Bulls have held tight control over Dalal Street for the last four days, especially ahead of the Union Budget scheduled for February 1. The Nifty 50 recorded more than a 1.1% gain on January 31, making a healthy start to the February series. The market breadth also remained positive, with 1,931 shares gaining against 622 declining shares on the NSE. The market is expected to take a cue from the budget for further direction, while volatility may remain on the higher side. Below are some trading ideas for the near term:

Sudeep Shah, Deputy Vice President and Head of Technical and Derivative Research at SBI SecuritiesBharat Electronics | CMP: Rs 292.65

Bharat Electronics gave a neckline breakout of the Adam & Adam Double Bottom pattern on a daily scale. This breakout was accompanied by substantial trading volume—nearly three times the 50-day average volume—indicating strong buying interest from market participants. The 50-day average volume stood at 179 lakh shares, while on Friday, the stock recorded an impressive total volume of 502 lakh.

Currently, the stock is trading above its short and long-term moving averages. Further, all momentum-based indicators and oscillators suggest strong bullish momentum. Hence, we recommend accumulating in the zone of Rs 293-290, with a stop-loss at Rs 270. As per the measure rule of the Double Bottom pattern, the upside target is placed at Rs 325.

Strategy: Buy

Target: Rs 325

Stop-Loss: Rs 270

Rail Vikas Nigam | CMP: Rs 476.3

Rail Vikas Nigam has given a breakout above a downward-sloping trendline on a daily scale. This breakout is confirmed by robust volume. In addition, the stock has formed a sizeable bullish candle on the breakout day, which adds strength to the breakout. Currently, the stock is trading above its short and long-term moving averages, which are in a rising trajectory. The daily RSI (Relative Strength Index) has given a breakout from a falling channel, indicating strong bullish momentum. Hence, we recommend accumulating in the zone of Rs 480-475, with a stop-loss at Rs 440. On the upside, it is likely to test the level of Rs 550 in the short term.

Strategy: Buy

Target: Rs 550

Stop-Loss: Rs 440

UltraTech Cement | CMP: Rs 11,487.85

UltraTech Cement has formed a strong base near the prior swing low and subsequently witnessed a strong rebound. Currently, it is trading above its crucial moving averages. Notably, the ratio chart of the stock compared to the Nifty has recently given a consolidation breakout, which suggests strong outperformance. The weekly RSI has given a bullish crossover, indicating limited downside for now. Hence, we recommend accumulating in the zone of Rs 11,500-11,400, with a stop-loss at Rs 10,650. On the upside, it is likely to test the level of Rs 13,050 in the short term.

Strategy: Buy

Target: Rs 13,050

Stop-Loss: Rs 10,650

Riyank Arora, Technical Analyst at Mehta EquitiesUPL | CMP: Rs 603.75

With the agricultural theme in focus, UPL has broken out of its ascending triangle pattern on the weekly charts, accompanied by a good spike in volumes. The stock is also seen breaking above the crucial resistance mark of Rs 600. The overall strong technical structure makes the stock a good buy, with a strict stop-loss placed at Rs 575 for potential upside targets of Rs 650 and above.

Strategy: Buy

Target: Rs 650

Stop-Loss: Rs 575

BEML | CMP: Rs 3,844.7

BEML has given a strong breakout above its swing high resistance mark of Rs 3,823 and managed to close well above the same. With volumes spiking and the RSI (14) crossing the 50 mark, momentum looks to be at its peak, and the stock is set for an upside move towards Rs 4,190 and above. A strict stop-loss should be kept at Rs 3,750 to manage risk on this trade. With the railway and defence sectors in focus, BEML makes a good buy at CMP.

Strategy: Buy

Target: Rs 4,190

Stop-Loss: Rs 3,750

Om Mehra, Technical Analyst at Samco SecuritiesNTPC | CMP: Rs 324

NTPC has been steadily consolidating, showing resilience near Rs 330 while maintaining strong support at Rs 315. It is poised for a breakout, with a push above Rs 332 likely to fuel fresh upside momentum. In its recent consolidation, the overall trend remains constructive. A sustained move above its 20-day moving average could attract fresh buying interest, strengthening the bullish outlook.

The RSI is gradually improving, indicating bullish momentum buildup. If volumes pick up, NTPC could witness a strong rally in the coming sessions. The broader market sentiment and the budget announcement will play a crucial role in sustaining the uptrend. Hence, one can initiate a long position at CMP (current market price) for a target price of Rs 350, with a stop-loss at Rs 310.

Strategy: Buy

Target: Rs 350

Stop-Loss: Rs 310

IRCTC | CMP: Rs 822.3

Indian Railway Catering & Tourism Corporation (IRCTC) has exhibited a double-bottom pattern and a strong breakout, surpassing its falling trendline resistance and rising 5.6% on Friday. This move was accompanied by increased volumes, signaling robust buying interest. The stock also crossed its previous swing high of Rs 800, reinforcing bullish momentum. The RSI is comfortably above 60, indicating strengthening momentum.

