Juzer Gabajiwala

Taxation plays a vital role in any investments as capital gains and interest earned on the investment are reduced to the extent of taxes paid. Ultimately, what matters to the investors is what is left in hand after taxes are paid.

It is, therefore, imperative for the investors to know about the impact of taxation on earnings from investments. Our current topic is on debt mutual funds and the taxation applicable to them.

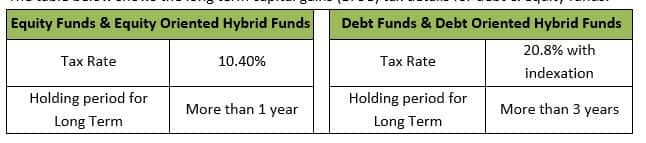

The capital gains tax to be paid on mutual funds depends on the type of investment (equity/debt) and the duration of time for which the investment is held.

The table below shows the long-term capital gains (LTCG) tax details for debt and equity funds:

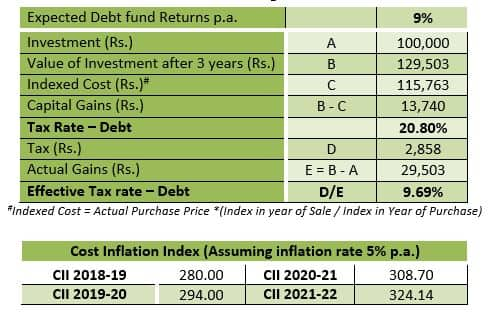

Assuming a debt fund generates a return of 9 percent per annum (pa) and the Cost Inflation Index (CII) is 5 percent pa, the effective tax will come to about 9.69 percent. The following table will illustrate the same:

Ideally, a debt fund can be compared to a fixed deposit or a bond which pays interest. Interest income from fixed deposits and taxable bonds is added to the individual’s total income and is taxed as per the tax slab applicable to the individual’s total income.

Another category of funds which used to be popular earlier were monthly income plans (MIPs). These funds were structured to have a small component of equity, of say between 10-20 percent and the balance would be debt. They lost their charm when dividend distribution tax (DDT) was introduced.

The introduction of DDT gave rise to equity savings funds, which have 35 percent exposure to arbitrage (classified as equity for taxation) and 30 percent to pure equity and 35 percent to debt. These funds became popular because of their taxation advantage.

However, in the recent budget with the introduction of taxation on equity-oriented funds, the equation has undergone a slight change. Though equity savings funds still retain the upper hand as the holding period for LTCG is one year, compared with three years for debt schemes, the 10 percent tax on LTCG from equity funds has reduced the tax disparity.

The indexation benefit available for long-term capital gains from MIP funds makes these schemes fairly tax-efficient. Indexation can significantly reduce the effective capital gains, reducing the tax liability for the investor.

Going ahead, for investors holding hybrid funds for the long term, there will not be much difference in the tax rate; what will matter is the allocation to equity and the holding period.

Impact of dividend distribution tax

Dividend distribution tax on debt mutual funds (including surcharge and cess) is at the rate of 29.12 percent for individuals and 34.94 percent for corporates. So, if the dividend is 7 percent, individuals will earn 4.96 percent net of tax. For corporates, the same will be 4.55 percent. Thus, investors should favour the growth option over the dividend option in debt oriented funds.

Thus, it is very important for investors to make the correct decision so as not to lose out on the returns due to taxation as this could otherwise reduce their post-tax returns substantially.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.