The usage of credit cards has crossed pre-pandemic levels. According to Reserve Bank of India (RBI) data, there were around 8.03 crore credit cards in circulation in the country as of July 2022. This number has increased 26.5 percent from the end of July 2021.

Most of us these days have more than one credit card. The question is: how many should you have?

Should I apply for more than one credit card?

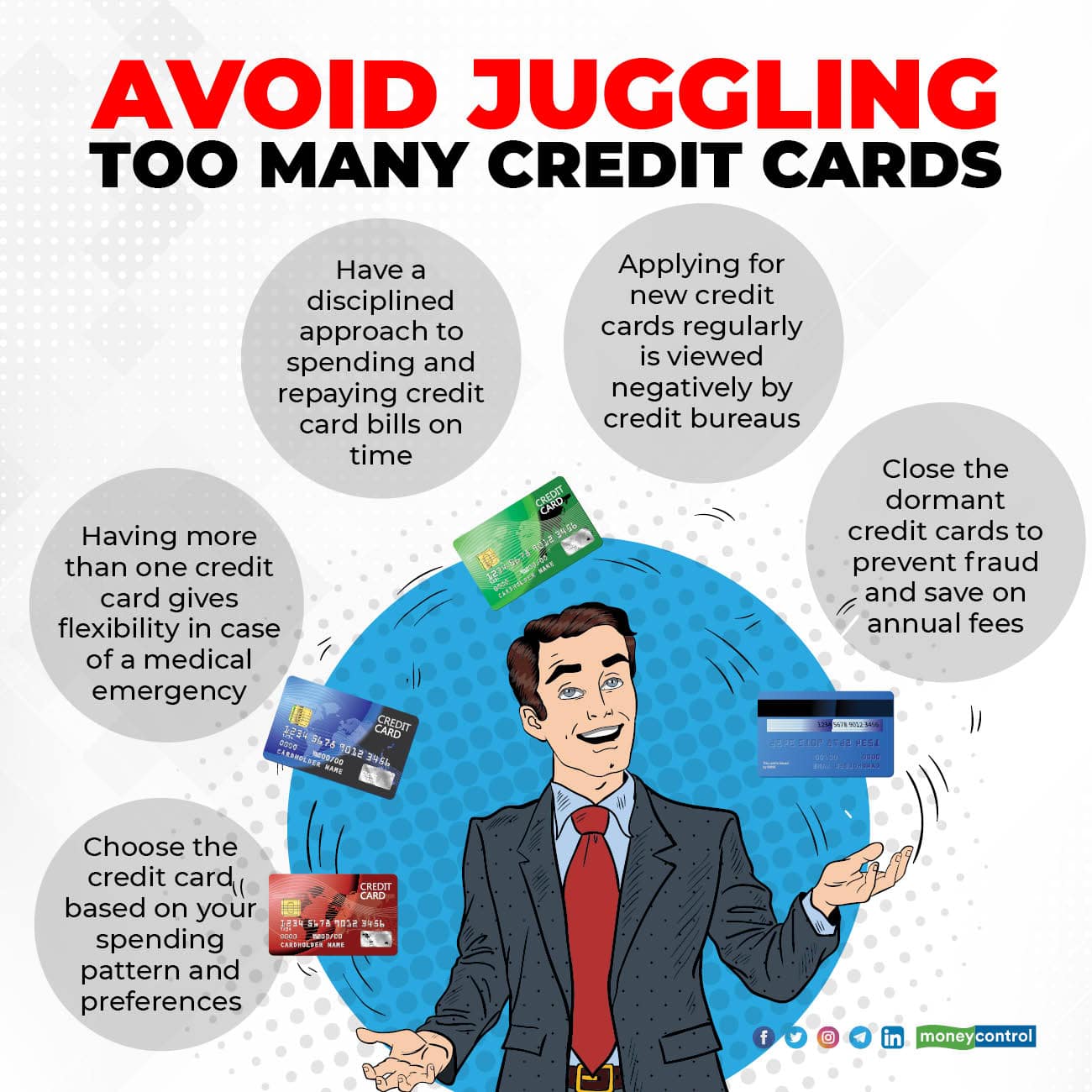

Ideally credit cards are fine, because if one doesn’t work, the other can come in handy. But, “Managing multiple cards and their timely repayments could get challenging,” says Parijat Garg, a credit scoring expert.

