Now, RuPay BOBCARD credit card holders can convert their purchases into equated monthly installments (EMIs) by scanning a QR code through UPI (Unified Payments Interface) apps.

RuPay credit card users can link the card to Amazon Pay, BHIM, CRED, Google Pay, Paytm and PhonePe apps.

They can convert their UPI transactions into EMIs at any UPI-accepting merchant, both online and offline.

The National Payments Corporation of India (NPCI) had announced this feature in April 2024. BOBCARD Ltd, a wholly owned subsidiary of Bank of Baroda, is one of the early adopters of this new feature and launched it for its credit card users. Other banks are likely to follow suit and announce this new feature for RuPay credit card holders.

Here’s a closer look at this new feature and how it works.

Pay for purchases in installments

Users can apply for the EMI facility directly on their linked RuPay credit card through any UPI app. The UPI PIN serves as user consent for the terms and conditions. At checkout, users can select the EMI option , allowing them to choose the EMI period during shopping, and ensuring that high-value purchases are spread over manageable installments. The process is digital and requires no additional paperwork.

Users can also convert past purchases made with their RuPay credit card into EMIs by accessing their transaction history on the UPI app.

The EMIs will be billed in the monthly statement starting from the immediate billing cycle date.

“This feature gives our customers greater flexibility and control over their finances,” says Ravindra Rai, Whole Time Director, BOBCARD Ltd.

This feature is designed to meet the growing demand for flexible payment options during the festive season and aims to drive the adoption of digital credit solutions across India, particularly in Tier 2 and 3 cities, he adds.

Eligible RuPay credit card users can convert UPI transactions into EMIs, based on the following conditions: the transaction amount should be Rs 2,500 or more and the transactions can be done on white-listed merchant category codes by BOBCARD Ltd. UPI transactions on gold, jewellery and fuel cannot be converted into EMIs.

Also read | Credit on UPI: Convenient loans at your fingertips, but watch for pitfalls

Two modes of EMI conversion

The conversion to EMI can be done during or post debit transaction.

During the financial transaction

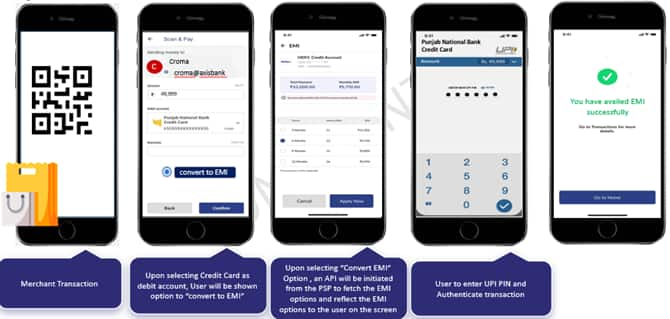

Users can convert person-to-merchant transaction to EMI during purchase. The steps to EMI conversion during the transaction processing is as follows:

Step 1: Users need to scan the QR code and select the BOB CC option for payment

Step 2: System will provide applicable EMI plans

Step 3: Click on 'Convert to EMI' option

Step 4: Select the required EMI plan and authenticate the transaction process

After debit transaction

Users can also convert person-to-merchant transaction to EMIs, after purchasing. The steps are as follows:

Step 1: Users will go to transaction history page

Step 2: Select the transaction to which customer wants to convert to EMI.

Step 3: System will check for the eligibility criteria

Step 4: If transaction is eligible for EMI conversion, customer needs to select the BOB CC as EMI conversion mode

Step 5: Select the EMI plan and authenticate the transaction using PIN

Interest and other charges

Users must pay 16 percent interest rate per annum to avail the EMI facility on UPI payments. The tenure options are 3 months, 6 months, 9 months, and 12 months. Then, there is a processing fee of Rs 199 plus GST. The GST is also applicable on monthly EMIs.

Late payment charges are in the range of Rs 100 to Rs 1,300. These charges are applicable as per the outstanding balance in the statement. In case of a default in EMI payment on the due date, the EMI facility account services would be suspended and could further be terminated.

There are pre-closure charges as well. The charges are 3 percent of the outstanding principal balance or a minimum of Rs 299, whichever is higher. Along with pre-closure charges, pro-rata interest applicable and the credit card's outstanding balance at the time of pre-closure have to be repaid for the pre-closure of the EMI.

Also read | New credit card allows you to spend on Mastercard, UPI-linked Rupay. A Moneycontrol review

Should you opt for this facility?

While opting for EMI facility through UPI application, it's important to understand that with every purchase converted to EMI, you will have to pay interest. For instance, Bank of Baroda is charging 16 percent p.a. as interest. It will vary from bank to bank. Then, there are processing fees and late payment charges in case of default.

“Customers must be careful while opting for EMI facility through UPI, as this can lead to overspending,” says Sumanta Mandal, founder of TechnoFino, a platform that reviews debit and credit cards.

The fascination for expensive gadgets and easy EMI options has led many millennials and GenZers to accumulate debt. Buying iPhones, laptops, and other electronics through loan-based payments can have long-term consequences such as debt accumulation and bad credit scores.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.