Abhishek Jaju, 35, is self-employed and lives in Mumbai. He is a frequent traveller by flights – domestic and international – for business purposes. He opted for a travel rewards credit card in November 2019 from a bank. This year, he was planning to travel more for business and take advantage of various benefits that airlines/travel partners associated with the bank offered. But, the COVID-19 pandemic resulted in a lockdown extending for months from the start of the year. While local travel is restricted, going abroad is still not possible as flights do not operate to overseas locations.

Complimentary tickets upon joining, accumulating air-miles, getting lounge access – all these much-coveted benefits have taken a backseat due to the lockdown. Although a few countries in Europe are slowly opening up for travel, the new wave of infections threatens to throw water over any travel plans that people hoped for. There are several customers like Abhishek, who hold travel credit cards after paying steep annual fees. They are unable to take core travel benefits with this credit card in the current circumstances. Some are also worried about losing the miles and reward points accumulated on the credit card over the years.

You need to evaluate if you need to hold a travel credit card at all, given the present situation.

How are travel credit cards impacted due to the pandemic?

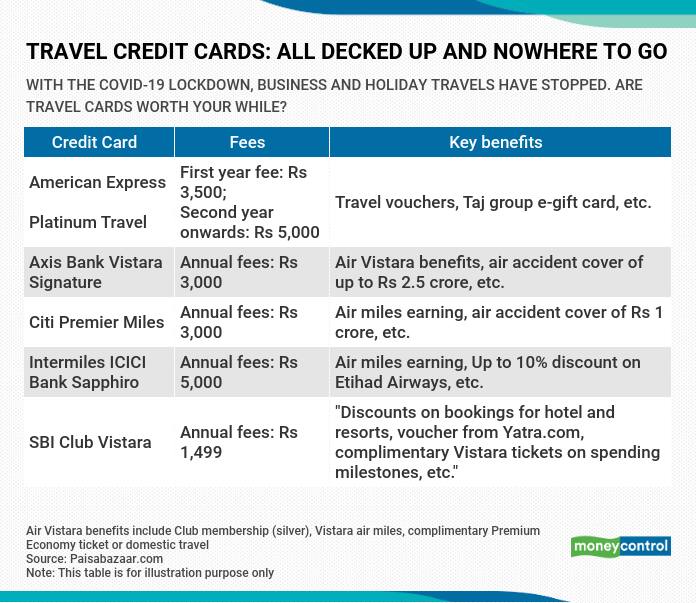

Travel credit cards offer higher benefits and reward points on travel-related expenses than other categories. The annual fees for these cards are higher compared to other credit card categories since they cater to a premium customer base.

Manoj Adlakha, Senior VP and CEO, American Express Banking Corp India says, “In these pandemic times, we observe that online spends, which generally account for 50 per cent of our customer spends, have improved in certain areas such as online education and groceries, but there has been a definite hit in travel-related spends.”

Loyalty benefits offered by banks

The most common benefit of a travel credit card is earning air-miles while using the card for transactions. Customers holding these cards have a common concern as to what will happen to accumulated air miles that are about to expire in the near term.

Sahil Arora, Director and Group Head, Investments, Paisabazaar.com says, “Considering customers’ concerns, banks are now extending the use of air miles accumulated to buy non-travel related vouchers and merchandise from the card issuer’s reward catalogue.”

For instance, American Express is now offering Amazon shopping vouchers worth Rs 1,000 by redeeming 3,900 reward points; earlier, 4,400 reward points were required for the same amount.

Moneycontrol reached out to Axis Bank, Citibank, Bank of Baroda, HDFC Bank, State Bank of India (SBI) cards, among others to understand the alternative measures or benefits they aim to roll out to their existing customers. None of them got replied to queries.

Ajay Awtaney, editor of LifeFromALounge.com, a website which tracks and analyses Indian credit cards and does airline reviews says, “American Express (India) is the only bank that has rolled out offers and benefits for all their Platinum/Centurion credit card members in a systematic way in these pandemic times. Other banks don’t have a systematic approach, but they have a customised deal in place for some of their credit card customers.”

Some banks, on conditions of anonymity, privately admit that measures must be taken to justify the fees in a price-sensitive market such as India, and compensated adequately.

Pankaj Bansal, Business Head, Account Management, BankBazaar.com says, “Several banks are looking at providing benefits, apart from spending on travel. These are primarily for discretionary, luxury and education spends.” For instance, customers holding travel cards can earn extra cash back on purchases made through music and video streaming platforms. American Express is crediting higher reward points for spending on online education programs. There are other banks giving discounts to enrol for online education programs using these cards.

Other rewards handed out

Some banks are also extending the validity of stay vouchers issued from hotel partners while enrolling for travel credit cards or on renewals. Sapna Tiwari, Co-founder and COO, Rupeewiz Investment Advisors says, “This benefit seems to have been extended to revive the hospitality industry post-COVID-19 and gain customers’ confidence to travel again.”

Internationally, many banks and card companies have rolled back annual fee hikes they had planned for earlier.

Should you cancel your travel credit card?

Before choosing to continue with a travel card, consider the amount of spending a card requires to earn extra bonus points and the timeframe in which you must do so. “If it is more than what you usually spend or more than what you can reasonably pay back without carrying a balance, it is not worth it,” says Bansal.

Charge annual fees of up to Rs 5,000 on travel credit cards. Tiwari says, “Considering the present crisis, holding such expensive credit cards in your wallet is of no value. You can always reach out to the bank and cancel the credit card.”

Banks usually refund the annual fees if you cancel the credit card within 30 to 60 days from the billing statement date. In case you have paid annual fees four to six months back, banks will take your application to cancel the card and refund the annual fees on a pro-rated basis. “In some cases, banks are seeing the past spends of the customer and waiving off 50 to 100 per cent of the annual fees for this year to retain the cardholder with the bank,” says Awtaney.

“Travel credit card holders having other cards like fuel cards, reward cards, shopping cards, etc. can divert their spending to those credit cards if their chances of travelling are very slim in the near future,” says Arora.

Moneycontrol’s Take

In these COVID-19 pandemic times, evaluate how your expenses will change for the next one year and be clear about the purpose for which you would be using the card. If you have a travel card, then check with your bank if you are being offered a discount on the annual fee, or any other benefit to compensate for lack of travel, such as grocery purchases. Retain your travel credit card only if it fits your needs.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.