Neha Dave

Moneycontrol Research

Next week, the Maharashtra government will file its response in the High Court on the matter of allowing outside food in multiplexes in Maharashtra.

Share prices of multiplex companies, PVR and INOX Leisure, fell sharply last week even though the court has yet to give a verdict in the case. That is because the food supply minister has already said that his ministry was in favour of movie goers carrying their own food. While the matter is sub judice, we try to assess the potential financial impact of the ruling on the listed multiplex operators.

Some background

The minister’s comments comes in the wake of a public interest litigation (PIL) filed in the Bombay High Court (HC) challenging the current practice wherein multiplexes prohibit customers bringing in and consuming food and beverages (F&B) from outside sources within their properties. In January this year, the HC had directed the Maharashtra Government to file a response. After having sought extensions, the government is now expected to file its response on July 25 in the High Court.

Why the ban on outside food into multiplexes matter?

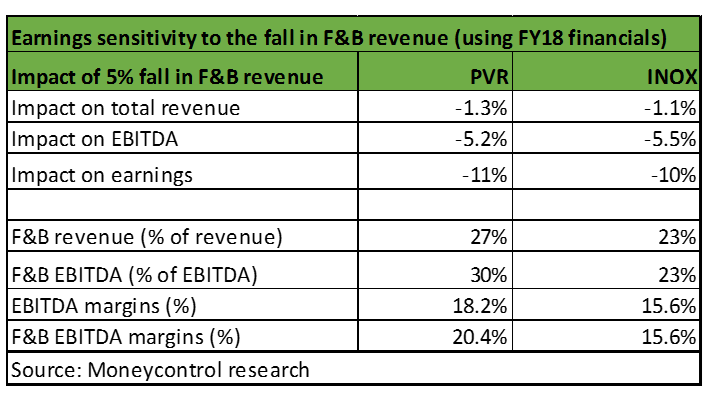

F&B contribute a big share to the revenues and profits of theatre operators. The share of F&B in PVR’s overall revenue stood at 27 percent and for Inox it was 23 percent in FY18.

F&B is also the second-fastest growing revenue stream after advertising, at 10 percent year-on-year (YoY) for PVR and 7.7 percent YoY for Inox. Most importantly, F&B is a high margin business for the cinema operators. In fact, PVR’ gross margin of 72 percent and Inox’s 76 percent in F&B business is broadly in line with some of the well-operated QSRs (quick service restaurant).

The growth in F&B revenue was due to increasing average spend per head (SPH). Despite increasing over a period of time, F&B spend per head as a percent of average ticket price at 35-45 percent, is still low compared to global players in the US and Canada. Sensing this opportunity and huge growth potential, multiplexes have been trying to grow their F&B offerings by experimenting with cuisines and products.

Hence, the move of allowing outside food, if implemented, could severely hit the earnings of cinema theatre operators.

Potential impact on earnings in case outside food is allowed

We have roughly calculated the likely impact on PVR’s and INOX’s financials due to the possible fall in F&B revenue if the court rules in favour of allowing outside food. We estimate a 11 percent decline in PVR’s profit, if there is a 20 percent fall in F&B revenue in Maharashtra, which is equivalent to 5 percent of overall revenue.

The estimates are based on certain assumptions, the most important one being ceteris paribus i.e. all other things being the same. So, we have assumed no hike in ticket prices. Note that the potential price hikes may adversely impact occupancy as well.

Other assumptions are non-strategy related. For instance, we assumed Maharashtra contributes 25 percent to total F&B revenue (equivalent to its share in total screens). As on March 31, 2018, PVR had 157 screens (25 percent of total screens) in Maharashtra and Inox had 122 screens. For now, the case is restricted to Maharashtra. However, if the court order allows movie goers to carry their food, it would set a precedent for other states. In such a scenario, the F&B business in multiplexes elsewhere could also be hit and can severely impact profitability.

Potential impact on the business valuationThe incidental impact of the ruling in favour of allowing outside food can be much bigger and impact business valuation.

There is inherent volatility in the film exhibition business. First, given the high fixed costs, profitability of multiplex players depends largely on audience numbers, which in turn depends on the success of the films. Second, regulatory risk can also be a key concern. For instance, the state government can exercise its power to cap ticket prices. Third, multiplex operators face still competition from online video streaming companies like Netflix and Amazon’s Prime Video, which are fast growing in popularity

With their affordability, convenience and sheer number of options, online streaming players are threatening to disrupt the multiplex business model. While that could still be some time away, Netflix and Amazon can change the way patrons watch the movies over a period of time.

Despite multiple headwinds to business, multiplex operators are trading at rich valuations. For instance, PVR is trading at 44 times FY18 price to earnings multiple (P/E) and 16 times FY18 enterprise value to earnings before interest, tax, depreciation and amortisation (EV/EBITDA). The high valuation can be partly attributed to the fact that almost one fourth of multiplex operator’s revenue is contributed by F&B. So, though not as expensive as QSR (Jubilant FoodWorks trades at FY18 P/E of 99 times), multiplex operators do enjoy high valuation as the street implicitly assigns reasonable value to the high margin F&B business.

Hence, the current developments on F&B front can hurt earnings and thereby the high valuations of multiplex operators. In the short term, these stocks can be volatile and we advise investors to stay cautious till the picture becomes clearer.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.