Juzer Gabajiwala

In the age of globalisation, we cannot be investing in isolation. With liberalisation of the economy, we have been experiencing a very high level of exposure to international products. We have now been aggressively using foreign products and services with ease. I-phones, Google, Facebook, Alibaba and Amazon, etc., are now household names. In the same manner as we are now getting accustomed to such products and services, it is time to look at investing in companies and economies outside India. This is the diversification that we often ignore – geographical diversification.

Geographical diversification is partly for pursuing growth (in a potentially high-growth market, for example) and partly for mitigating the risk of focusing in domestic markets alone.

Now, the question is how to go about it? Either you can invest on your own (RBI now permits Indian residents to invest up-to $250,000 per year) or a simpler option is to invest in mutual funds which invest in equity stocks or funds outside India.

International funds are those mutual fund schemes which invest in foreign markets. These funds can be of different types, like, country-specific international funds, commodity-based international funds or thematic funds. There are funds that invest in the US, Brazil, Europe or Asia. Some international funds are theme-based and invest in sectors such as consumption, energy, real estate and agriculture.

There are two main issues which need to be addressed apart from the regular equity market risks.

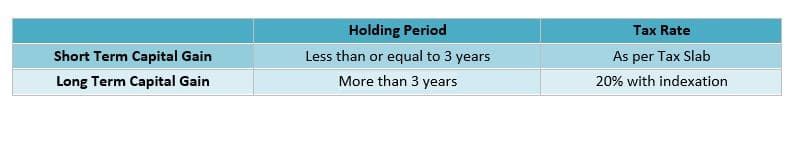

2. Taxation: Gains on international funds are taxed just like a debt fund. To qualify as an equity fund for tax purposes, a fund has to hold at least 65 percent in Indian equities. Since these funds invest in international stocks, they do not qualify as equity funds for tax purposes. Dividend Distribution Tax on International mutual funds is 25 percent tax + 12 percent surcharge + 4 percent cess.

More information about international funds can be found here

More information about international funds can be found here

The writer is director at Ventura Securities

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.