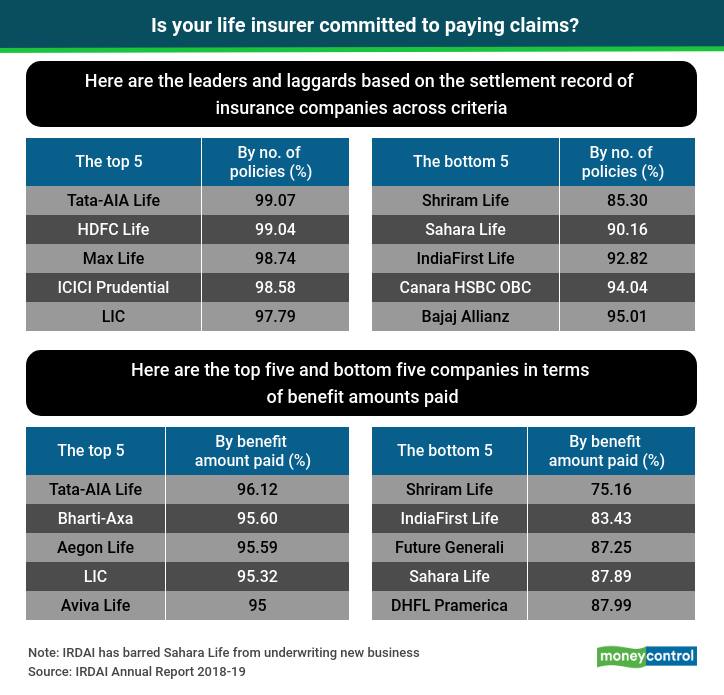

For private sector insurers, the improvement in the claims paid ratio was evident in terms of number of policies as well as the benefit amount paid out in 2018-19. LIC’s claims paid ratio by policy count decreased marginally downwards to 97.79 per cent from 98.04 per cent (see table). However, it remained higher than what most private players managed.

In terms of the benefit amount paid, the industry bettered its performance to 94.26 per cent in 2018-19 from 93.07 per cent in 2017-18 (see table). Yet, it continues to be lower relative to the claims paid ratio by policy count. The gap can attributed primarily to repudiation of some early high-value claims. “Repudiation of claims under policies with relatively larger sums insured is the key reason for this gap,” says Sunil Sharma, Chief Risk Officer and Chief Actuary, Kotak Life Insurance. The chief causes of repudiation are frauds and non-disclosures. “It is the insurer’s responsibility to investigate suspicious early claims, particularly if the sum insured is high, to protect the interests of all stakeholders, including genuine policyholders,” he adds.

Since the idea of buying online term policies with large sums insured has gained ground in recent years, it is imperative that insurance-seekers scrutinise these ratios closely before taking a call.

Number of policies vs benefit amount

According to insurers, the claims paid ratio in terms of number of policies is a more relevant indicator as it points to the number of customers whose claims have been settled. “On the other hand, one large-value case can skew the benefits paid ratio either way. The customer chooses his/her sum assured basis his/her requirements and human life value (HLV). It helps understand the number of such customers we have settled the claim for,” says Yusuf Pachmariwala, Executive Vice President and Head of Operations, Tata AIA Life Insurance.

While newer companies tend to register relatively lower ratios due to investigations that some early claims necessitate, most companies have completed at least ten years of operations. A majority of the insurers reported a claim settlement ratio (by policy count) of over 95 per cent, which is considered a healthy number.

However, those looking at buying high-value term policies with sums assured of over Rs 1 crore should delve deeper, feel others. “A customer buying a high-value term cover wants information on settlement of larger claims, not the smaller ones. Therefore, for such individuals, the claims paid ratio in terms of benefit amount paid would be a more relevant metric,” says Mahavir Chopra, Director, Health, Life and Strategic Initiatives, Coverfox.com. Relying solely on a higher claim settlement ratio by policy count ignores the possibility of high-value claims being repudiated. You should compare the difference between claims paid ratio by policy count and benefit amount paid. “Those considering high-value term plans can give preference to companies where the gap is narrower,” he adds. For example, this gap is 86 basis points for Aegon Life Insurance, while it is as wide as 10.14 percentage points in case of Shriram Life Insurance. A narrower gap is an indicator of fewer high-value claims being repudiated.

On their part, companies need to adopt watertight underwriting practices during policy inception itself, so that the life assured’s dependents do not suffer due to their negligence in future. Underwriting refers to the process of assessing the risk of insuring prospective policyholders. Insurers claim that they have tightened their underwriting processes to weed out fraudulent cases at inception, over the years. Availability of newer data sources for detailed profiling has helped.

"Going forward, thanks to the use of analytics and credit bureau data leading to more robust underwriting, the claims settlement ratio will continue to be good. Stringent underwriting will minimise the scope for fraud, resulting in better quality lives being covered,” says Pachmariwala. A provision in the amended Insurance Act, which disallows calling a policy into question after three years of policy issuance, has also played a role in ensuring stricter underwriting processes.

What should you do?

Your due diligence need not be centred on the claim settlement ratio alone. “The claim settlement ratio may provide psychological relief, but offers no guarantee that your claim will be paid if the need arises in future. At your end, ensure that you do not make any wrong declarations while filling up your proposal form,” advises Chopra. Be completely transparent, particularly with respect to your health history and income details. Do not leave the task of completing the proposal form to agents, friends or relatives. “As long as there is no misrepresentation, there is no reason to fear claim repudiation,” says Sharma.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.