The benchmark indices rebounded smartly to close more than half a percent higher on January 22, despite weak market breadth. A total of 1,914 shares declined, against 635 shares that advanced on the NSE. The market may continue its upward journey amid likely consolidation. Below are some trading ideas for the near term:

Vidnyan S Sawant, Head of Research at GEPL Capital

Hindustan Aeronautics | CMP: Rs 3,903.45

On the monthly scale, Hindustan Aeronautics has maintained a strong uptrend, with price stability above the 12-month and 26-month EMAs (Exponential Moving Averages), reaffirming its bullish stance. Currently, the stock is testing its 12-month EMA, signaling a potential bullish mean reversion. On the weekly scale, HAL is near the 61.8% golden Fibonacci retracement level of its Rs 2,904–Rs 5,657 rally, aligning with the 50-week EMA. This confluence creates a strong support zone where the stock could form a base. Additionally, the stochastic indicator has shown a bullish crossover on the weekly scale, indicating improving momentum. These factors suggest that HAL may be gearing up for a potential recovery, supported by its broader positive trend.

Strategy: Buy

Target: Rs 4,370

Stop-Loss: Rs 3,670

Ashoka Buildcon | CMP: Rs 270.60

In June 2024, Ashoka Buildcon achieved a multi-year breakout above its 2018 swing high, signifying robust price structural development. On the weekly scale, the stock has been in a steady uptrend since May 2023, consistently forming higher tops and higher bottoms. It is well-supported above the rising 26, 50, 100, and 200-week EMAs, reaffirming its strong bullish trend. Furthermore, the ratio chart of Ashoka Buildcon against the Nifty is forming a significant base pattern, highlighting the stock's potential for continued outperformance compared to the broader market.

