Bears maintained control over Dalal Street for the fourth consecutive session, dragging the Nifty 50 down by 0.8 percent on February 10, with market breadth favouring the bears. About 2,149 shares saw a correction compared to 471 shares that gained on the NSE. The market may attempt a rebound after the four-day loss, but sustainability will be key. Below are some trading ideas for the near term:

Jigar S Patel, Senior Manager - Equity Research at Anand Rathi

Tata Steel | CMP: Rs 134

Tata Steel has found strong support at the 200-week EMA, reinforcing a potential reversal. This support coincides with multiple technical factors, making it a high-probability zone for a rebound. Firstly, the price is retesting its previous breakout zone, a key level where demand could emerge. Additionally, it aligns with the S3 yearly Camarilla support, which often acts as a strong floor for price action.

The bullish BAT reversal zone further indicates a potential bounce based on harmonic analysis. Moreover, the stock has retraced between the 0.618% and 0.50% of its entire upward move from June 2022 to June 2024, a classic Fibonacci retracement level where reversals commonly occur. Given these technical factors, traders may consider entering long positions in the Rs 133-135 zone, with an upside target of Rs 145.

Strategy: Buy

Target: Rs 145

Stop-Loss: Rs 128

Tanla Platforms | CMP: Rs 554.85

Tanla Platforms has recently completed a two-year-old bullish Bat pattern, which began in March 2023 and concluded in January 2025. Since the pattern developed over an extended period, we anticipate a sharp reversal in the stock. Additionally, the S2 and S3 yearly Camarilla supports align with the reversal zone, further strengthening the bullish case. This confluence of technical factors makes the stock an attractive buy. Traders may consider entering long positions in the Rs 540-560 zone, with an upside target around Rs 675.

Strategy: Buy

Target: Rs 675

Stop-Loss: Rs 490

SAIL | CMP: Rs 105.18

Steel Authority of India (SAIL) has undergone a significant correction, retracing 0.618% of its upward move from June 2022 to May 2024. Since May 2024, the stock has been forming a lower lows and lower highs structure on the daily chart, leading to a sharp 74-point correction, equivalent to a 43% decline. However, a double-bottom formation has recently emerged near the 0.618% retracement level, which also aligns with a previous breakout zone, adding strength to this support. This confluence of factors makes SAIL an attractive buying opportunity. Traders may consider entering long positions in the Rs 105-106 zone, with an upside target around Rs 115.

Strategy: Buy

Target: Rs 115

Stop-Loss: Rs 100

Jay Thakkar, Vice President & Head of Derivatives and Quant Research at ICICI Securities

Kotak Mahindra Bank Futures | CMP: Rs 1,966.8

Kotak Mahindra Bank has provided a breakout from the sideways consolidation, and with that, the stock is witnessing an increase in open interest (OI), indicating a long buildup after a long time. So far, the stock has witnessed upward momentum from the lows of Rs 1,600 on the basis of short covering, and now, after a long time, it is witnessing some long buildup, which is a positive sign going forward.

The stock is trading well above its maximum pain, modified maximum pain, as well as its 30-day VWAP (volume-weighted average price) levels of Rs 1,920, Rs 1,919, and Rs 1,865, respectively, so these levels will act as crucial support for the stock going forward. On the upside, there is near-term resistance at the Rs 2,000 strike, as it has the highest call base, whereas the Rs 1,900 strike has the highest put base, so the short-term range is Rs 1,900 to Rs 2,000, and the trend is up, so a trend continuation is likely on the upside.

Strategy: Buy

Target: Rs 2,060, Rs 2,100

Stop-Loss: Rs 1,920

Chambal Fertilisers and Chemicals Futures | CMP: Rs 548.65

Chambal Fertilisers has provided a breakout from a sideways consolidation, and with that, the OI has also increased, indicating a long buildup in the stock. The correction in the stock, which started in mid-2024 until the recent breakout, was on account of long unwinding, and hence the stock was stuck within a range of Rs 570 to Rs 450. Now, the stock has broken out of this range with an early sign of long buildup, so there is a higher probability of an upward trend in the short to medium term.

Now, on the lower side, Rs 530 to Rs 510 is a very crucial support range, which is well supported by the options data as well, wherein there are good Put additions from Rs 540 to Rs 500 strikes. On the upside, the Rs 560 strike has the highest Call base on an immediate basis, and above that, it will lead to a further trend toward Rs 600 levels. So, the risk-reward ratio is well in favour of the bulls. The stock is trading well above its maximum pain, modified maximum pain, as well as its 30-day VWAP, i.e., Rs 540, Rs 546, and Rs 506 levels, respectively, and these will act as crucial support going forward.

Strategy: Buy

Target: Rs 575 and 590

Stop-Loss: Rs 528

Hero MotoCorp Futures | CMP: Rs 4215.55

Hero MotoCorp has witnessed some short covering before the budget, as well as on the day of the budget. The OI in futures had reached its lifetime highs, indicating that huge short positions had been built in the stock. In fact, the entire two-wheeler pack witnessed a similar trend in futures. Post-budget day, there has been again some short buildup; however, the stock is managing to hold on to its recent lows, and it is now back at its 30-day VWAP level of Rs 4,192, which is a good short-term support. Below the VWAP, there is another critical support at Rs 4,100, whereas the highest put base is at Rs 4,200, which is the immediate support.

