If your savings account runs out of steam towards the end of the month, soon, you will have a credit line on the Unified Payments Interface (UPI). It’s a pre-sanctioned credit limit which can be availed of by customers at the time of purchase.

In September, during the Global Fintech Festival (GFF), the National Payments Corporation of India (NPCI) gave a demonstration to the audience of how this will work. Axis Bank, HDFC Bank, ICICI Bank, Kotak Mahindra Bank, Punjab National Bank (PNB), and the State Bank of India (SBI), among others, are testing this feature among a limited set of users on payment apps such as Bharat Interface for Money (BHIM), PayZapp, Paytm, and GPay. According to the banks Moneycontrol spoke to, the facility will be rolled out to a larger set of customers in the coming months.

“The decision to expand the scope of UPI by inclusion of credit lines is yet another remarkable feature added to UPI,” says Mandar Agashe, founder and MD, Sarvatra Technologies, a fintech firm. He adds that till now, savings and overdraft accounts, prepaid wallets, and credit cards could be linked to UPI. This feature will be a game changer as it puts credit lines attached to UPI and credit cards on the same pedestal.

In April, Reserve Bank of India (RBI) governor Shaktikanta Das had announced the introduction of a collateral-free, pre-approved credit line, or borrowing limit, that a user could access from his bank via the UPI platform.

