Most tyre stocks have witnessed a strong recovery in the wake of the COVID-19 pandemic and brokerages still see some steam left for select players in the space.

Brokerages point out that the domestic tyre industry has witnessed strong recovery after the lockdown was eased which was reflected in their September quarter numbers.

In Q2 FY21, all the tyre companies registered strong EBITDA margins due to cost-cutting, scale benefits and lower commodity and raw material prices.

Analysts expect tyre industry to maintain the growth momentum owing to an improved outlook for the auto sector, strong rural demand and increasing personal mobility trend.

Robust replacement demand, improving demand from OEM segment and favourable policy initiatives are expected to augur well for the tyre industry as well.

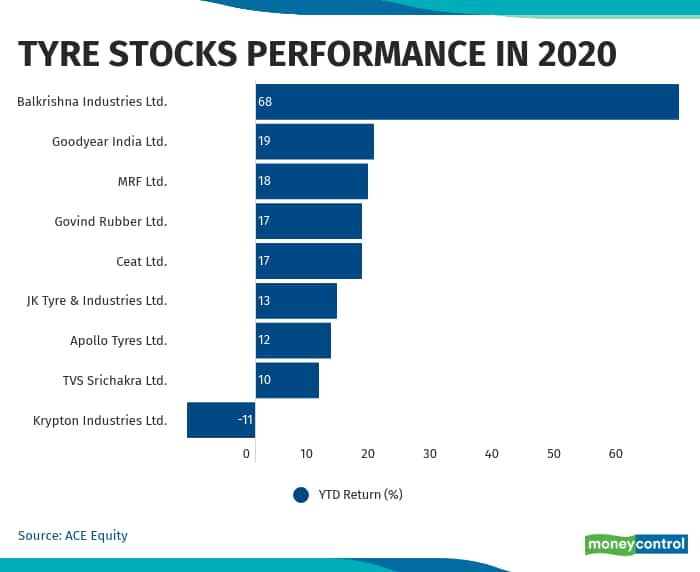

Year-to-date, shares of most tyre manufactures have logged healthy gains. Data available with Ace Equity shows shares of Balkrishna Industries, Goodyear India, MRF, CEAT and Apollo Tyres have risen in double-digits year-to-date.

On a smooth track

Amarjeet Maurya, AVP, Mid-Caps, Angel Broking, is positive on the sector.

"Demand is improving gradually in the tyre sector on the back of healthy growth in the replacement market and gradual recovery in the OEM segment month on month. Government restrictions on tyre import would support growth in Indian tyre sectors," Maurya said.

"Management of companies are also optimistic on volume growth going ahead. We are positive about the sector. In space, we like stock CEAT and MRF."

Ajit Mishra, VP Research, Religare Broking believes the tyre industry will see growth in sync with the auto sector.

"Similar to the auto pack, the tyre sector is also expected to witness healthy recovery led by a revival in demand from OEMs. The replacement demand is also expected to improve as easing restriction has helped economic activity to return to normal," Mishra said.

"We remain constructive on the sector. However, given the sharp run-up, we would recommend accumulating Apollo Tyres, MRF and CEAT gradually on dips," he said.

Tyre sector is one of the most unpredictable and volatile sectors and a lot will depend on the commodity prices. It depends on anti-dumping duty and raw-material prices while industrialisation and economic growth help the sector flourish.

Shrikant Chouhan, Executive Vice President, Equity Technical Research at Kotak Securities points out that during the period of COVID-19, the support of stimulus packages helped the sector substantially.

"We feel, a sudden rise in the demand of vehicles from the emerging countries would help the sector to perform better than ever before," he said.

Chouhan is positive on Balkrishna Industries from the sector.

"It is forming rising top rising bottom series on a monthly and weekly basis after completing the erratic corrective pattern between Rs 1,400 and Rs 700 levels. It is in a trending wave that could lift the stock to the levels of Rs 2,000 or Rs 2,200 in the next 3 to 6 months. It would change the trend if it closes below the level of Rs 1,400," he said.

MRF is his second preferred pick. "Technically, this stock is on the verge of completing the corrective pattern," he said.

"Since April 2018, the stock had been in time and price-based correction. If the stock doesn’t give any bonus or split then it would be the first stock to trade above the level of lakh. A monthly close above the level of Rs 81,500 would lift the stock to Rs 1,10,000. Be a buyer in the stock at every major dip with a final stop loss at Rs 74,000," he said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.