The market experienced selling pressure on December 30, declining by seven-tenths of a percent, following nearly a percent gain last week. The market breadth was negative, with 1,793 shares declining compared to 761 shares advancing on the NSE. Benchmark indices are expected to remain under bearish control as long as they trade below all key moving averages. Below are some trading ideas for the near term:

Jigar S Patel, Senior Manager - Equity Research at Anand Rathi

Escorts Kubota | CMP: Rs 3,266

Escorts has seen a 30% correction from its peak and is now finding support near its previous breakout zone, aligning with the 12-month Market Profile from January 2024 to date, as depicted in the chart. On the daily chart, a Bullish Crab pattern has emerged, reinforcing the potential for bullish momentum. Traders can consider initiating long positions above Rs 3,250, targeting an upside move toward Rs 3,575.

Strategy: Buy

Target: Rs 3,575

Stop-Loss: Rs 3,090

Indian Renewable Energy Development Agency | CMP: Rs 218.47

IREDA recently broke above the Rs 214 resistance level with strong volume, aligning with the VWAP (Volume Weighted Average Price) resistance visible on the chart. On the daily timeframe, a triple-bottom pattern is evident in the Rs 185–200 zone, accompanied by a bullish divergence, signaling potential upside momentum. This breakout suggests renewed strength in the stock. Traders can consider entering long positions above Rs 215, targeting a move toward Rs 255.

Strategy: Buy

Target: Rs 255

Stop-Loss: Rs 195

Hindustan Unilever | CMP: Rs 2,343.5

Hindustan Unilever has undergone a steep correction of 22% from its peak of Rs 3,000 and is now approaching a crucial support zone near its previous breakout level. This support aligns with the 6-month Market Profile from July 2024 to date, reinforcing its significance. Additionally, multiple Doji candlesticks have formed around the Rs 2,300 mark, accompanied by a daily RSI bullish divergence, indicating a potential reversal. Traders may consider initiating long positions above Rs 2,330, with an upside target of Rs 2,550.

