As India starts getting vaccinated, all of us hope to travel again. And banks are gearing up to spruce up their credit cards reward programs to give travel benefits. While most Indians are still some months away from hopping on to the next flight for risk-free leisure travel, it pays to evaluate travel credit cards. It is also time you understood the features of the card that you yourself own, but weren’t able to use last year due to COVID-19. Does it still make sense to continue with it?

Making travel lucrative again

American Express (AMEX) is changing redemption options for its Platinum Travel Credit Card, effective January 22, 2021. Redemption options are being increased for customers. The bonus points that AMEX gives on crossing its usual spending thresholds (Rs 1.9 lakh and Rs 4 lakh) can now be used to book air tickets and hotels domestically. Previously, these points could be redeemed only for travel vouchers.

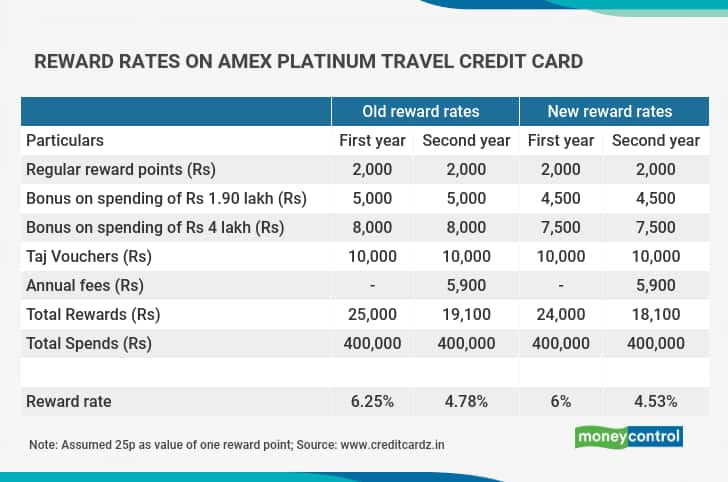

Additionally, you can now transfer your reward points to other loyalty programs you may already have, such as Marriott Bonvoy and Club Vistara. Or, you can use your reward points to shop from Flipkart. “There is a minor devaluation of 0.25 per cent on an annual spend of Rs 4 lakh and above (refer to illustration table); but, it has broadly maintained the appeal of this credit card with increase in redemption options of reward points,” says a spokesperson from www.creditcardz.in.

A few other banks are evaluating their options. Arjun Chowdhry, Consumer Business Manager, Global Consumer Banking, Citi India says, “We are seeing some interesting trends and we will launch new offers and programs, aligned with those new preferences. In addition, the basic rewards and redemption program would also remain intact.” At present, Citi PremierMiles Credit Card holders can redeem miles towards the preferred airline frequent flyer program, pay with miles to more than 100 airlines and hotel partners. Or, they can just shop from its shopping catalogue. Arjun says that the main benefit of the card is that Citi miles never expire, so cardholders can always use it in future.

Moneycontrol reached out to Axis Bank, HDFC Bank, State Bank of India (SBI) cards, Standard Chartered, among others to understand the rewards program they aim to roll out for their existing customers. None of them replied to Moneycontrol’s queries.

Also read: Are expensive travel credit cards needed when flying is restricted?

Travel cards took a backseat during COVID-19

During the Covid-19 lockdown last year, travel cardholders were unable to redeem their reward points for travel. Some credit card companies, instead, gave their card members other benefits. “With less spending related to travel some banks reduced their credit card welcome bonuses for new customers. This is because banks probably felt the need to reduce cost in face of declining transactions and credit card revenue,” says Sahmi Chowdhury, Research Analyst for ValueChampion India, which is into quantitative and qualitative analysis of financial products.

For instance, some market observers claim that Standard Chartered Bank discontinued some of the facilities that it was providing earlier to existing travel credit card customers, apart from also reducing the joining offers to new customers. Standard Chartered Bank did not respond to the email sent by Moneycontrol.

Some cards devalued their reward points around May last year. “This devaluation of reward points is not beneficial for the customers holding credit cards, as banks do not increase the valuation later on,” says a spokesperson from www.creditcardz.in. For instance, Yes Bank reduced a reward point value from 25 paise to 15 paise during the lockdown. In simple words, this means you need more reward points to buy the same item you could have bought with fewer points earlier.

You will travel, someday

You are bound to resume travelling someday, if not in the immediate future. In which case, it makes sense to hold on to your card. “If the annual fee is low compared that on other cards in this segment and the credit card earns good rewards on non-travel expenditures, you should continue to hold it. That way, you can still earn rewards to make travel arrangements for next year,” says Sahmi of ValueChampion India. Just make sure that your reward points are valid for as long as possible, may be forever. After all, you never know when your turn for vaccination would come.

But if travel scares you despite getting vaccinated, then you might want to switch to another credit card. Sahmi says that there are cards that reward you handsomely only on travel-related expenditures (such as booking an air ticket), but not much on other spends. Then, it doesn’t make sense to hold on to such cards as well.

Also read: How many credit cards should you have?

How to cancel your credit card

Give it in writing and get a written confirmation from your credit card company that your card is indeed cancelled. But make sure you spend your reward points before you cancel your card. “If transfer your points to an airline, you should make sure that the value of your points or miles is more than the fee you incur to make the transfer,” says Sahmi of ValueChampion India.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.