The multiple ascribed to Nifty depends on earnings growth, the sentiment, money flows, and interest rates prevalent in India and abroad for the year. As things stand now, we are ascribing multiple of 20 to that earnings at the base case, VK Sharma, Head – PCG & Capital Market Strategy, HDFC Securities, said in an interview with Moneycontrol’s Sunil Matkar.

Edited excerpt:

The market rallied more than 15 percent in 2019 given the government measures to boost the economy and positive global cues. Do you expect the momentum to continue in 2020?

Nifty Companies are likely to earn Rs 697 per share on the aggregate in FY21. As we progress towards the next year, it will be clearer whether Nifty companies are able to grow their earnings at that fast clip. The multiple ascribed to Nifty depends on earnings growth, the sentiment, money flows, and interest rates prevalent in India and abroad for the year.

As things stand now, we are ascribing multiple of 20 to that earnings at the base case. This means we are looking at the Nifty levels of 13243 in FY21. This means Nifty has potential to rise to 14 percent next year over and above 12 percent return in 2019. Nifty midcap -5% and Nifty small cap -12% returned this year. We are betting on mid cap and small cap stocks to outperform next year.

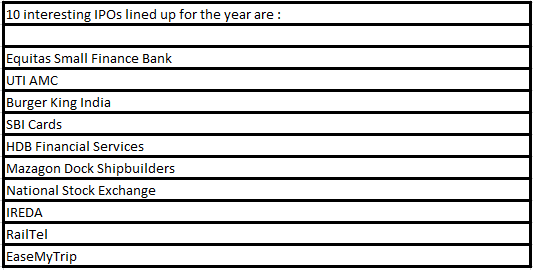

Q: The primary market saw fewer IPOs in 2019 than 2018 and half of them gave double-digit returns. What are your thoughts on the primary market for 2020, do you see more IPOs in 2020 than 2019 and what are those expected IPOs in coming year?

Yes, we see a substantially higher number of IPOs in 2020 compared to 2019.

Q: Five stocks which you feel could return more than 50 percent in 2020.

A: We like corporate 4 facing banks

Worst long behind (in terms of asset quality) and strategic growth plans from new management gives confidence to us on Axis Bank’s future. Key positives like high CASA ratio, wide distribution network, franchise value and the high and growing share of retail loans support our bullish view on the stock. We have an estimated 15% CAGR in NII, 48% in Net Profit and 15.7% in Loan Book over FY19 to FY22E.

With lower incremental slippages, improving loan growth, superior liability franchise and revival in core operating profit, we believe ICICI Bank is well-positioned to tap the strong growth opportunities available in the banking space. Limited exposure to known stressed names gives us some comfort and we believe the worst in terms of asset quality is long past.

APL Apollo Tubes is the largest producer of ERW steel pipes and Sections in India. The ERW market is expected to grow around ~10-12% CAGR every year. Company has a diversified product portfolio in structural steel sector an recent acquisition of Apollo Tricoat will enable company to expand its portfolio in the high margin segment. Revenue/EBITDA/PAT is expected to grow at CAGR of ~18.5/31/57% respectively. The stock is available at lucrative valuations of ~11x FY21E earnings.

Q: What are major events to look at in 2020?

•Change in Interest rate cycle amid higher food inflation

•US elections (November 03) and Trump Impeachment proceedings

•Global trade protectionism tendencies

•Rising global Debt is a major cause of concern.

• Fiscal slippages, Slower growth in India

Q: Most experts believe the broader markets (midcap and smallcaps) will gain strength and outperform frontliners in 2020. What are your thoughts?

A: SEBI’s circular on categorization and rationalization of mutual fund schemes led to cash inflows into several small-cap funds drying up is also one of the reason for their underperformance.

Nifty Midcap 100 and Nifty Small cap 100 continued its downward journey for the second year on the trot by falling by 6% and 12% respectively. Before this, since their launch in 2005 and 2004 respectively, they have never given negative return for the two consecutive years. From the Launch date of July 2005, Nifty Midcap 100 Index has given CAGR Return of 18% while Nifty Smallcap Index has given CAGR Return of 12% since its launch date of January 2004.

As we expect earnings growth to improve for next 2 years on the back of various measures taken by Govt for economy, we believe that Nifty mid & small caps which have grossly underperformed can do well for this year. First sign of that is already visible where on BSE monthly advance decline ratio is above one for last four months. This is something which has happened only after December 2017.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.