Also read | How to use QR codes and UPI AutoPay to make recurring payments

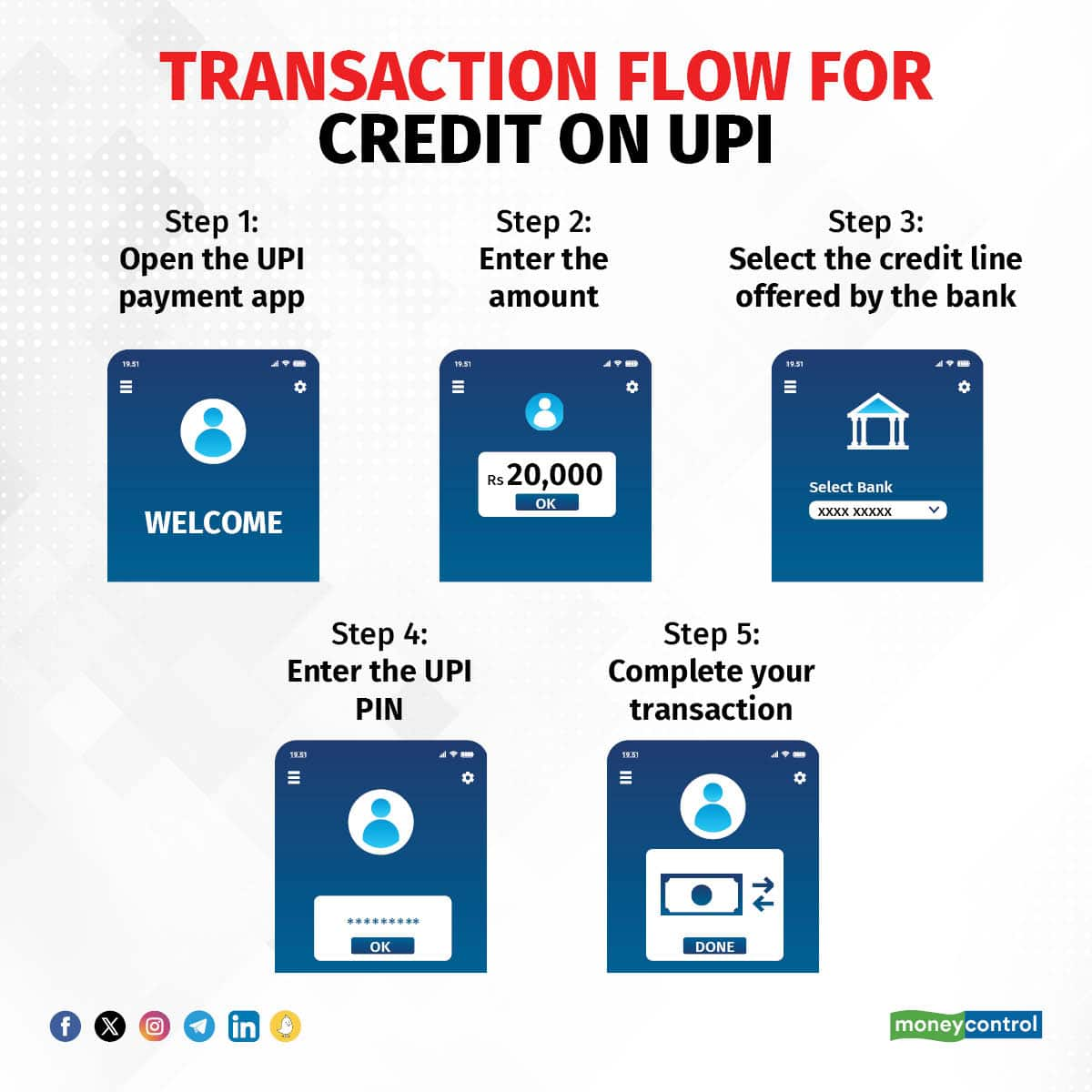

How this works

Each UPI account is linked to a savings account with a bank. To access the credit line on UPI service, users will need to submit a formal application to their bank. The banks will then assess the borrower's financial information, including eligibility, income, credit score, and repayment history. Depending on the bank's requirements, you may need to submit supporting documents, such as income statements, identity proof, address proof, and other relevant paperwork. The specific procedures and requirements for applying for a UPI credit line may vary from one financial institution to another. The bank will review the application and documents submitted. If application is approved, the bank will notify the applicant of the approved credit limit, and its terms.

“Once the bank approves the pre-determined borrowing limit, which is similar to the credit limit of a credit card, one can utilise it as one wants,” says Virat Diwanji, group president and head, consumer banking, Kotak Mahindra Bank. He adds that repayment, along with the applicable interest, can be settled at a later date, akin to how credit card payments work.

Parag Rao, country head, payments, consumer finance, technology and digital banking, HDFC Bank, says, “Being an interoperable platform, UPI users will be able to use the credit available on UPI across multiple payment apps.”

“When using the credit facility, the UPI apps you use will be linked to your credit line and show the debits in your loan account instead of your savings bank account,” says Rahul Jain, CFO, NTT DATA Payment Services, India.

Tenure and interest rates

The tenure of a UPI credit line can vary, ranging from a few months to years. “Banks may offer options for short-term credit lines or longer-term credit lines, allowing borrowers to choose a repayment period that suits their needs,” Diwanji says.

Interest rates for the credit line can vary based on the bank, the borrower's creditworthiness, and prevailing market conditions. “These interest rates are typically lower than credit card interest rates, making them a relatively cost-effective way to access credit. Banks may offer fixed or floating interest rates,’’ Diwanji says.

Benefits to users

For those who are comfortable managing credit, incorporating a credit line with their UPI app eliminates the need to carry multiple credit cards. It will be interesting to see if the banks offer reward points and other benefits typically offered to credit card holders, to customers availing of credit lines through UPI. The rewards rate may not be higher for credit line users due to the absence of the merchant discount rate (MDR). The MDR is the fee that merchants pay to a credit card payment processing company.

“If someone does not have a credit card but still wants a credit facility while making payments, s/he can simply avail of credit from the bank first, and then link that funding loan account to UPI,” says Agashe.

Also read | Making UPI payments via RuPay credit cards: Is it worth it?

Users can use the credit at the point of transaction and convert it into equated monthly installments (EMIs). “New-to-credit (NTC) customers can build their credit score over time,” says Rao.

Diwanji says, “However, as with all credit options, it's important to use the credit line on UPI wisely, ensuring a clear understanding of the repayment terms.”

As with credit cards, going overboard with credit through UPI can land you in a debt trap. Use credit responsibly.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.