Strategy: Buy

Target: Rs 2,550

Stop-Loss: Rs 2,250

Anshul Jain, Head of Research at Lakshmishree Investments

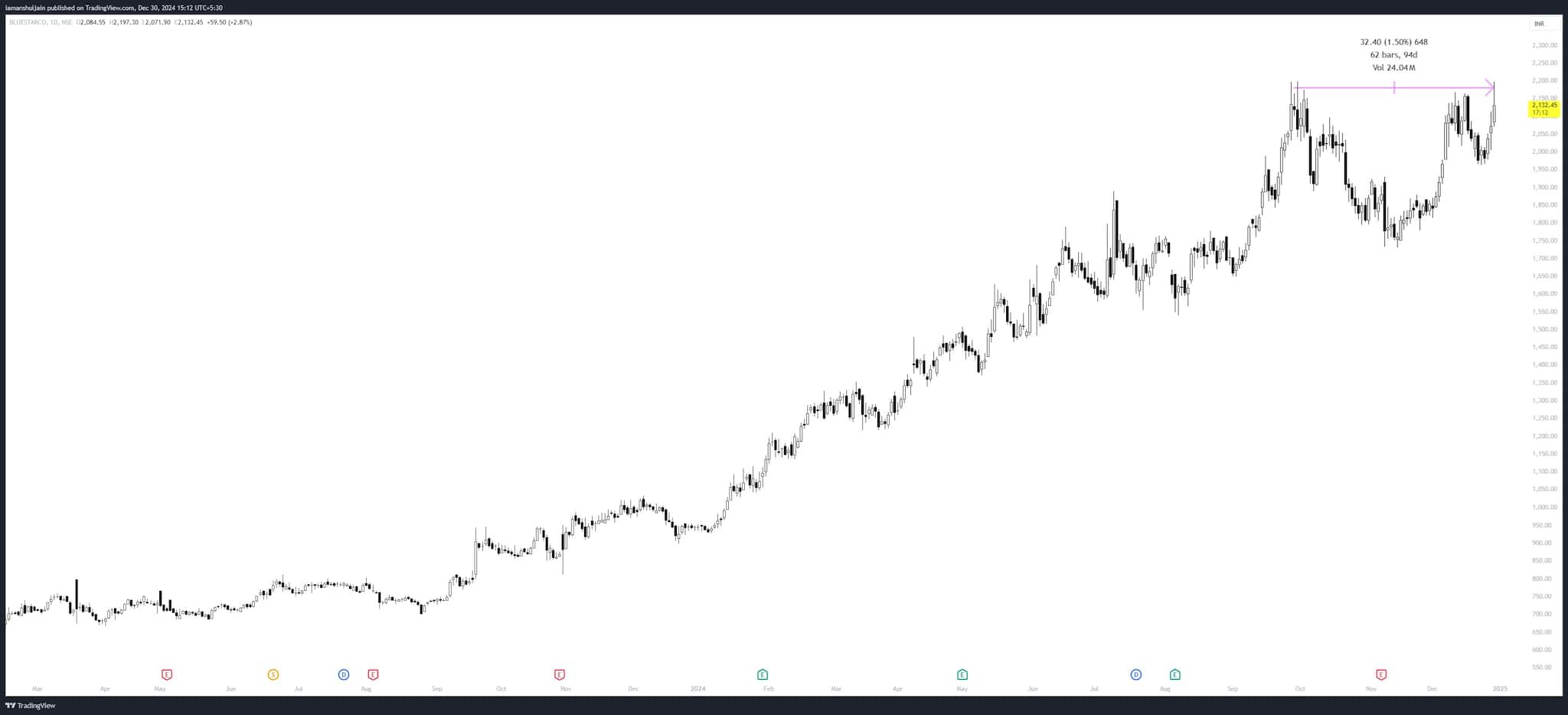

Blue Star | CMP: Rs 2,130.35

Blue Star is on the verge of breaking out after forming a 63-day Cup-and-Handle pattern on daily charts. Monday’s trading volume surged to three times the 50-day average, signaling strong momentum. Institutional accumulation is evident, with low volumes on down days and higher volumes on up days throughout the base. Investors should watch closely as this technical setup suggests a high probability of a bullish move.