It could also lead to over-spending and a debt trap, eventually. “Consumers can spend recklessly when a higher credit limit is available; they may end up not repaying on time, carrying forward the balance on monthly statement by repaying minimum due amount, or defaulting due to non-payment while managing multiple cards,” says Aparna Ramachandra, founder Director of rectifycredit.com.

How do I decide which credit card I need?

You should choose a credit card based on your spending patterns and preferences. If you prefer to spend a lot on e-commerce websites, it makes sense to have a shopping card which brings you the best offers, cashback and rewards on such spending. Similarly, if you travel by your own vehicle to work, a co-branded fuel credit card may work for you. “While applying for a card, it’s important that you read the terms, understand features of the card and then decide whether it suits your lifestyle and requirements,” says Ramachandra.

Also read: Are expensive travel credit cards needed when flying is restricted?

Should I apply for cards from different avenues?

Try to explore AMEX, Diner Club, MasterCard, Rupay and VISA card issuers. This will allow you maximum flexibility and enable you to gain cashbacks and reward points.

However, “If you are applying for a credit card for the first time, opt for VISA or MasterCard network. It shouldn’t be an AMEX or a Diners club network credit card. This is because there are acceptance issues at retailers/e-commerce websites with AMEX or Diners club network credit cards,” says spokesperson from www.creditcardz.in.

My credit limit increases with multiple credit cards, right?

Multiple credit cards may allow you to enjoy higher credit limit. For instance, one card issuer may give you a maximum credit limit of Rs 2 lakh. But, having two credit cards from different issuers, you may have total credit limit of Rs 4 lakh.

“However, don’t fall for the temptation of having higher credit limit by applying for new credit cards at regular intervals. Less than two times of your monthly salary should be adequate total credit limit on cards,” says Tushar Jain, a personal finance blogger at www.jaintushar.com.

Also read: How to select your first credit card?

Does having multiple credit harm my credit rating?

Look at your credit utilization ratio. Having multiple cards actually lowers your credit utilization ratio per card and this helps your credit score. But there is a flipside. “Make sure that your credit utilisation is no more than 30 per cent of the available credit. If you cross this limit, it can negatively impact your credit score,” says Kunal Shah, Founder of CRED.

Which is also why you shouldn’t keep applying for new cards. Every time you apply for a new credit card, the bank assesses your creditworthiness by fetching your credit report. “This lender-initiated credit report requests are termed as hard inquiries, which lead credit bureaus to reduce your credit score by some points,” says Sahil Arora, Director at Paisabazaar.com.

How do I track and pay multiple credit card bills on time?

Set up an electronic clearance service (ECS) debit with your savings bank account to ensure timely payment of your bills. “Alternatively, there are fintech apps that allow you to pay credit card bills through them. These fintech apps even send you reminders of credit card dues. Making a payment through such fintech apps comes in handy, especially for consumers with multiple credit cards,” says Garg.

Also read: The pros and cons of paying credit card bills through third-party mobile apps

I have multiple credit cards, but I do not use them. What should I do with them?

Close them soon. But repay pending dues, if any. “You must officially write a letter/mail to the bank, asking for the closure of the credit card account. Always communicate with the bank on its official email ID. Do not rely on phone communication or WhatsApp banking services,” says Ramachandra.

Make sure you get your bank’s confirmation in writing that your card is closed. To check if your card has indeed been closed, apply for a credit report after 45 days of closing your card. Your credit report ought to reflect this. If not, raise the issue with your card company.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!