The benchmark indices closed at a seven-month low, extending their downtrend for the fourth consecutive session, declining over 1.4% on January 13, with negative market breadth. A total of 2,373 equity shares saw a correction, compared to 212 shares that gained on the NSE. The market may attempt a rebound amid likely consolidation; however, the overall sentiment remains bearish. Below are some trading ideas for the near term:

Jay Thakkar, Vice President & Head of Derivatives and Quant Research at ICICI Securities

Hindustan Unilever | CMP: Rs 2,451

HUL has started forming higher tops and higher bottoms on the daily charts, accompanied by a bullish crossover in the MACD (Moving Average Convergence Divergence) with a positive divergence. The FMCG sector, in general, has shown positive divergence and buying interest at lower levels, reversing from oversold territory. On the options front, significant Put writing at the Rs 2,400 strike makes it a crucial support level, while the Rs 2,500 strike, with the highest Call open interest, serves as resistance.

Strategy: Buy

Target: Rs 2,510, 2,530

Stop-Loss: Rs 2,385

Sun Pharmaceutical Industries Futures | CMP: Rs 1,754.2

Sun Pharma appears to have completed a three-wave corrective bounce and is now forming lower tops and lower bottoms, confirmed by a sell crossover in the daily MACD. Options data indicates a downward trend, with substantial Call open interest at the Rs 1,800–Rs 1,900 strikes. Minor support exists at Rs 1,760; a break below this level could lead to further downside.

Strategy: Sell

Target: Rs 1,707, Rs 1,680

Stop-Loss: Rs 1,807

Siemens Futures | CMP: Rs 5,843

Siemens has broken multiple support levels and shows a sell crossover in the MACD on both daily and weekly charts, indicating a bearish trend. On the options front, significant Call writing from the Rs 6,000 strike and above suggests resistance, with no major support below Rs 5,800. A break below Rs 5,800 could accelerate the weakness.

Strategy: Sell

Target: Rs 5,600, Rs 5,500

Stop-Loss: Rs 5,920

Anshul Jain, Head of Research at Lakshmishree Investments

Jubilant FoodWorks | CMP: Rs 706.6

Jubilant FoodWorks has retested its 65-day Cup-and-Handle pattern during the recent market correction, finding support at its rising 20-day moving average. Despite sharp price action during the retest, the breakout structure remains intact, signaling potential upward momentum. The bullish pattern suggests the stock is well-positioned for a sustained move higher.

Strategy: Buy

Target: Rs 765

Stop-Loss: Rs 680

Apar Industries | CMP: Rs 10,231.15

Apar Industries has tested its 39-day Cup-and-Handle pattern with sharp price action, forming a Long-Legged Doji candle on the daily chart. This, coupled with a Bullish Hammer formation, indicates strong buying interest, setting the stage for further upside. The technical setup points to sustained upward movement, making it an appealing trade.