However, minor resistance remains at Rs 850, which could act as a near-term hurdle. On the downside, Rs 790 serves as an immediate support level. With the railway sector showing strong bullish momentum, the stock remains poised for further gains. Hence, one can initiate a long position at CMP for a target price of Rs 900, with a stop-loss at Rs 778.

Strategy: Buy

Target: Rs 900

Stop-Loss: Rs 778

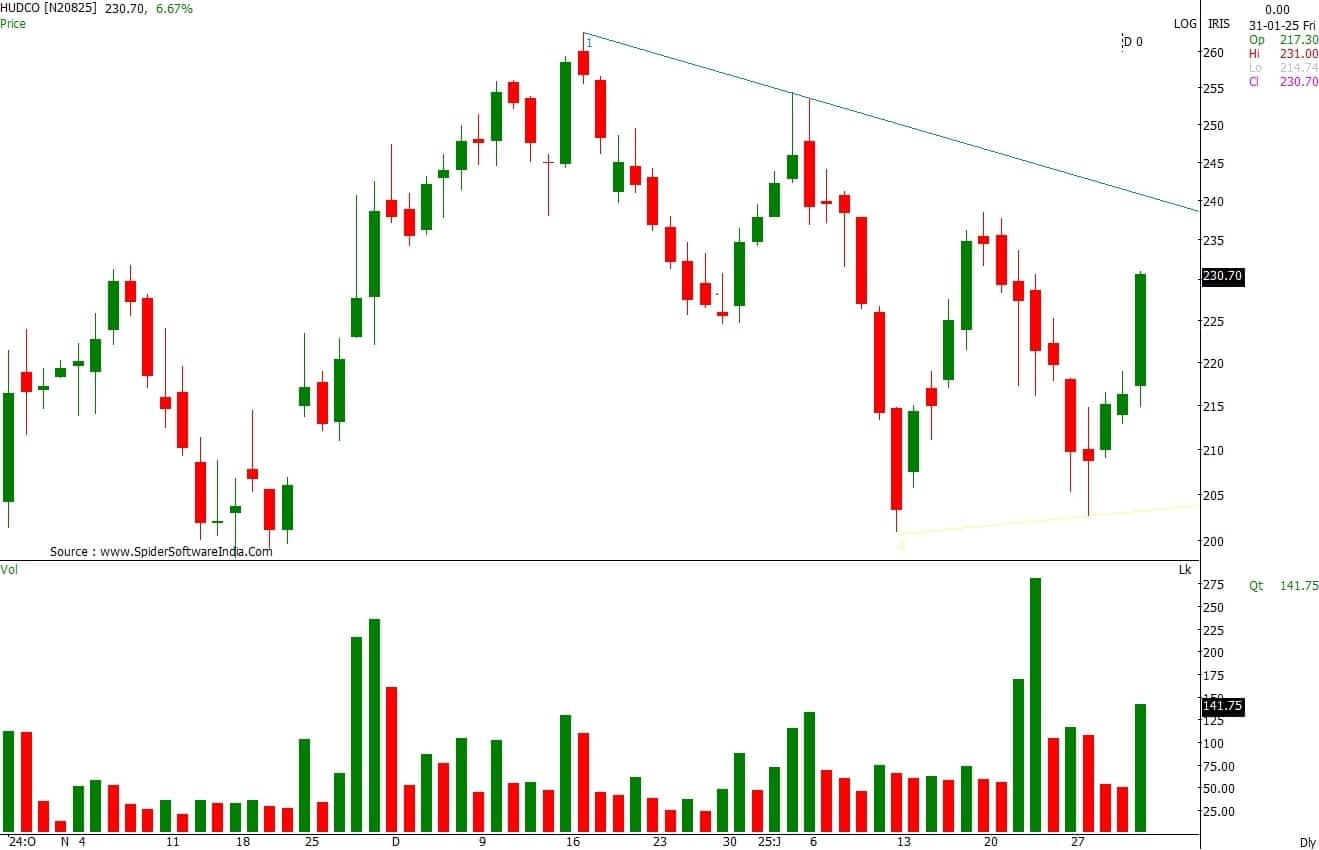

HUDCO | CMP: Rs 229.7

Housing & Urban Development Corporation (HUDCO) has shown a remarkable recovery from its lower levels. It has crossed above its 20 DMA, signaling a shift in sentiment toward the upside. The short-term resistance is at Rs 235, and a breakout above this level could lead to further gains. The stock is showing strength after forming a double-bottom pattern. On the downside, Rs 220 serves as a critical support level, maintaining the bullish structure as long as it holds. The recent surge in delivery volumes reflects strong participation from bulls. Hence, one can initiate a long position at CMP for a target price of Rs 252, with a stop-loss at Rs 218.

Strategy: Buy

Target: Rs 252

Stop-Loss: Rs 218

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.