The multi-cap category generated maximum wealth for the ultra-rich in 2019, data from PMSBazaar.com showed.

Even though small & midcap indices recorded double-digit fall from their respective record highs, select quality names created wealth also, suggest experts.

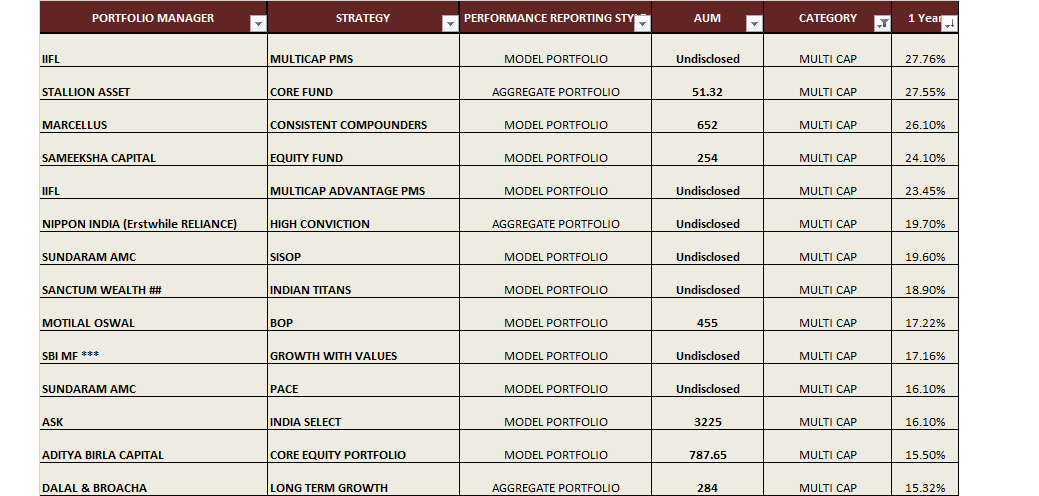

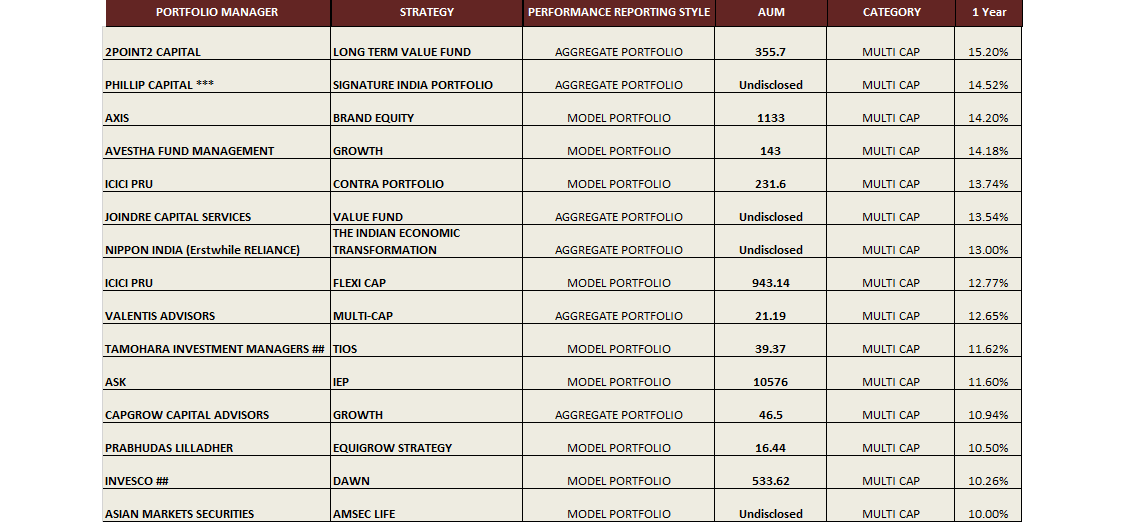

Data for PMS schemes for the period December 1, 2018 to November 30, 2019, highlighted that the multi-cap category was a winner.

As many as 30 out of 55 schemes covered by PMSBazaar.com under the multi-cap category gained 10-27 percent in the 1-year period, data showed.

Portfolio Management Services cater to wealthy investors. The minimum ticket size of these schemes was raised from Rs 25 lakh to Rs 50 lakh recently by SEBI. The professional fee charged by them is slightly higher than regular mutual funds (MFs).

A multi-cap category funds are more diversified and include stocks from various market-cap baskets. A typical multi-cap portfolio comprises of stocks from largecap, midcap, and smallcap space.

IIFL Multicap PMS scheme generated maximum wealth or return for ultra-rich in 2019. It recorded 27.76 percent return under the 1-year category, which exceeds returns across all categories, data from PMSBazaar.com showed.

IIFL Multicap Portfolio comprises of just 15-20 high-quality companies which are business leaders, have strong management, low leverage, and offer a large margin of safety.

Other schemes that delivered more than 10 percent returns include Stallion Asset’s Core Fund Strategy which gave 27.55 percent returns, Marcellus Consistent Compounders have 26 percent returns in the 1-Year period.

After a strong correction seen in the small & midcap space, experts are of the view that the froth in the broader market space has cleared, and investors could actually look at investing in these funds or stocks.

“Improving earnings and the sharp price correction in mid-caps over the past couple of years have compressed mid cap valuation multiples and brought them in line with large caps. However, earnings revisions data remains dismal for mid-caps,” Sanctum Wealth Management said in a report.

In the last three months, the broader markets showed signs of improvement and have gained in the range of 9-12 percent. Since market is trading near record high, investors are moving towards stocks with high growth potential.

“Currently, the focus is largely on the index heavyweights but we’re seeing select pockets from the broader front also attracting buying interest. Further, many stocks have shown signs of improvement in its financials in Q2FY20 earnings and provide valuation comfort as compared to its largecap peers,” Ajit Mishra, Vice President,Research,Religare Broking told Moneycontrol.

“Hence investors having a horizon of more than 2-3 years can start investing in quality mid and smallcap with a good promoter track record, low leverage as well as healthy growth prospects,” he said.

Going ahead, earnings revival and growth forecast could further accelerate the recovery in the broader market. But, one should strictly avoid stocks, which have run into trouble owing to mounting debt, promoters’ pledge etc., suggest experts.

“The broader market started to outperform due to buying in some beaten-down financial stocks because there are many signs that worst is over for the NBFC sector and the government has a continuous focus on infra and real estate sector,” Amit Gupta, Co-Founder, and CEO, TradingBells told Moneycontrol.

“There is a need for some growth signs for overall small and midcap space to outperform because growth is main factor for broader market while large-cap stocks may continue to do well because of global liquidity,” he said.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.