On the upside, there is aggressive Call writing from the Rs 4,300 strike until the Rs 4,500 strike, indicating that the bears have an upper hand. The stock is also trading below its maximum pain and modified maximum pain levels of Rs 4,250 and Rs 4,293, which will act as resistance. Despite that, based on the short covering that has started from the lows of Rs 3,997, it seems there is a high chance of the stock providing one more bounce on the upside, unless it holds the recent lows.

Strategy: Buy

Target: Rs 4,450, Rs 4,600

Stop-Loss: Rs 4,100

Anshul Jain, Head of Research at Lakshmishree Investments

L&T Technology Services | CMP: Rs 5,507.25

L&T Technology Services (LTTS) has successfully retested the 55-day Cup and Handle pattern at Rs 5,500, with volumes surging before the breakout and drying up on the retest—a strong bullish signal. A follow-through move above Rs 5,530 could trigger fresh buying interest, setting the stage for an immediate rally toward Rs 5,800. The stock’s price structure and volume dynamics indicate growing momentum, making it an attractive setup for traders. As long as support holds, LTTS remains in a prime position for a strong upside move in the near term. Keep an eye on key levels for confirmation.

Strategy: Buy

Target: Rs 5,800

Stop-Loss: Rs 5,450

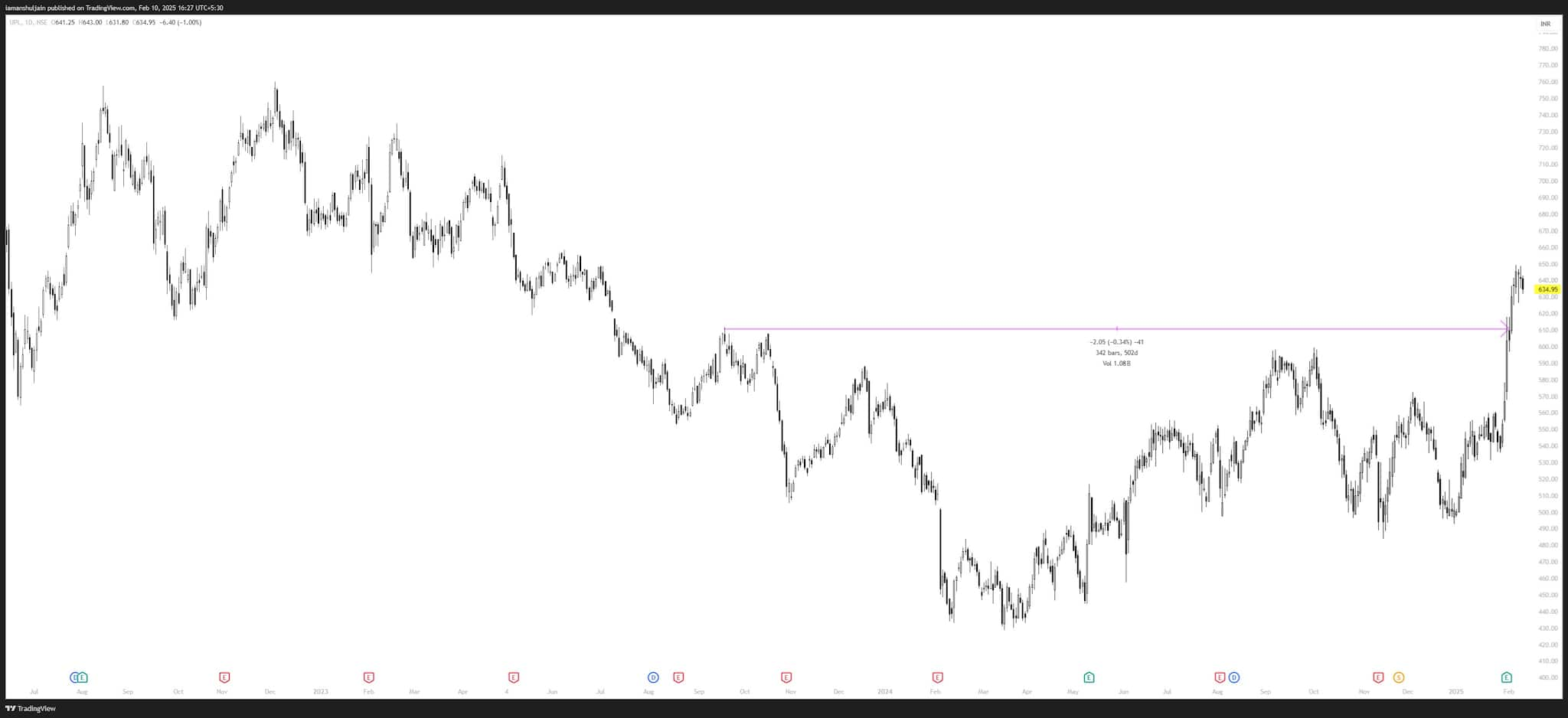

UPL | CMP: Rs 635

After a 342-day Volatility Contraction Pattern (VCP) breakout, UPL witnessed a strong momentum surge. Currently, the stock is consolidating in a pennant-like formation with falling volumes, indicating a healthy pause before the next move. The presence of five tight closes reflects increasing compression, a classic sign of accumulation. This tightening range suggests an impending expansion, which could propel UPL toward Rs 720 in the near term. A decisive breakout from this pattern could trigger fresh buying interest, making it an attractive opportunity for momentum traders. Watch for volume expansion and price confirmation for the next leg higher.

Strategy: Buy

Target: Rs 720

Stop-Loss: Rs 620

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.