Strategy: Buy

Target: Rs 2,430

Stop-Loss: Rs 2,030

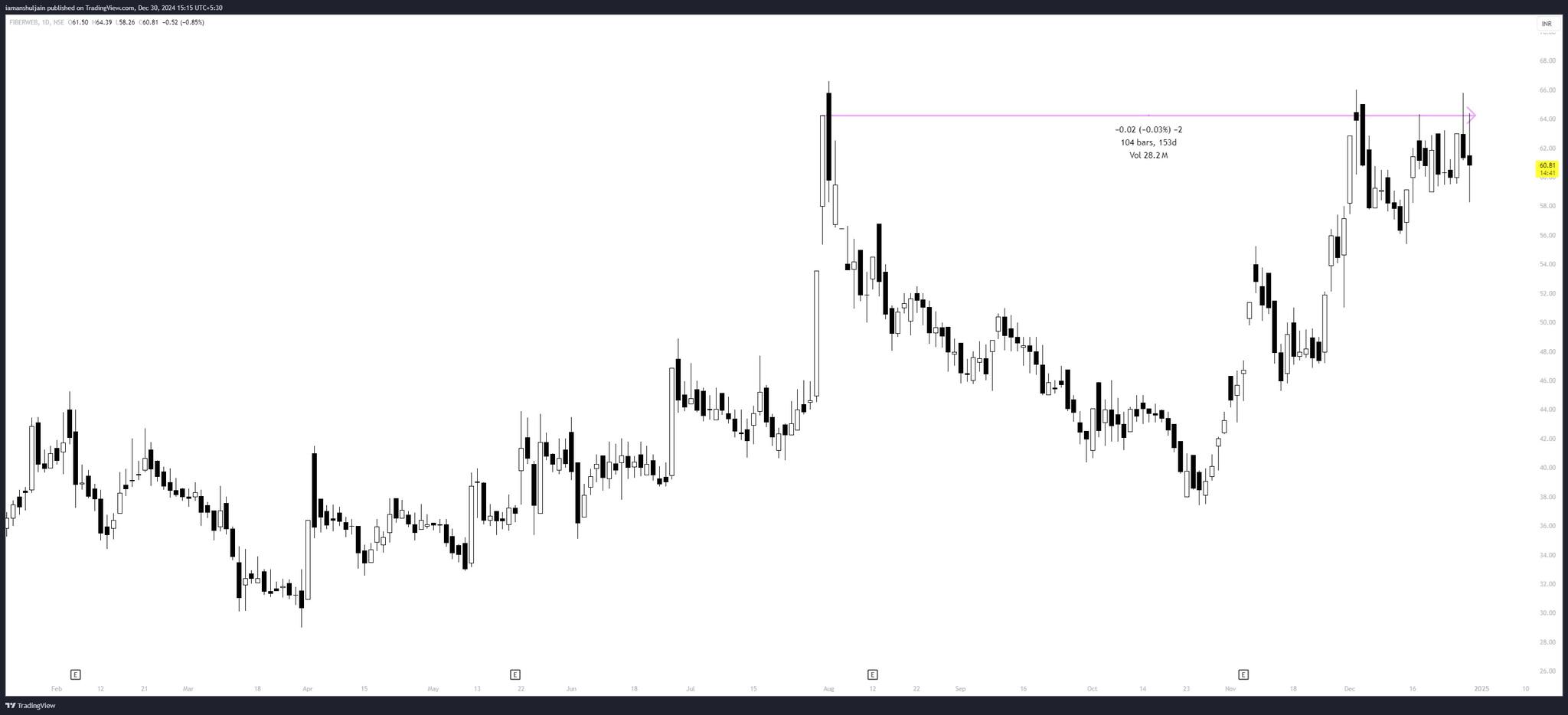

Fiberweb India | CMP: Rs 60.77

Fiberweb’s 104-day Cup-and-Handle pattern signals a potential breakout above Rs 64. The chart reveals notable volume behaviour: dried-up volumes during the cup formation, followed by a spike above the 50-day average on up days. The handle formation has seen volumes dry up again, a classic bullish sign. A volume surge above Rs 64 would confirm the uptrend, making it a stock to watch for momentum-driven investors.

Strategy: Buy

Target: Rs 70

Stop-Loss: Rs 57

United Spirits | CMP: Rs 1,619.55

United Spirits has decisively broken out of a 60-day bullish rounding bottom pattern with a wide breakout bar and volumes four times the 50-day average. The accumulation phase showed clear signs of institutional buying, fueling confidence in the move. This breakout suggests strong upward momentum, making it a compelling opportunity for growth-focused investors.

Strategy: Buy

Target: Rs 1,760

Stop-Loss: Rs 1,570

Jay Thakkar, Vice President & Head of Derivatives and Quant Research at ICICI Securities

United Breweries | CMP: Rs 2,035.4

UBL has been holding onto its uptrend line support on a closing basis, indicating that the short-term trend is positive. The momentum indicator MACD (Moving Average Convergence Divergence) is also well into buy mode on the daily, weekly, and monthly charts, further indicating an up move in the short term.

From a derivatives perspective, the maximum pain level is Rs 2,020, and the stock is trading well above it, which is positive. There has been good Put writing at lower levels at the Rs 2,000 strike, while the Rs 2,100 strike has witnessed the highest call open interest, setting a short-term range of Rs 2,000–Rs 2,100.

Strategy: Buy

Target: Rs 2,200

Stop-Loss: Rs 1,985

Lupin | CMP: Rs 2,311.35

Lupin has witnessed an increase in volumes along with price gains, indicating a price-volume breakout. Futures open interest has also increased, confirming long positions in the stock and the continuation of the uptrend. Technically, it has broken out from various falling trendlines with a positive crossover in the momentum indicator MACD.

There have been significant Put additions from the Rs 2,200 to Rs 2,300 strikes and notable Call unwinding at the Rs 2,200 and Rs 2,240 strikes. The Call base has shifted to Rs 2,300, the next hurdle, but the price is trading above it. The maximum pain level is Rs 2,260, and the price is above it, suggesting a higher probability of an upside move.

Strategy: Buy

Target: Rs 2,400, Rs 2,450

Stop-Loss: Rs 2,370

Axis Bank Futures | CMP: Rs 1,078.3

Axis Bank Futures has broken multiple support levels, including the Rs 1,120 range, on a closing basis, signaling technical weakness. The momentum indicator MACD is in sell mode across daily to monthly charts, giving bears the upper hand.

From a derivatives perspective, the stock has witnessed significant call additions at the Rs 1,110 strike, with the Rs 1,100 and Rs 1,110 strikes showing the highest call open interest. The Rs 1,100 strike also has the highest put open interest, making it a critical make-or-break level. The trend remains negative as long as the price stays below Rs 1,100.

Strategy: Sell

Target: Rs 1,020

Stop-Loss: Rs 1,120

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.