Krishna KarwaMoneycontrol Research

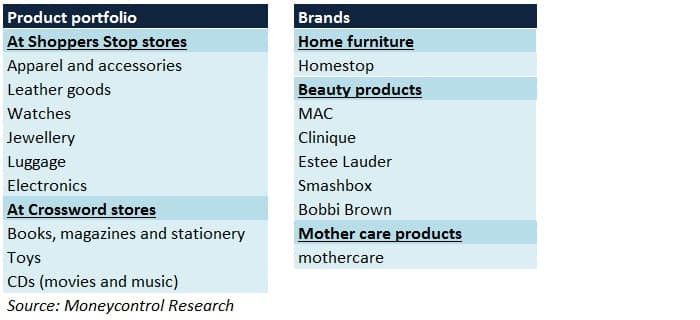

Shoppers Stop, a part of the K Raheja group, is amongst India’s largest retailers. The company operates 242 departmental stores (spanning 4.39 million square feet) in 38 cities across the country. Its ‘First Citizen Loyalty Programme’ covers nearly 55.36 lakh members.

Revenue drivers

By entering into a tie-up with Amazon, Shoppers Stop’s products, particularly private label ones, will gradually gain better visibility on the dedicated web pages of the e-commerce major. Given the importance of online platforms in Indian retail, this move should be a big advantage for Shoppers Stop.

5-6 large format stores are likely to be opened each year, primarily in the tier 2/3 regions of India, to capitalise on the low base vis-à-vis metros and tier 1 cities. Brand loyalty tends to be higher in such areas too. Capex of Rs 100-150 crore allocated for this purpose will be funded through internal accruals.

The share of ‘First Citizen Members Club’ sales to Shoppers Stop’s yearly sales has been on an uptrend in recent years. Keeping this in mind, the management will introduce new schemes at regular intervals in H2 FY19, when the festive and wedding season is at its peak.

A healthy uptick in demand has been visible in the home products segment. More stores are likely to be added on this front in due course.

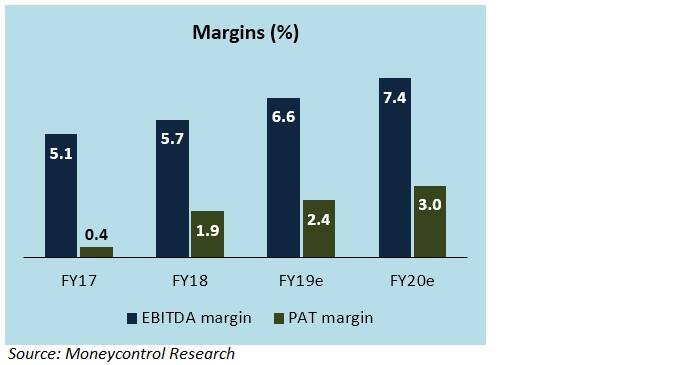

Margin drivers

In case of Shoppers Stop’s own brands, investments are being made to set up design studios and testing labs to achieve product differentiation, quality control and a better connect with present and prospective buyers. This will be crucial in doubling private label sales over the next 3 years from the current mark of 15 percent.

Since branded beauty products help Shoppers Stop derive good margins compared to apparel and accessories, the management aims to augment its existing 104-store network by adding 10-12 outlets in the near-term.

To diversify risks associated with a high degree of dependence on clothing products, impetus is being laid on boosting the contribution of non-apparel products (home furniture, footwear, watches, jewellery, electronics, personal accessories, luggage) to total revenue from 30-35 percent at present.

Shoppers Stop’s long-term debt is likely to be repaid in entirety by FY19-end. Proceeds from the sale of the erstwhile ‘Hypercity’ outlets to Future Retail and amount received from Amazon on stake sale will be used for this purpose.

Outlook and valuation

Shoppers Stop, by virtue of its brand recognition across a wide product portfolio, has the potential to attract high footfalls. Tweaks in the revenue mix in favour of premium lifestyle products, coupled with improving cash flows, should augur well for the company’s earnings.

However, problems associated with sluggish same-store sales growth continue to remain a bottleneck. In the beauty products space, marketing spends are expected to be on the higher side in initial years and could limit margin accretion.

While women’s ethnic wear sales have been witnessing strong traction of late, the men’s formal wear segment has been fairly sluggish. Furthermore, it remains to be seen as to how extended discount periods impact product realisations, considering the stiff competitive intensity in the retail industry.

Barring the recently observed corrections, Shoppers Stop, more often than not, had a good run at the bourses since September last year. The rally, particularly on the back of 2 instances (sale of Hypercity to Future Retail, a tie-up with Amazon), caused the stock to re-rate sharply and make it one of the best performers in the retail space in terms of price returns.

At 31.7 times its 2-year forward earnings, Shoppers Stop, despite being optically expensive, is only 4.6 percent up from its 52-week low. This suggests that most of the optimism associated with the 2 big deals stated above, that has been factored in the stock’s price for a long time, has now been taken off. We advise investors to take advantage of this weakness.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!