Strategy: Buy

Target: Rs 318

Stop-Loss: Rs 250

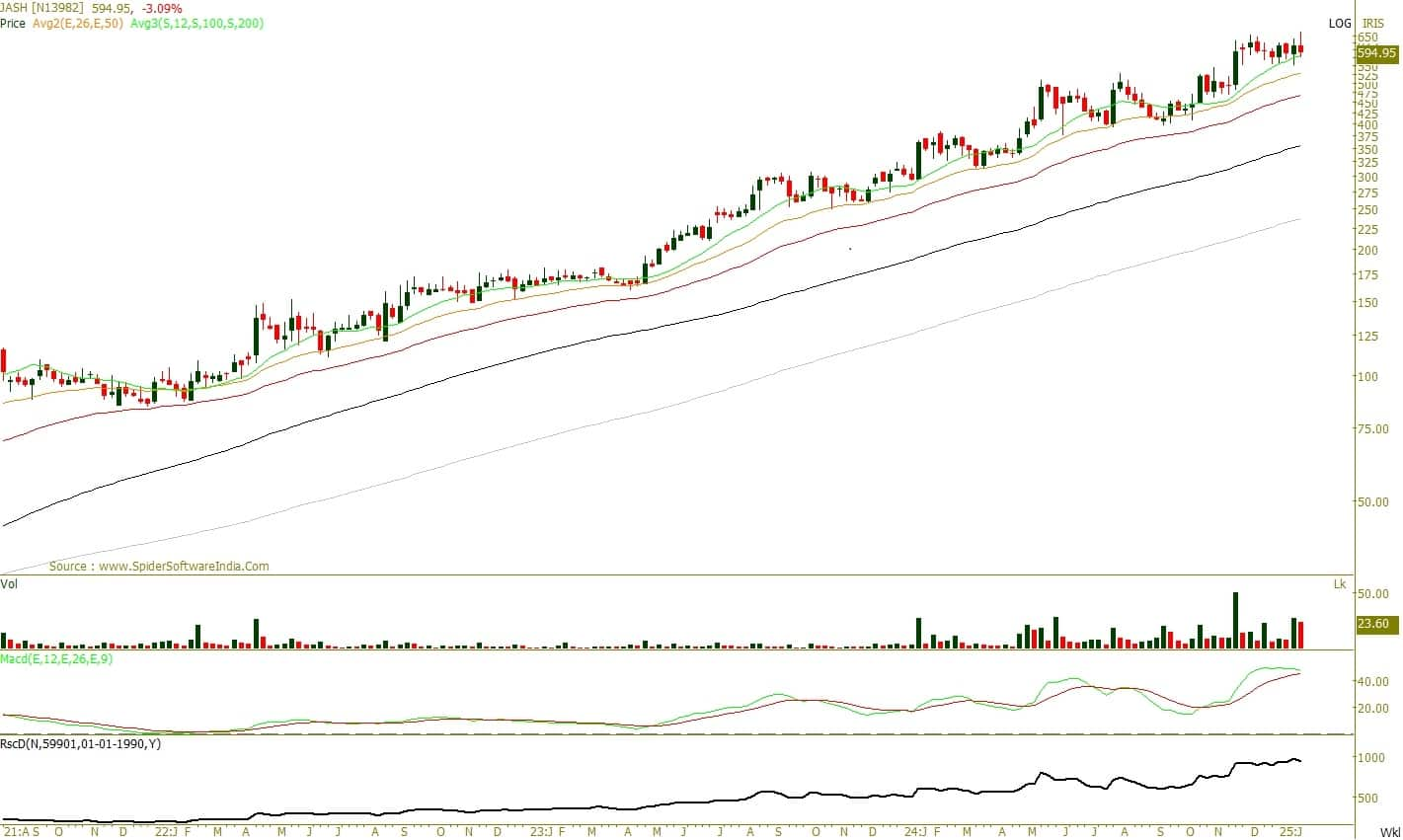

Jash Engineering | CMP: Rs 592.75

Jash Engineering continues its upward trajectory, consistently forming higher tops and higher bottoms while maintaining support above the 12-week and 26-week EMAs, reinforcing its bullish trend. Despite broader market volatility, the stock demonstrates strong price stability, indicating high relative strength. The MACD (Moving Average Convergence Divergence) indicator remains in buy mode, further supporting the bullish outlook. Additionally, the ratio chart of Jash Engineering against the Nifty shows a rising trend, highlighting the stock's continued outperformance.

Strategy: Buy

Target: Rs 684

Stop-Loss: Rs 560

Skipper | CMP: Rs 465.45

Since 2022, Skipper has been in a strong rising trend on the monthly scale. In January 2024, the stock achieved a multi-year breakout above its 2017 swing high, signaling robust structural development. It has since sustained well above its 12-month EMA, indicating a potential bullish mean reversion. The ratio chart of Skipper against the Nifty is forming higher highs and higher lows. Currently, it sits at the lower range of a rising channel, presenting a favourable accumulation opportunity.

Strategy: Buy

Target: Rs 555

Stop-Los: Rs 430

Jatin Gedia, Technical Research Analyst at Mirae Asset Sharekhan

Lupin | CMP: Rs 2,139.15

Lupin had formed a Hammer Candlestick pattern on the daily charts, and after a day of consolidation, it has resumed its upward movement. On the hourly charts, it is sustaining above the key short-term moving averages, and the momentum setup also suggests that positive momentum is likely to continue.

Strategy: Buy

Target: Rs 2,195, Rs 2,234

Stop-Loss: Rs 2,100

AU Small Finance Bank | CMP: Rs 604.4

AU Small Finance Bank has been consolidating in a narrow range for the last five trading sessions. In terms of price pattern, it has formed a Triangle pattern, which is a trend continuation pattern. We expect this consolidation to break out on the upside. The Momentum Indicator has a positive crossover, which is a buy signal.

Strategy: Buy

Stop-Loss: Rs 590

Target: Rs 626, Rs 637

Shitij Gandhi, Senior Technical Research Analyst at SMC Global Securities

SBI Cards and Payment Services | CMP: Rs 756.55

Over the last few months, SBI Card has been consolidating in a broader range of Rs 660–740, with prices sustaining well below its 200-day exponential moving average on daily charts. Technically, the stock has formed a Double Bottom pattern on daily charts around the Rs 660 level and given a breakout above the consolidation zone. The breakout has been observed above the W pattern on broader charts. Therefore, one can accumulate the stock in the range of Rs 750–760 for the expected upside of Rs 830–835 levels, with a stop-loss below Rs 700.

Strategy: Buy

Target: Rs 830, Rs 835

Stop-Loss: Rs 700

Marico | CMP: Rs 665.35

Marico has been maintaining its bullish trend, as prices have witnessed a series of upward movements from the Rs 590 level towards the Rs 650 level over the past few weeks. Recently, the stock gave a fresh breakout above the Inverted Head & Shoulders pattern and has been consolidating since then. The upward momentum is likely to continue, as positive divergences on secondary oscillators point towards the next upswing in prices. Therefore, one can accumulate the stock in the range of Rs 655–665 for the expected upside of Rs 710–715 levels, with a stop-loss below Rs 620.

Strategy: Buy

Target: Rs 710, Rs 715

Stop-Loss: Rs 620

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.