Strategy: Buy

Target: Rs 11,500

Stop-Loss: Rs 9,500

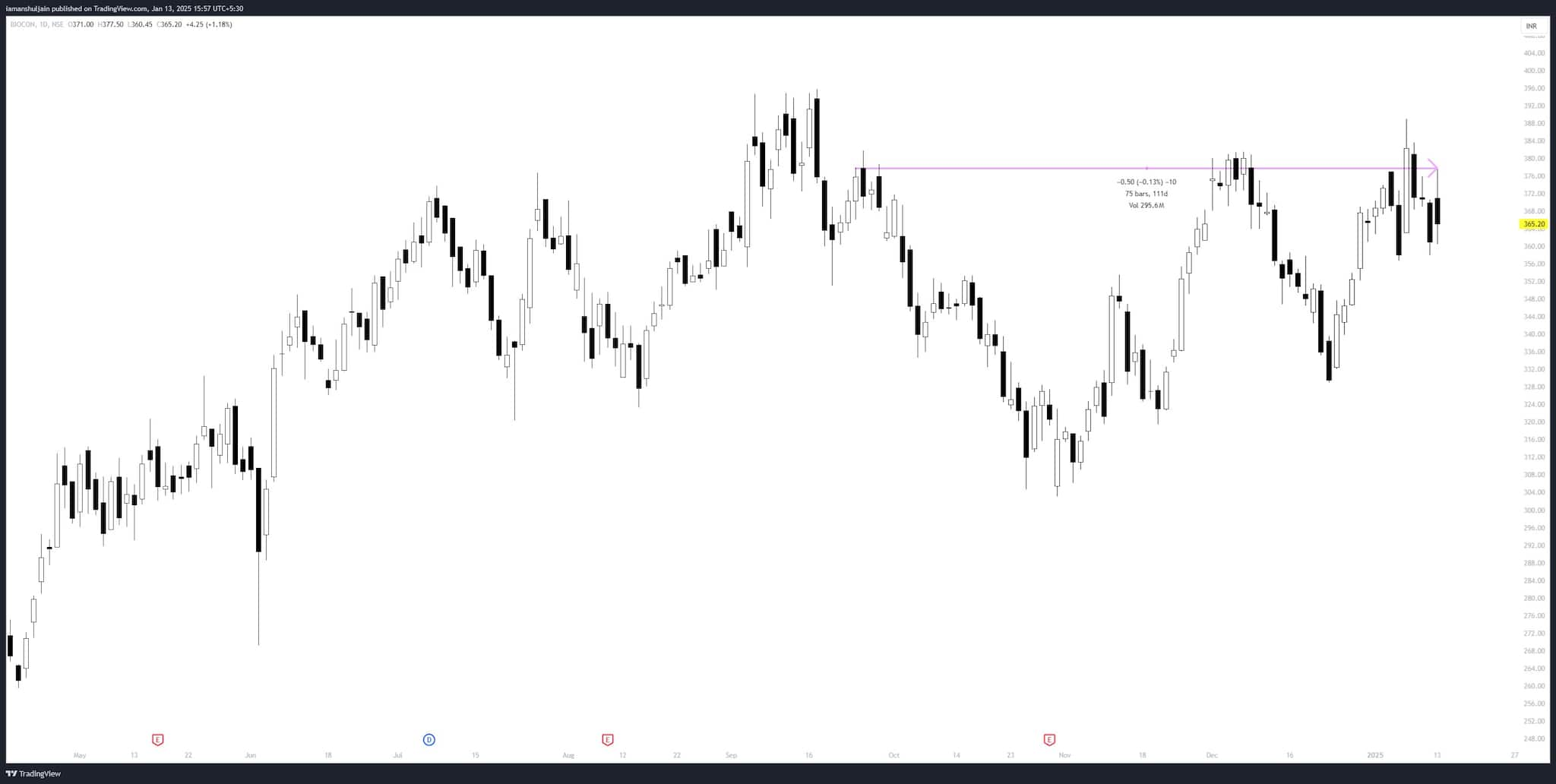

Biocon | CMP: Rs 365.2

Biocon is forming a 75-day Cup-and-Handle pattern and is nearing a breakout above Rs 378. Two of the last five sessions have witnessed volume surges exceeding 400% of the 50-day average, indicating strong accumulation. A breakout above Rs 378 could trigger a sharp move toward Rs 430, presenting a promising trading opportunity.

Strategy: Buy

Target: Rs 430

Stop-Loss: Rs 350

Riyank Arora, Technical Analyst at Mehta Equities

BHEL | CMP: Rs 192.58

BHEL has seen a sharp breakdown below its immediate support at Rs 201.35 and closed significantly below this level. Trading below important moving averages and exhibiting weak momentum, the stock is likely to decline further toward Rs 170 or lower. A strict stop-loss is recommended near Rs 202.50 to manage risk effectively.

Strategy: Short Sell

Target: Rs 170

Stop-Loss: Rs 202.50

Zomato | CMP: Rs 227.15

Zomato has broken below its immediate support at Rs 239.45 and closed under its 200-period SMA (Simple Moving Average). With RSI (14) near 24, signaling weak momentum, the stock could move lower toward Rs 205 or below. However, a set stop-loss at Rs 242.50 is advised to manage risk.

Strategy: Short Sell

Target: Rs 205

Stop-Loss: Rs 242.50

Max Healthcare Institute | CMP: Rs 1,082.5

Max Healthcare has formed a double-top pattern on the daily charts, followed by a breakdown below the crucial Rs 1,100 support level. With RSI (14) declining to 41, the stock reflects weak sentiment. Trendline support lies near Rs 1,030, serving as a potential target. A strict stop-loss is advised at Rs 1,130 to mitigate risk.

Strategy: Short Sell

Target: Rs 1,030

Stop-Loss: Rs 1,130

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.