In June 2022, the Reserve Bank of India (RBI) allowed individuals to link their credit cards to the United Payments Interface (UPI). However, it is possible only through select banks which have enabled the linking of their RuPay credit cards to UPI.

On May 31, 2023, BOB Financial Solutions, a wholly owned subsidiary of Bank of Baroda, announced that Bank of Baroda credit card customers can now use RuPay Credit Cards on UPI-enabled apps, such as BHIM, PhonePe, Paytm, Google Pay, Slice, MobiKwik and PayZapp.

Similarly, in June, Canara Bank and Kotak Mahindra Bank also introduced the facility of UPI payments to merchants through RuPay credit card issued by them.

Some of the other banks that have enabled the linking of RuPay credit cards to UPI are Axis Bank, HDFC Bank, Indian Bank, Kotak Mahindra Bank, Punjab National Bank, Union Bank of India and YES Bank.

On RuPay credit cards linked to the UPI, K Satyanarayana Raju, MD and CEO of Canara Bank, said: “This seamless and secure digital payment method allows customers to make credit card transactions with utmost ease.”

“With RuPay credit cards linked on UPI, customers will have more flexibility and choice in making payments across merchant outlets,” said Dilip Asbe, MD and CEO of National Payments Corporation of India (NPCI).

Also read | Why credit cards on UPI is a game changer

Credit cards linked to UPI increases penetration

Credit cards linked to UPI are a major step towards pushing digital payments. Earlier, people could only add their bank accounts or debit cards to UPI apps, but now they can link select banks' RuPay credit cards to UPI and use them for payments.

“It is convenient to use credit cards at small vendors who do not have a point of sale (POS) card swipe machine,” says Ankur Mittal, Co-Founder and Chief Technology Officer, Card Insider, a platform that tracks the Indian credit card industry.

“In rural India, numerous merchants do not accept credit card payments due to various challenges, such as merchant discount rate (MDR) and requirements like POS machines and paperwork. However, they accept UPI payments because setting up the UPI system and accepting payments is incredibly easy,” said Sumanta Mandal, Founder, TechnoFino, another platform that tracks the Indian credit card industry.

Now, he adds, card users have the option to link their RuPay credit cards to the UPI system and make payments to merchants who do not have the infrastructure to accept credit cards. This development will benefit the entire digital payment system and increase digital payment penetration.

Benefits to card users

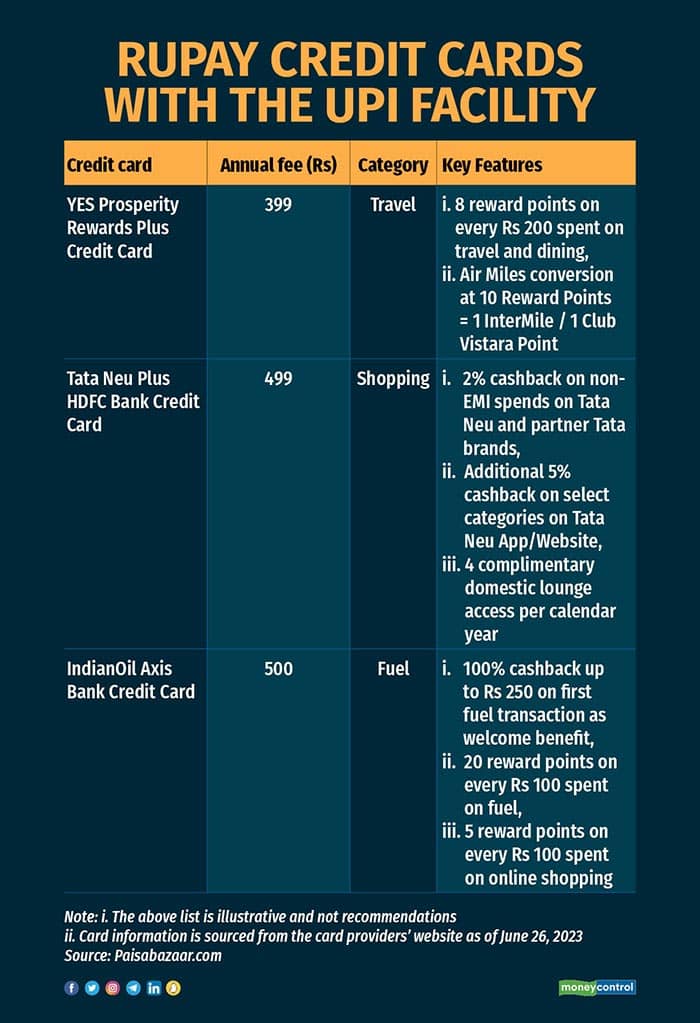

RuPay credit cards issued by banks which can be linked to UPI facilities offer benefits across categories, including travel, shopping and fuel (refer to graphic - RuPay credit cards with the UPI facility).

“Credit cards on UPI gives our customers access to the ease and convenience of transacting on UPI while they continue to enjoy the benefits of a credit card. They do not even have to carry the card with them,” said Sanjiv Chadha, Managing Director and CEO, Bank of Baroda.

Linking credit cards to UPI provides convenience to the customers as they can use credit cards linked with UPI for daily spends and bigger purchases using the short-term credit facility offered by credit cards. “Users will not only have immediate access to funds but can also avail benefits like rewards and cashback,” said Rohit Chhibbar, Head of Credit Cards, Paisabazaar.

In comparison to savings account-linked UPI payments, credit card UPI payments can help you save more in the form of reward points and other cashback benefits. “You can also access other milestone benefits and privileges,” Mittal added.

People who travel a lot and regularly refuel their vehicles can use their UPI-linked credit card for fuel spends as there is no fuel surcharge on UPI payments. “You can keep a RuPay credit card for UPI payments and keep track of spending directly from the card statement,” he says.

Restrictions on using credit cards for UPI payments

“While there are no restrictions on the number of transactions that can be carried out using the card linked to UPI, there is a maximum UPI limit of Rs 1 lakh per card per day or your credit limit, whichever is lower,” Chhibbar said.

Also, consumers can only use UPI-linked credit cards to make payment at merchant outlets and not to send funds to another user.

“At present, only merchant payments are allowed using this facility, and person-to-person, card-to-card, or cash-out transactions will not be permitted for UPI payments from RuPay credit cards,” said Asbe.

Currently, we can only link RuPay credit cards to the UPI system. “But most banks issue credit cards on Visa and Mastercard networks, which pose a significant restriction,” Mandal added.

Keep track of your spending

After linking the RuPay credit card with the UPI app, you can make purchases using the credit limit even when you do not have the physical card. “Such convenience comes with the risk of overspending, which can lead to high credit card dues,” Chhibbar pointed out.

Failure to pay bills on time can lead to hefty finance charges and other penalties by the card-issuing bank. So, it’s advised to keep a track of UPI-linked transactions to ensure discipline in card usage and spend only as much as you can afford to repay on time, he said.

Also read | UPI scams on the rise: Know how to protect yourself while making payments via UPI

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.