For the average borrower, it is becoming increasingly easier to access loans.

From buy-now-pay-later schemes to loans for online purchases to EMI-based credit card payments, there are many avenues for instant gratification, with consumers finding it difficult to resist the allure of easy credit to fund their lifestyle needs.

Understanding the newest kid on the block

The latest entrant in the list of instant loans is credit line linked to UPI, which was launched last year in September. Conceived by the National Payments Corporation of India (NPCI), it enables users to access instant credit directly through their UPI-enabled apps such as Bharat Interface for Money (BHIM), PayZapp, Paytm, GPay and others. It’s a pre-sanctioned credit limit which can be availed by customers while using the UPI payment app at the time of purchase.

These are predetermined loans that banks or financial institutions make available to users based on their creditworthiness. The user can use this credit line to make payments through UPI.

In terms of advantages, the facility ensures quick and convenient loan disbursals, eliminating the need for traditional loan approval processes and extensive documentation.

“Users especially those from the lower-income segments can now meet their financial needs promptly whether it's for emergencies, education, healthcare or business ventures, without the hassle of collateral or lengthy paperwork,” says Ashish Tiwari, Chief Marketing Officer, Home Credit India, an NBFC.

How ‘credit on UPI’ facility works

Each UPI account is linked to a savings account with a bank. To access the credit line on UPI service, users will need to submit a formal application to their bank. The banks will then assess the borrower's financial information, including eligibility, income, credit score, and repayment history. Depending on the bank's requirements, you may need to submit supporting documents, such as income statements, identity proof, address proof, and other relevant paperwork. The specific procedures and requirements for applying for a UPI credit line may vary from one financial institution to another. The bank will review the application and documents submitted. If the application is approved, the bank will notify the applicant of the approved credit limit and its terms.

“Once the bank approves the pre-determined borrowing limit, which is similar to the credit limit of a credit card, one can utilise it as one wants,” says Virat Diwanji, group president and head, consumer banking, Kotak Mahindra Bank.

Parag Rao, country head, payments business, consumer finance, digital banking and marketing, HDFC Bank, says, “Being an interoperable platform, UPI users will be able to use the credit available on UPI across multiple payment apps.”

Interest rates for the credit line can vary based on the bank, the borrower's creditworthiness, and prevailing market conditions. “These interest rates are typically lower than credit card interest rates, making them a relatively cost-effective way to access credit,’’ Diwanji says.

Using ‘credit on UPI’

In May 2024, a study on Indian lower middle-class consumers was published by Home Credit. According to a study, 42 percent of consumers foresee the potential usage of credit on UPI, a concept that enables a user to access instant credit directly through their UPI-enabled apps.

“Many fintech players have started offering micro loans and credit lines to those without traditional credit histories by leveraging their UPI transactions. This approach is driving financial inclusion across the country, especially for the lower-middle-class cohort,” says Shikhar Aggarwal, chairman of BLS E-Services, a digital service provider that offers Business Correspondence services to major banks in India.

Further, according to the Home Credit study, about 53 percent of consumers feel that the primary motivation for adopting credit on UPI lies in its time-saving capabilities, streamlining the loan process and reducing administrative hassles, while 44 percent feel that it makes shopping easier due to the ease of accessing credit directly through their UPI-enabled apps.

Additionally, 23 percent feel that there are better offers while opting for credit on UPI. These are some of the factors driving its adoption among consumers seeking financial flexibility and value. The sample size for the Home Credit study was 2,500.

Uptake remains low

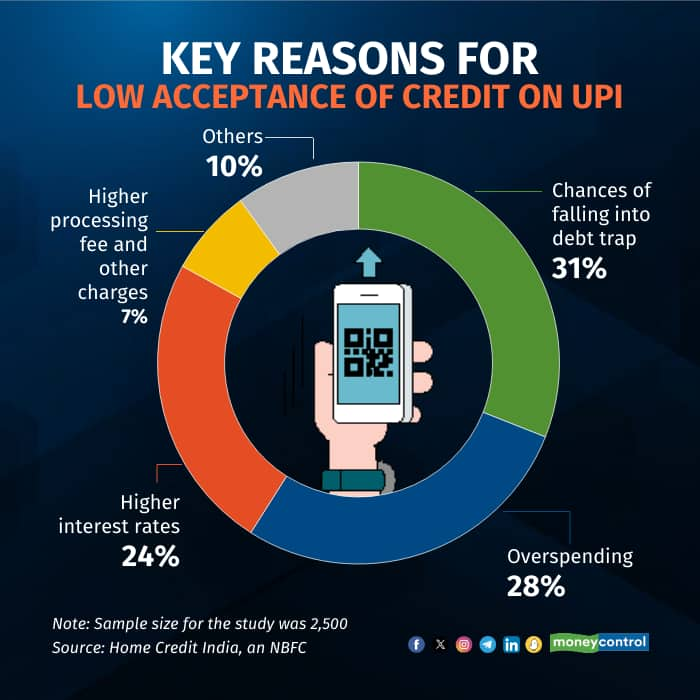

However, some users wouldn’t prefer using credit on UPI (refer to graphic). “Some of the common causes are—easy access to credit might lead to the risk of overspending, the potential for users to accrue debt if not managed properly and users finding it difficult to understand the terms and conditions of credit use on UPI,” says Kunal Varma, CEO and co-founder at Freo, a digital banking platform.

Tiwari says, “These findings reflect a mix of apprehensions among users regarding the potential risks and financial implications associated with accessing credit through UPI, highlighting the importance of addressing these concerns to foster greater trust and adoption of the services.”

Implementation challenges

Banks are not very keen to roll out credit on UPI facility. The most important reason is that credit cards have a merchant discount rate (MDR) of around 2 percent and are more profitable for banks. “Why would a bank undercut its own business and promote credit on UPI instead?” asks a senior retail banker requesting anonymity. The MDR is the fee that merchants pay to a credit card payment processing company (the credit card issuing bank).

Further, banks are already issuing RuPay credit cards which can be linked to customers’ UPI accounts on payment apps, and this has been quite popular among users. There is a wide acceptance and convenience of linking RuPay credit cards on UPI. Also, users get to earn reward points that come with credit card transactions using UPI.

The ‘credit on UPI’ facility is a competing product with less margin for the bank and low awareness among users. According to the Home Credit study, despite the widespread adoption of UPI, only 40 percent of users were aware of UPI on credit feature.

A spokesperson from a digital payment firm requesting anonymity says, “The UPI payment apps are also not keen on the credit on UPI product because there isn’t much scope to generate profit out of it.” He adds that a larger pie of the MDR goes to credit issuers.

Also read | RBI plans auto-replenishment of UPI Lite wallet: What does it mean to users?

Beware of frauds

As we become more digital, the chances of data breaches and other such risks also increase. “Frauds in 'Credit on UPI' can include unauthorised access to UPI credit, phishing scams where fraudsters trick users into revealing their credentials, and misuse of borrowed credit through identity theft,” says Varma.

The surge in such frauds is attributed to people's tendency to overlook due diligence in their busy schedules.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.